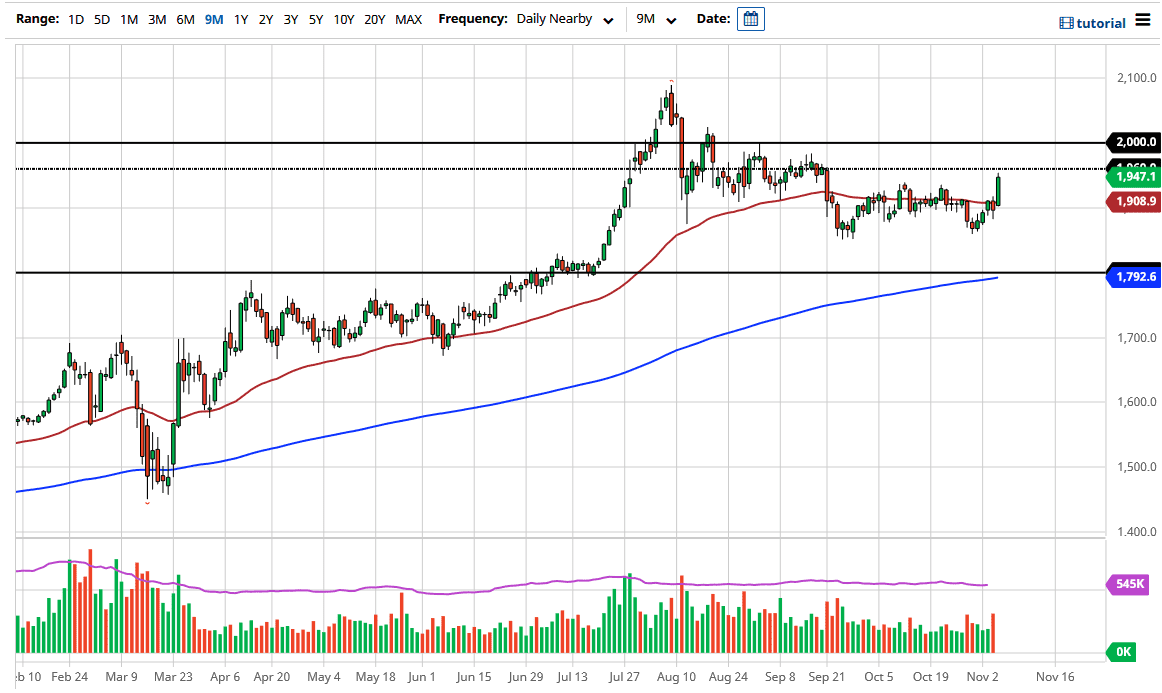

As you can see on the chart, the market reached towards the $1950 level, and now that the Federal Reserve has spoken, there is now going to be a certain amount of focus on the jobs number, and of course the fact that we still have no finalized election results in America. This continues to have people concerned and they may be buying gold for a safety trade. Furthermore, we need to take a look at the overall action when it comes to the greenback.

After all, the gold market has been negatively correlated to the US dollar for some time now, and certainly this point in time it looks as if stimulus is coming and people are starting to bank on that possibility. That should drive the US dollar lower, and then by extension drive gold higher. However, there is a massive amount of resistance above near the $1960 level that extends up to the $2000 level. With this being the case, it is very likely that we will continue to see noisy action, and is not until we break above the $2000 level on a daily close that we can start to think about more of a “buy-and-hold” type of market. In the meantime, it is probably easier to simply buy on the dips, because most certainly the longer-term trend is going to be for higher gold prices.

Remember, it is not just about the US dollar. We also have a lot of election concerns out there that could drag on for weeks, especially if there is lawsuits involved. With that being the case, I do think that we are looking at the 50 day EMA as potential support near the $1900 level, and then of course the two previous support levels at the $1850 level in the $1800 level that I have been talking about. At the $1800 level we also have the 200 day EMA coming into play, which would be the ideal place to start buying. Whether or not we get down there is a completely different story but the one thing that I would urge you to take away from this analysis: selling gold is all but verboten