Forget what you have heard about Brexit: it appears the British pound has completely looked through it. That has been the case for some time, so even though we get the occasional negative headline when it comes to the Brexit situation, it seems as if the British pound is all but impervious to any bad news. This is particularly interesting, because Brexit is not exactly humming along and we also have to worry about the United Kingdom locking its economy down, which by extension should be rather negative for the currency.

However, people seem to be focusing more on the idea that the Federal Reserve is probably going to do more quantitative easing down the road, or at the very least stay loose for the foreseeable future. Because of this, people look at the British pound as being “cheap”, which by historical standards it most certainly is. But at the end of the day, there is a lot of risk when it comes owning sterling.

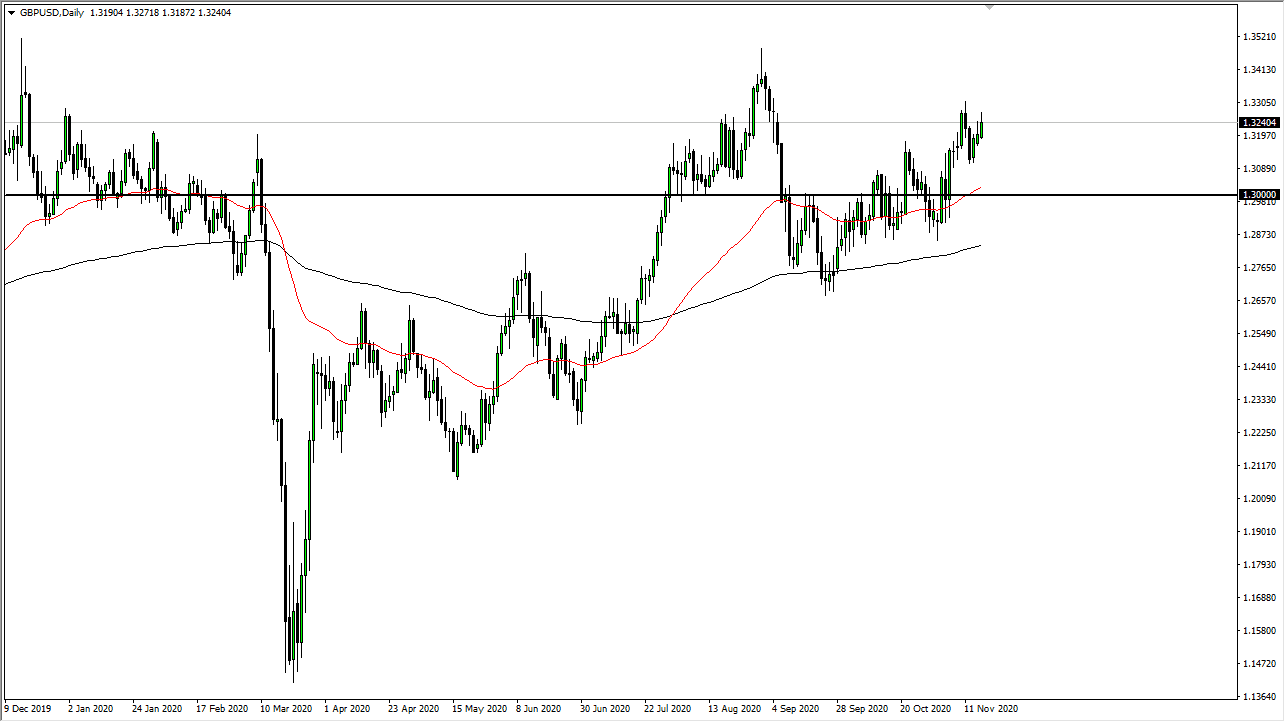

The 50-day EMA is currently crossing the 1.30 level and I think of that as more or less a “floor the market” right now. The 1.30 level is not only where we find the 50-day EMA, but it is also the large, round, psychologically significant figure that a lot of people will be watching. I would be very interested in buying a supportive candlestick in that region, because it is likely to be a nice opportunity to pick up value.

On the other hand, if we break above the 1.33 level, it opens up the possibility for a move towards the 1.35 handle. The 1.35 level is also a large, round, psychologically significant figure and will attract a lot of attention. This is what makes it such a significant target and a good place to take profit from what I see. I like the idea of buying short-term dips, because it does offer value. As far as shorting is concerned, we have all been taught that shorting the British pound is dangerous to do, despite the fact that Brexit seems like it is never going to get solved anytime soon.