The recent performance of the pound in the Forex market contributed to a strong upward momentum for the GBP/USD pair, which moved towards the 1.3313 resistance, its highest in over two months. The pair was more resilient to the return of the dollar's strength as the profit-taking sales did not exceed 1.3190 in yesterday's session. The pair is stabilizing around 1.3217 at the time of writing, prior to the announcement of important economic data and upcoming statements by international central bank officials. The sterling lost some of its strength against other major currencies. Headlines have claimed that the European Union and the United Kingdom are likely to abandon the deadline for reaching a deal next week, but analysts say such a delay is unlikely to materially affect the currency outlook.

Sources from both sides told Reuters on Wednesday that the talks were expected to continue in London until the end of this week. In this regard, a senior EU diplomat said that a report reveals that the EU ambassadors were not informed of the talks at a meeting yesterday and that the issue is now on the table for their meeting on 18 November. European Union leaders are expected to discuss Brexit at an online session of the European Council on November 19.

It was this meeting that the parties had set as the deadline.

On the other hand, European Union sources told Reuters that they now expect negotiators to reach an agreed text in the middle of next week, unless talks collapse or a breakthrough occurs earlier. "The real breaking point is late next week," an EU diplomat said. Two diplomats from the European Union also added that the agenda could be updated at the last minute if the negotiations resulted in a breakthrough or a breakdown.

A British source told the newspaper that talks between the negotiating teams in London are expected to continue until the end of this week.

Amid exciting expectations in the market based on the course of the talks, analysts at Goldman Sachs continue to favour more strength in the British pound against the euro, on the basis that an agreement will be reached. However, this bullish stance comes with a warning that talks could extend beyond next week and a deal may only be struck in December.

Analyst Zach Bandel of Goldman Sachs says the European Council meeting scheduled for December 10-11 may be a focus, followed by the final plenary session of the European Parliament between December 14 and December 17. Accordingly, Pandel said: "This should provide the pillar for the month of December if the talks go on for a longer period."

UK labour market statistics released on Tuesday revealed that the British economy shed 164,000 jobs in the three months since September, a number that was worse than -148,000 in a survey of economists. The job losses were driven by a record high number of layoffs in the recent period, pushing the UK unemployment rate from 4.5% to 4.8% according to the Office for National Statistics data, but economists warn that this number could nearly double by next year.

The holiday plan is expected to be extended until the end of March as Chancellor Rishi Sunak announced last week, and the economy awaits the opportunity to completely reopen again. As of September, government subsidies were cut under the scheme from 80% to 70%, with companies required to contribute 10% to the salaries of workers sent on holiday. ONS BICS data show that the number of people on the vacation scheme fell by 600,000 in September. Lloyds Bank economists measured this against the one-month decline in employment during September (around 60K) and concluded that about 10% of people who took leave lost their jobs.

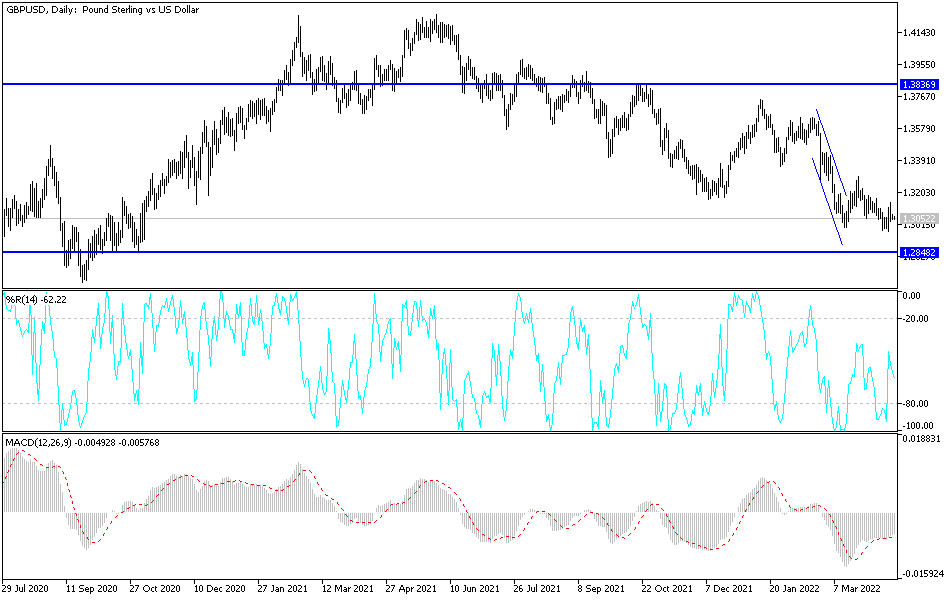

Technical analysis of the pair:

On the daily chart, the GBP/USD pair is still in an upward correctional range despite the stalling of its gains. The formation of its recent ascending channel may face risks if the currency pair pushes towards the support levels at 1.3150 and 1.3080, respectively. In return, breaching the resistance 1.3300 will be important for the bulls to complete the recent ascending path. It must be taken into account that the sterling’s gains in general will be subject to developments regarding negotiations between the European Union and Britain, which have entered a decisive stage. The usual failure means a rapid collapse of the sterling's gains. If an agreement is reached, investors' attention will turn to efforts to contain the outbreak of coronavirus, which forced the country to completely shutdown again. I still prefer to sell the pair from every upper move.

Today's economic calendar:

The day will begin with the announcement of the rate of growth of the British economy, as well as the index of industrial and manufacturing production and the rate of business investment. These will be followed by statements by the Governor of the Bank of England. For the USD, the US Consumer Price Index and the weekly jobless claims will be announced, followed by statements by Federal Reserve Governor Jerome Powell.