The GBP/USD pair witnessed a downward correction by more than 100 points amid profit-taking selling that pushed it towards the 1.3263 support. This came after strong upward momentum pushed the pair towards the 1.3397 resistance, its highest level in nearly three months, and stands at 1.3310 at the time of this writing. What caused the correction was the USD's strength ahead of the Thanksgiving holiday this week, which will affect liquidity in the markets on Thursday and Friday. The pound is trying to take advantage of the UK Treasury's assertion that it is on the verge of halting the spending that boosted the British economy during the COVID-19 pandemic. Chancellor of the Exchequer Rishi Sunak announced plans Sunday morning to give the National Health Service 3 billion pounds ($4 billion), and pledged that support for businesses and workers affected by the pandemic will continue through the spring.

The comments came amid reports that Sunak may announce a pay freeze for government employees when it delivers the annual spending review to Parliament on Wednesday. This raised questions about whether he is preparing to tighten the screws on spending and raise taxes, amid expectations that government borrowing will reach 372 billion pounds in the current fiscal year.

Sunak said the British government remains focused on responding to the epidemic, as 750,000 people have already lost their jobs and others are likely to follow. He declined to comment on the wage freeze reports. He told the BBC: "It is sad to see. It is real, it is not just the graph numbers, but the lives of the people, it is their livelihood and security that is affected. This is something we will unfortunately have to deal with for a while.”

Government spending is a very sensitive issue in the UK, which has suffered for years after the 2008 financial crisis. It is even more dangerous now as public sector workers, including nurses, firefighters and care workers, have borne the brunt of the COVID-19 burden.

The overall impact of the virus on government spending will become clearer this week when the Office of Budget Responsibility releases its latest fiscal and economic forecast. The UK is facing one of the deepest recessions in its history, with economic growth down by at least 10% from last year, even after a rebound over the summer. Government debt reached 101% of GDP in October, the highest level since 1961.

Survey results from IHS Markit revealed that the UK private sector contracted by the most in six months in November due to the fastest drop in service sector output since May, amid a temporary shutdown by leisure and hospitality businesses. Therefore, the Composite Production Index - which includes manufacturing and services together - decreased to 47.4 in November from 52.1 in October. A reading below the 50 level indicates contraction. However, the result was higher than economists' expectations of 42.5. The British services sector contracted significantly in November as the second shutdown severely affected the entertainment and hospitality sector. In contrast, industrial production grew at a strong pace in November and the rate of growth accelerated from the previous month.

The Services PMI fell sharply to 45.8 from 51.4 in the previous month. Meanwhile, the UK's manufacturing PMI rose to 55.2 in November from 53.7 in the previous month. The expected reading was 53.3. Demand from export markets, especially from China and the European Union, supported the growth of the manufacturing sector.

According to Markit, the service economy's weak performance relative to the manufacturing sector was the widest in nearly 25 years of data collection.

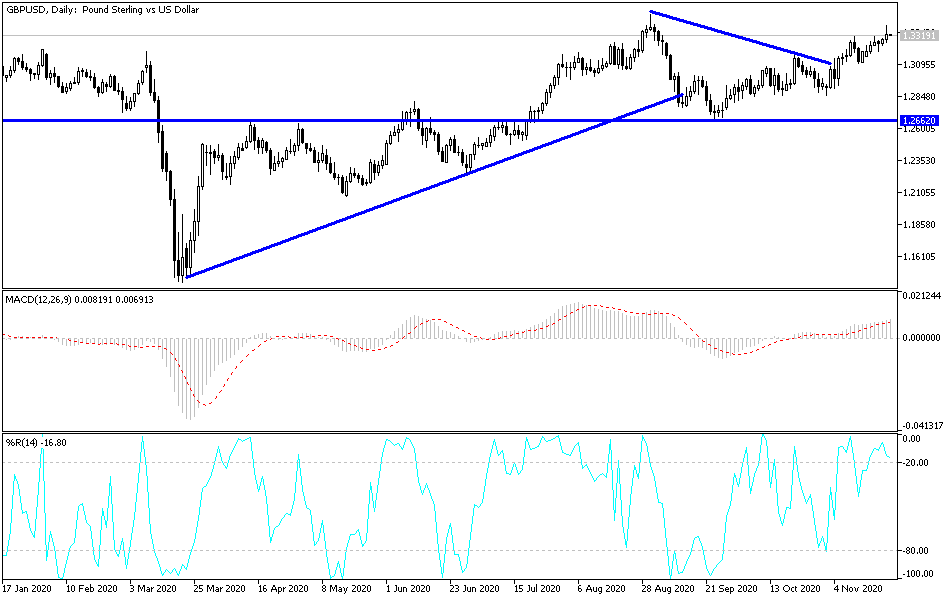

Technical analysis of the pair:

Despite yesterday's performance, the GBP/USD pair still has the opportunity to correct higher as long as it is stable around and above the 1.3300 resistance. Gains will depend on Brexit developments between the European Union and Britain. The Brexit file is the most influential on the pound's trends against other major currencies. Despite the recent optimism, it must be emphasized that the technical indicators head towards overbought areas. As I mentioned before, there will be no real and strong bearish reversal for this pair without breaching below the 1.3100 support.

Today's economic calendar data:

The pound is not expecting any important economic data. During the US session, US Consumer Confidence and Richmond Manufacturing Index will be announced.