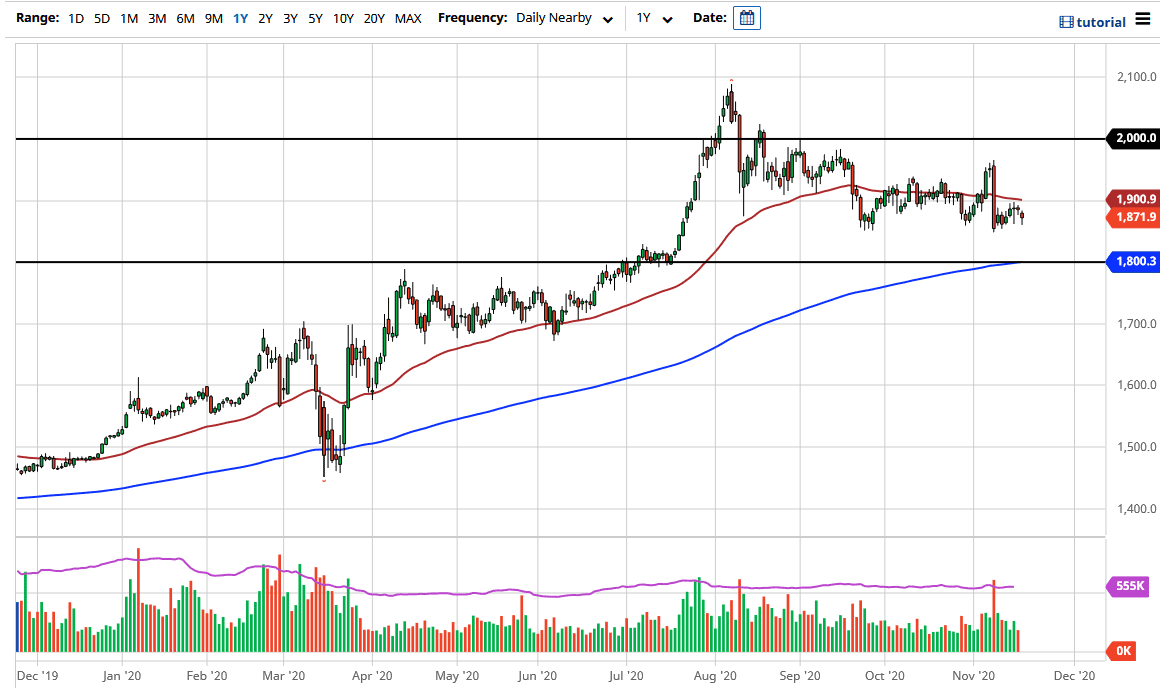

Gold markets have pulled back a bit during the trading session on Wednesday, reaching down towards the $1850 level. This is an area that has been crucial more than once, so it is no surprise to see that we have bounced. However, I see even more support underneath, so I have a conviction to buy gold and not sell it.

There is a huge “zone of support” extending all the way down below the $1850 level to the $1800 level. The 200-day EMA sits right at that level as well, which lines up nicely for some supportive action. Beyond that, the market's break out from that level a couple of months ago has not been tested. Because of this, we will continue to see a lot of interest in the $1800 level, so if we can drift down to that level it would be an excellent buying opportunity. If we break down below there, it could change a lot of things, but right now we are nowhere near doing that.

Another thing I would point out is that it appears that we are stalling when it comes to falling, so the rate of change is something to be watched. We had that massive candlestick from last Monday that has not been broken yet. That suggests that we are trying to find buyers in this area and are starting to become “less bearish.” This should be paid attention to, not only because the price action has slowed down, but also because it is really all about the US dollar. Remember, the US Dollar Index tends to have a strong negative correlation to this market over the last nine months or so.

That's why I am looking to buy dips as they occur, but we will probably have an opportunity to pick up some value going forward. In that case, I will be very patient. But if we were to turn around and break above the $1900 level, we would start to look towards a move of about $50 or so higher.