It seems clear that the pound has the necessary momentum to move towards higher levels against the rest of major currencies. For three weeks in a row, and with many influencing events, the GBP/USD pair remained in an upward correction range that culminated recently in testing the 1.3280 resistance, around which it is stable at the time of writing. The latest momentum for the sterling was a report from The Sun indicating that a Brexit trade deal could be announced early next week. The British negotiator, David Frost, reportedly told Prime Minister Boris Johnson that the deal may be ready as early as Tuesday, although it is not clear whether the conversation took place before or after his remarks on Sunday.

Commenting on this, Elias Haddad, a strategist at the Commonwealth Bank of Australia, said: "We expect the GBP/USD pair to rise towards 1.3600 if there is tangible progress."

Before opening trades this week, Frost said that he would only agree to a deal "to regain control of our laws, our trade and our water", warning that "this was our consistent position from the beginning and I will not change it". It was reported that the European Union is ready to "find an innovative solution" to the impasse over its demands. Obstacles to the deal include the European Union's insistence on so-called equal opportunity clauses that would preserve its influence and control in economic policy areas, and the pursuit of an automatic right to a large share of sustainable fishing opportunities from British fisheries.

Commenting on the recent positive news, Clyde Wardle, Chief Foreign Exchange Strategist at HSBC, says: “With the exception of an upbeat article in The Sun, investors seem to still assume the Brexit negotiations will be fruitful. But caution is still required.”

The EU leaders' summit was described Thursday as the last deadline for national leaders to ratify an accord. It still leaves time to ratify it in various parliaments across Europe, with the Brexit transition period extending to midnight on December 31.

Results of British Prime Minister Boris Johnson's test showed that he was not infected with coronavirus, but would complete 14 days of self-isolation anyway due to contact with an infected person. In this regard, Johnson's office says the prime minister was tested using the side-flow test - a rapid test that does not need to be treated in the laboratory. Tests are not widely available in the UK, but the government says employees in the Prime Minister's Office can get them as part of a pilot project.

Johnson was asked to self-isolate on Sunday after a lawmaker he had met three days earlier tested positive for coronavirus. For his part, Prime Minister Johnson said he has no symptoms and will continue to lead the government, holding meetings using video conferencing.

Government rules state that people who have had close contact with an infected person should be subject to quarantine for a period of two weeks. Johnson fell seriously ill with the coronavirus in April and spent three nights in intensive care. People who recover from the virus are believed to have some immunity, but it is unclear how long it lasts. There have been a few confirmed cases worldwide of people who have contracted the virus again.

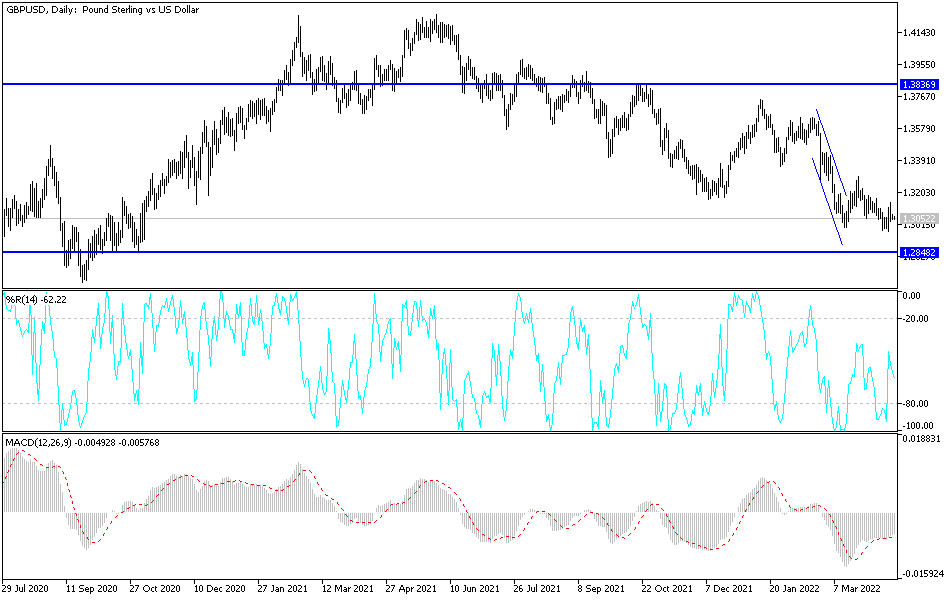

Technical analysis of the pair:

The general GBP/USD trend is still bullish, which will remain supported as long as optimism regarding a Brexit agreement persists. This is, of course, taking into account that these are mere expectations, and the strongest reaction will be after the official announcement of the terms and details of the agreement. According to the performance on the daily chart, crossing the resistance barrier at 1.3300 will support technical indicators moving towards overbought areas, and technically it is expected to activate sales to reap profits. On the downside, a move below the 1.3100 support will be a return to bear control over the performance again. Today, the pound will react to UK inflation numbers amid the absence of US data.