Despite the recent stalemate in trade negotiations between the European Union and Britain, the GBP/USD pair remained steady around recent gains. The pair extended to the resistance level at 1.3393, near its three-month high, and stabilized around stronger gains with the beginning of the today’s trading session. Analysts' expectations still indicate the possibility of continuing the upward momentum in the coming days, provided positive results in the Brexit negotiations take place. European Commission President Ursula von der Leyen said on Wednesday that "real progress" has been made in the Brexit negotiations, but the risk of failure remains.

Meanwhile, British Prime Minister Boris Johnson told Parliament that “our position on fisheries has not changed. We will only be able to make progress if the European Union accepts the reality that we should be able to control access to our water.” Addressing the EU Parliament on Wednesday, Von der Leyen implied that progress has been made on these issues as well, saying, “In discussions about state aid, we still have serious problems, for example, when it comes to enforcement.”

The European Union has demanded from the outset that Britain remain bound by all its rules in the aforementioned areas. The political declaration accompanying the EU Withdrawal Agreement, when combined with the new powers granted to Brussels by the EU on the 27th of July, implies the scope for which the European Union seeks to exercise new powers over the United Kingdom, including in relation to tax matters.

British Prime Minister Johnson has so far opposed all of these demands, while British negotiator David Frost said in his recent official statements: “We are working to reach an agreement, but the only thing possible is an agreement that is compatible with our sovereignty and gives us back control of our laws, our trade and our water. This has been our consistent position from the start, and I will not change it."

In terms of British stimulus to confront the epidemic, British Chancellor of the Exchequer Rishi Sunak has boosted infrastructure spending and plans to create jobs for the unemployed, as official forecasts point to the worst economic downturn in more than 300 years due to the coronavirus impact. "Our health emergency is not over yet, and our economic situation has just started," Sunak told lawmakers as he presented his latest spending review. He also said that financing public services to tackle the coronavirus will amount to 55 billion pounds next year. Prior to that, the Office of Budget Responsibility had forecasted a 11.3 percent contraction of the UK economy this year, which would be the largest drop in output in more than 300 years.

The economy is expected to recover with the easing of the COVID-19 lockdown restrictions, with a record growth of 5.5% next year and growth of 6.6% in 2022. The pace of growth is expected to slow to 2.3% the following year. However, growth is not expected to return to pre-crisis levels until the fourth quarter of 2022.

Sunak said the damage will continue and is likely to keep the economy at 3 percent lower than expected in early 2025. British lending has increased to a record high. Borrowing is expected to reach 394 billion pounds, or 19% of GDP this year. This is expected to drop to 16 billion pounds next year and be around 4% of GDP after 2022-23.

Core debt was expected to reach 91.9% of GDP this year, excluding the one-off effect of asset purchases from the Bank of England. The ratio is expected to continue to grow and reach 97.5% in 2025-26.

The UK Treasury has committed nearly £3 billion to start a new three-year restart program aimed at helping over a million unemployed find new work.

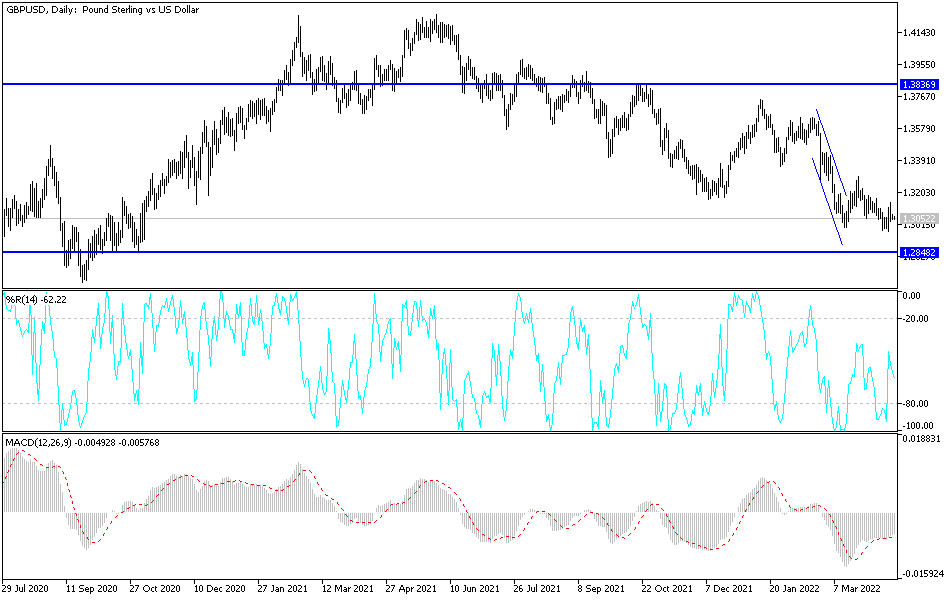

Technical analysis of the pair:

On the daily chart below, the general GBP/USD trend remains bullish, and breaking the 1.3400 resistance pushes the technical indicators into overbought areas. Accordingly, any negative development regarding Brexit will be an opportunity to activate profit-taking operations, and even then, the trend is ready to test the nearest resistance levels, which are currently at 1.3420 and 1.3500, respectively. According to the performance over the same period of time, there will be no real downward turnaround for this pair without the pair moving back to the support level at 1.3160. Today, this pair is not expecting any important British or American economic data. The extent of investor risk appetite, along with hints regarding Brexit negotiations are going to be the main drivers of the pair's performance.