This is quite interesting considering that the Brexit situation has not gotten any better and it is likely that it will take the forefront sooner or later. However, in the meantime it is obvious that we are willing to ignore this and pay attention solely to the situation in the United States. The election of course has people thinking that there is eventually going to be some type of resolution and therefore everybody will celebrate for a moment. However, the real battle begins once we start talking about stimulus.

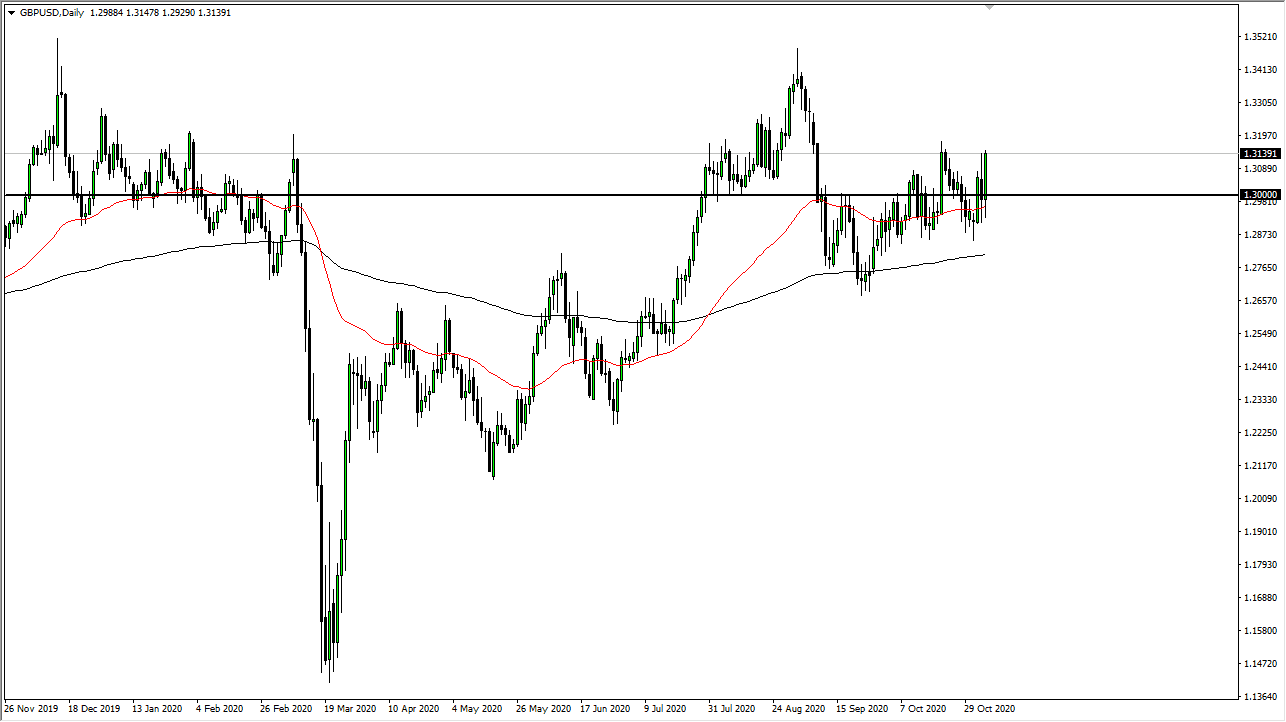

The size of the candlestick is somewhat important, and it is somewhat impressive. This suggests that we could break above the 1.32 level, which would be a sign that we are probably going to go looking towards the 1.34 handle. However, Friday also features the jobs number so that is something worth paying close attention to. The market will almost certainly be very volatile, but at this point in time I think it is only a matter of time before we see selling pressure come back into the fold.

With everything being said and done, it is likely that we will get a short-term burst only to be inundated with Brexit talk again. The 1.30 level does seem to be a bit of a magnet for price, so if we fell from here it would not be a huge surprise. Ultimately, I think this is a market that will try to go higher, but do not be overly surprised if the United Kingdom finds a way to mess things up again. After all, locking the economy down again is not going to do the UK economy any favors, so one has to wonder how long any type of celebratory rally will last. To the downside I see a lot of support between the 50 day and the 200 day EMA indicators though, so I would not get overly aggressive. I guess in the end, we are looking at a market that is at the top of its range, and now we need to see whether or not it can break out. We should continue to see a lot of noisy trading, but in general I think not much has changed, at least not yet. By the time we get a daily close on Friday we should have a lot more in the way of answers.