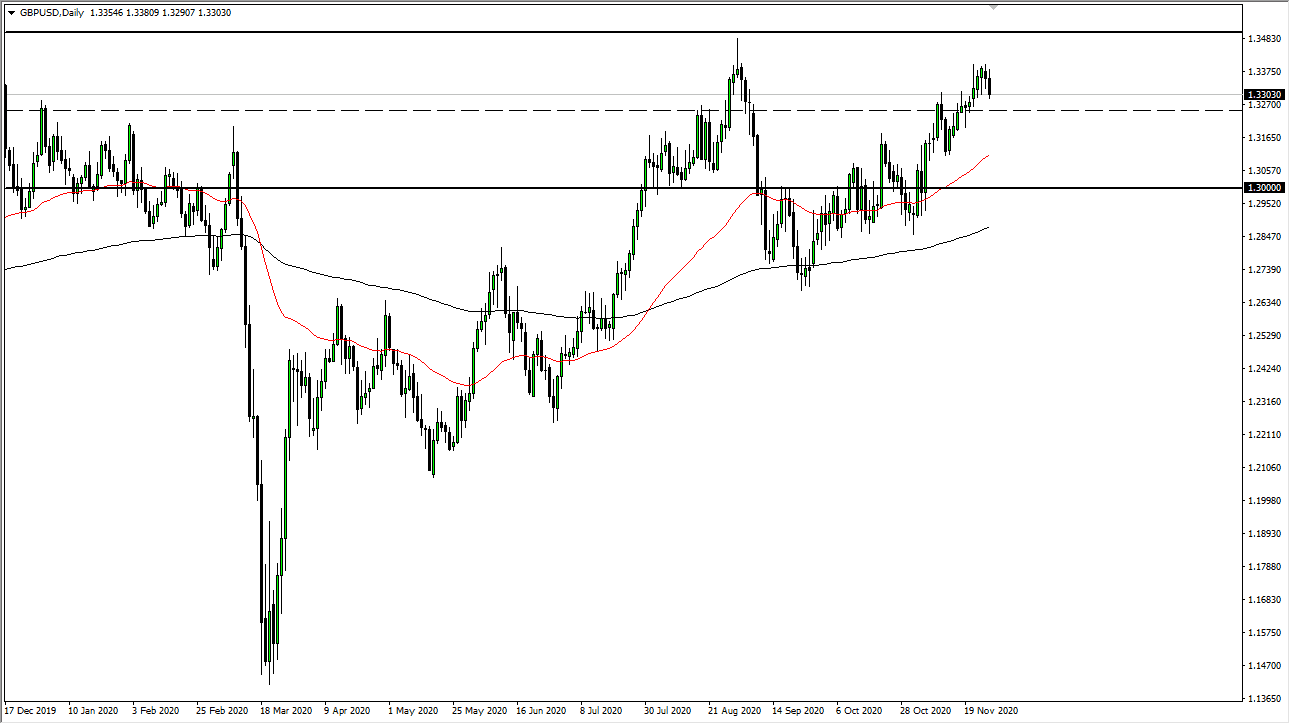

The British pound initially tried to rally during the course of the session on Friday, but then broke down to reach towards the 1.33 handle. The market still sees plenty of support underneath it, but perhaps some of the selling was due to Brexit headlines continuing to struggle to provide positivity, and people starting to see the lack of momentum forward as a potential problem. The British pound could very well find buyers underneath, perhaps near the 50-day EMA. Between now and then, there are plenty of short-term areas underneath that could offer buying opportunities. It is because of this that I have no interest in shorting this market, and I do think buyers will get back in. I am waiting for a supportive daily candlestick in order to go long, which we obviously do not have yet. Given enough time, we will see that, but at this point it is a matter of having a little patience.

Keep in mind that headlines will continue to cause issues in the market, which could include over the weekend. Most pundits believe that there is a deal coming; Citibank has even come up with a statistical analysis that suggests there is slightly over an 80% chance of a Brexit deal. It could be assumed that sooner or later, people will be interested in getting on board. Look at the historical prices when it comes to the British pound: we are very cheap, and that means a lot of value hunters will be involved.

In fact, I have no interest in shorting the British pound unless we see something that suggests a no-deal Brexit. In that case, we could see this market fall through the floor. There would need to be finality to the negotiations, something that neither the UK nor the EU seems willing to do anytime soon. For the most part, pullbacks will end up being buying opportunities going forward.