The British pound initially tried to rally during the trading session on Wednesday, but then turned around to fall from the 1.33 level. The pound has gotten ahead of itself, especially with Brexit uncertainty still ongoing, and we do not have a solution. It appears that the market is trying to front run whatever happens there, but you can make that argument for the trading action of the last four years.

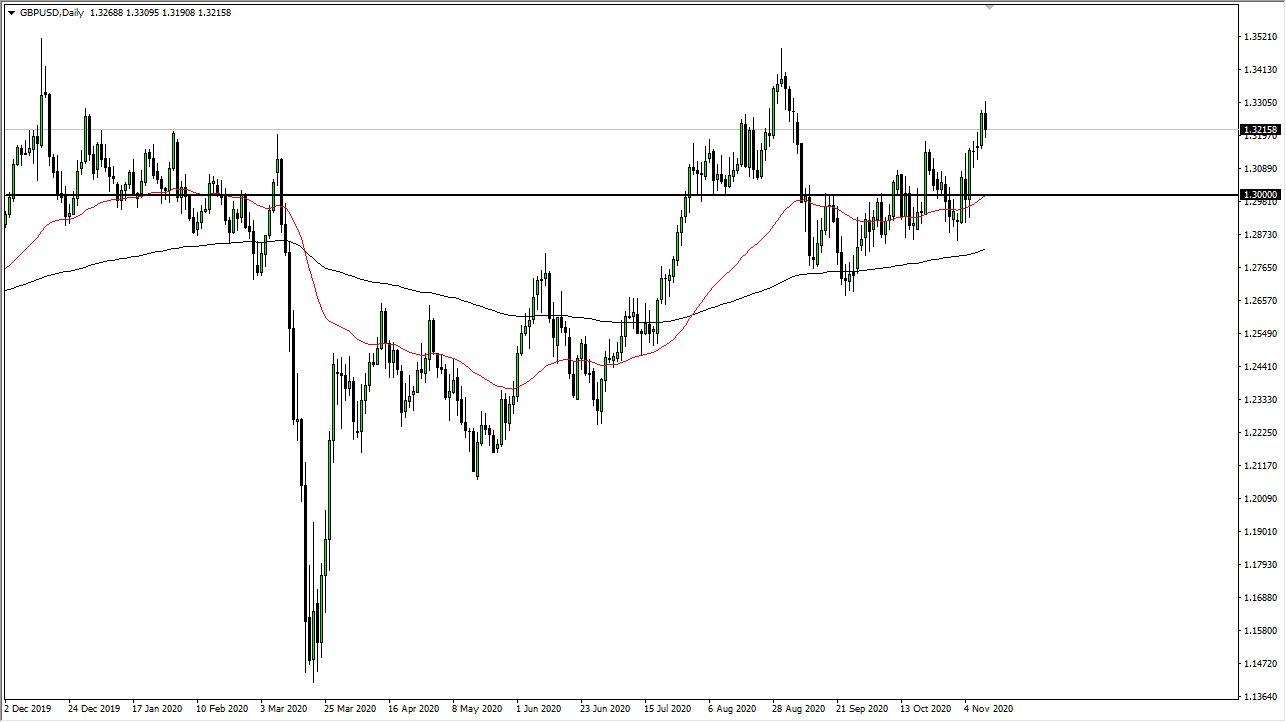

Looking at this chart, a significant pullback could be coming. I am not calling for some type of major selling opportunity; rather, a correction is necessary because we got ahead of ourselves. The 1.30 level underneath would be massive support, as it is a large, round, psychologically significant figure, and we have the 50-day EMA sitting just below there that would attract attention as well. The idea of buying pullbacks and taking advantage of value is probably what most people are looking for in order to get involved.

Breaking above the top of the candlestick for the trading session on Wednesday would be a very bullish sign, but it would also be concerning because it would be parabolic. The only way that I would be comfortable buying a breakout the candlestick for the trading session on Wednesday is if there was a deal with Brexit. Barring that, 2it would just make things more difficult for people to hang on to the uptrend and push the market higher. Pullbacks should offer a buying opportunity to pick up the British pound and go looking towards 1.34 handle, possibly even the 1.35 level.

Keep in mind that stimulus in the United States might be smaller than anticipated, which could have the US dollar strengthening as well. All it would take is a negative headline about Brexit to have the British pound selling off again. We are still very erratic in our behavior, but clearly it looks like the resiliency of the British pound should never be underestimated.