Recent GBP/USD bounce gains were capped by the move up towards the 1.3398 resistance near its three-month high before settling around 1.3345 at the time of writing. The British pound does not appear to be reacting adversely to signals that another deadline has passed for the UK to secure a new trade deal with the European Union. The decline in the pound, after approaching $1.34, was a result of the US dollar recovery.

Participants in the BREXIT negotiations still hope that a deal will actually emerge and are aware of the many legal maneuvers that the European Union can undertake to speed up the ratification process. As we have indicated, UK chief negotiator Barnier has suggested that he is ready to continue negotiations in December. However, nothing is agreed upon until everything is agreed upon, and the more difficult problems are naturally resolved in the end. In addition, if there are 60 elements of the agreement, then 95% completion means that three issues remain (state aid, fishing rights, and dispute resolution mechanism).

In general, optimism about the COVID-19 vaccines and hopes for an imminent deal on Brexit continue to support the strength of the British pound against the rest of other major currencies. The British pound was the best-performing main currency at the beginning of this week's trading, after sentiment towards the currency was supported by news that the Oxford University vaccine and AstraZeneca have proven successful in preventing the transmission of the coronavirus in the third phase of their trials.

Meanwhile, news reports regarding the status of trade negotiations after Brexit indicated that the two sides are close to reaching an agreement.

Commenting on this, Marek Rachko, an analyst at Barclays, says, “The optimism about the vaccine and the hopes for an eventual Brexit deal should provide a firm floor for the British pound, at least for now, and in our view, key dates for major progress in the negotiations still have to be postponed, but negotiations could continue until the beginning of December. Until then, we believe markets will remain comfortable in buying any drop in the British pound unless there are clear signs that negotiations are not progressing or Its collapses.”

"Positive vaccine news tends to support the British pound, as the British economy is more service-driven and more vulnerable to closures, travel restrictions, social distancing and consumer confidence," says Neil Wilson, Senior Market Analyst at Markets.com.

The announcement by the University of Oxford and AstraZeneca is a big moment in the battle against the coronavirus, because this candidate vaccine is much cheaper than its competitors and can be stored at room temperature. More countries have pre-orders for the AstraZeneca candidate than any other, and it is believed to be faster in production and distribution than mRNA candidates from Pfizer and Moderna.

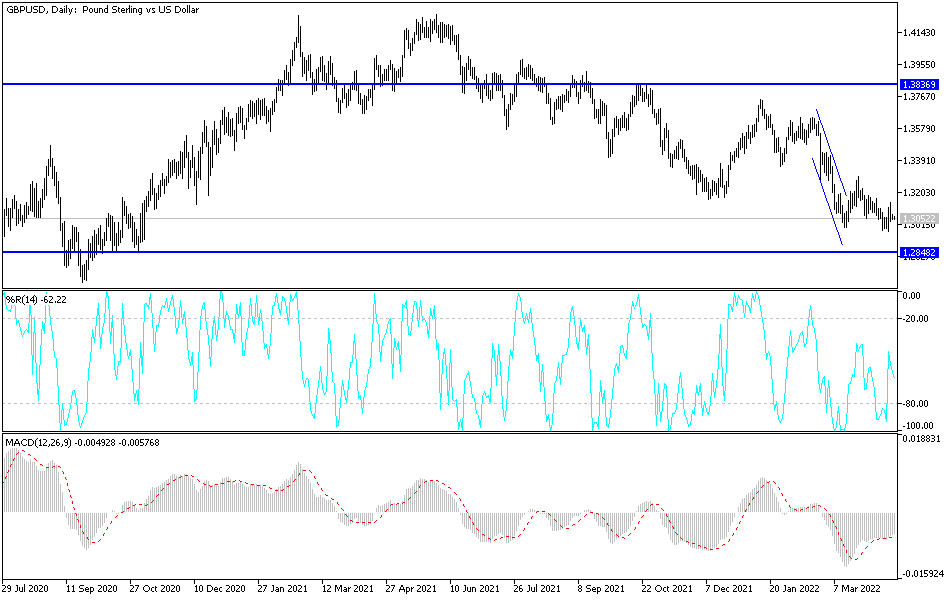

Technical analysis of the pair:

On the daily chart, the GBP/USD pair is still bullish. At the same time, breaking the 1.3400 resistance will push technical indicators towards overbought areas from which they can be sold, while waiting for profit-taking operations. All current factors support the pound's gains, unless there is a negative development in the Brexit negotiations. In return, a downward shift will occur if the currency pair moves below the support level at 1.3160. However, I still prefer to sell this pair from every upward level.

Today's economic calendar data:

There are no important British economic releases expected today, so the focus will be on the US economic data. There will be an announcement about the US GDP growth rate, unemployment claims, durable goods orders, consumer confidence, new US home sales, and then the content of the Federal Reserve Bank last MoM, before the tomorrow’s Thanksgiving holiday.