Optimism about the possibility of the European Union and Britain reaching a trade deal contributed to the GBP/USD gains, pushing it near its highest level in two-and-a-half months. It tested the 1.3312 resistance before settling around the 1.3225 level at the time of this writing, amid anticipation of an official announcement about a Brexit deal. The pound was indifferent to the announcement that the UK Consumer Price Index (CPI) inflation rose to 0.7% year-on-year in October 2020, up from 0.5% in September and above market expectations of a reading of 0.6%.

According to the Office for National Statistics, clothing, food, furniture, furnishings, and carpets made the largest upward contributions to price increases in the most recent set of statistics. However, prices did not change on a monthly basis between September and October, but they was still ahead of analysts' expectations of a -0.10% reading, and lower than the previous month's reading of 0.4%.

Inflation is traditionally one of the most important economic considerations for the Bank of England when it comes to setting interest rates, and news that inflation is stronger than expected may have in the past led to expectations of a rate hike in the bank. However, as the potential for the coronavirus to cause an economic crisis grows, economists say the latest data is unlikely to drive Britain's central bank policy.

CPI inflation by the Bank of England is expected to rise to 0.9% in March 2021, with expectations assuming that developments related to COVID-19 will affect spending in the near term, albeit to a lesser extent than it was earlier in the year. Commenting on this, Niksch Sujany, a British economist at Lloyds Bank, said: “Despite the high inflation rate in October, the headline CPI rate remains well below the Bank of England target of 2% as required by the UK government. In fact, since April, it has been at least one percentage point below this level, highlighting the overall weakness of inflation currently underlying the UK.”

Investec economist Victoria Clark said: “The 0.7% inflation target is unlikely to change direction much on the potential path of UK monetary policy over the coming months. It is higher than the 0.5% set by the bank in October. Nevertheless, it remains at a relatively weak level, and the most important driver of policy for the Bank of England in the coming months will be the path the UK economy takes during the pandemic and Brexit as well.”

All in all, it will be the evolution of COVID-19 restrictions and Brexit forces that will guide policy for the Bank of England at its meeting in December.

Economists at PwC say the current UK lockdowns will reduce price growth from the economy to the end of the year. Lloyds Bank's Sawjani says the outlook remains only consistent with a gradual upward trend, and the headline CPI rate is likely to remain below 1% through the first quarter of 2021.

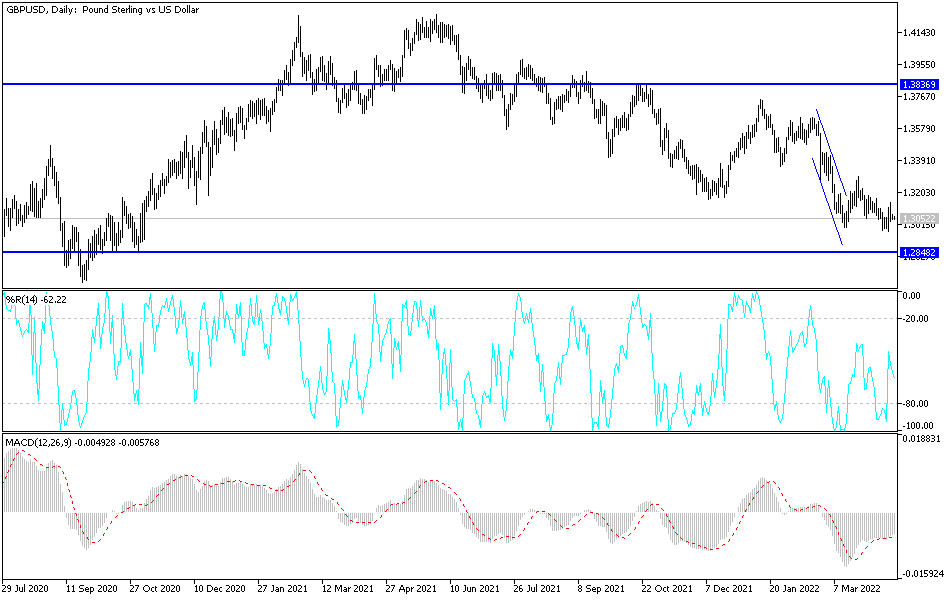

Technical analysis of the pair:

According to the daily chart performance, the GBP/USD still has the opportunity for an upward correction. Breaking the 1.3300 resistance is important for bullish control over performance to push the pair towards stronger levels, the closer of which are 1.3355, 1.3420 and 1.3500 respectively. It must be taken into account that the failure of the European Union and Britain to agree on a deal at this particular time would mean a rapid collapse of the sterling's gains, and then we will be heading to the 1.3000 psychological support again.

Today's economic calendar data:

All focus is on the results of the Brexit negotiations as well as the results of the US economic data, including the weekly jobless claims, the Philadelphia Industrial Index reading and the existing US home sales data.