Gold markets will be very tricky going into the year’s end. This is because there are multiple scenarios that could move gold in various ways. I suspect that at the very least, gold is going to be choppy as we start to head towards 2021, but we are currently facing several different situations that must be monitored simultaneously in order to discern our next trade.

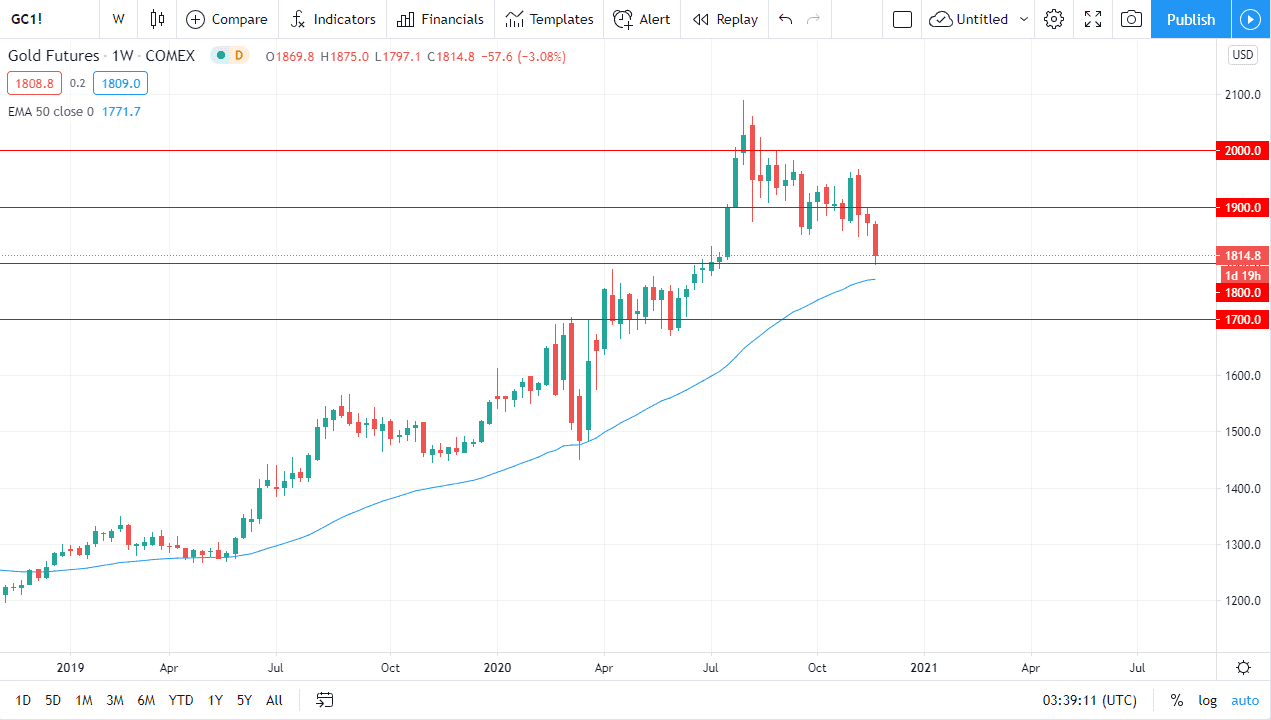

As you can see on the weekly chart, we have slammed into the $1800 level, which was the scene of a major breakout several months ago. By retesting this area, it allows for “market memory” to come into play. The 50-week exponential moving average is sitting just below it and, on the daily chart, there is the 200-day exponential moving average right around the same level. These are both technical indicators that will garner much attention, and the fact that it was the scene of a previous breakout does lend credence to the prospect of a bounce. However, it is not quite that simple.

The biggest problem with gold right now is that the US dollar is selling off in what is a “risk on move.” People are starting to price on the idea of a post-coronavirus world, so they are dumping dollars. This typically helps gold, but the world is so “risk on” suddenly that even gold is being dumped. As we go into December though, there will be a lot of questions as to where we go from here. I believe that longer-term, gold has a bright future, mainly because central banks are dumping so much liquidity into the markets around the world. However, there are no signs of inflation whatsoever yet, and that will be gold’s biggest problem.

It is a simple matter of whether or not we are above $1800 for this month. If we are below it, then I believe the gold market will continue to struggle. However, if the market holds above the $1800 level then it will continue to be a “buy on the dips” scenario. To the upside, the $1900 level would be a target, followed by the $1950 level. While I do think that we will get to the $2000 level eventually, I do not think it will happen in the month of December. The best thing that gold bulls could see at this point is stabilization and perhaps even a slow grind higher.