The gold market has rallied a bit to the upside during the trading session. The market is likely to see volatility, because the central banks around the world continue to want to flood the markets with currency, which drives up demand for the harder assets such as gold and silver. We are likely to see a lot of “buy on the dips” traders out there, so people will be getting involved.

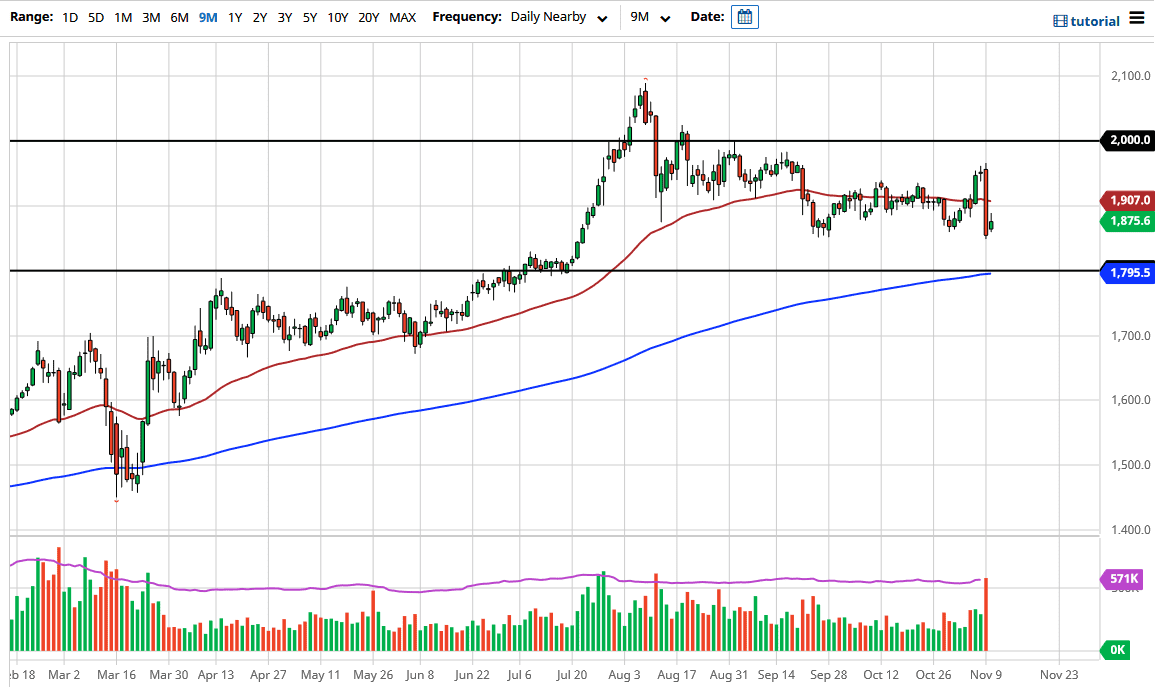

The $1850 level has been supportive in the past, and we are trying to find a turnaround here. However, even if we break down below there, it is likely that the $1800 level will then offer a significant amount of interest, because we had seen a major breakout in this area and it has yet to be tested again. We will eventually see buyers come back into this area and try to keep the uptrend going.

Pay attention to the US Dollar Index, because it will certainly have its effect on gold; but it is far beyond just the dollar. There are multiple reasons for gold to go higher, even beyond the central banks. The Federal Reserve is a major player in that, but the Reserve Bank of Australia is threatening negative rates, and there is the possibility of the European Central Bank doing something similar. All of that together means that people will be trying to get away from paper currency.

There are also many risks as the global economy continues to be concerning, and a lot of people will be using gold as a safety measure. I have liked the idea of gold for years, and I think this is more of an investment than a short-term trade. If you are short-term trading gold, you are probably going to be susceptible to a lot of potential whipsaw trading. Nonetheless, the longer-term trend is still higher.