The British pound initially pulled back during the trading session on Tuesday, but continues to find reasons to go higher. This market is trying to go towards the 1.35 handle, and it has already decided it is time to get there. However, there is a huge possibility of major disappointment this week.

This is mainly because traders believe that there will be a Brexit deal by the end of the week or shortly thereafter, so it is important to pay attention to the latest headlines. Traders are pretty much banking on a conclusion between now and Sunday. If it does not happen, there will be panic. Earlier this week, we had a bit of optimism come into the market after there were rumors of an extension to buy more time for a longer-term Brexit agreement. This is a story that we have heard before and, just as one would expect, traders were let down. So if we fall apart, it could be rather brutal.

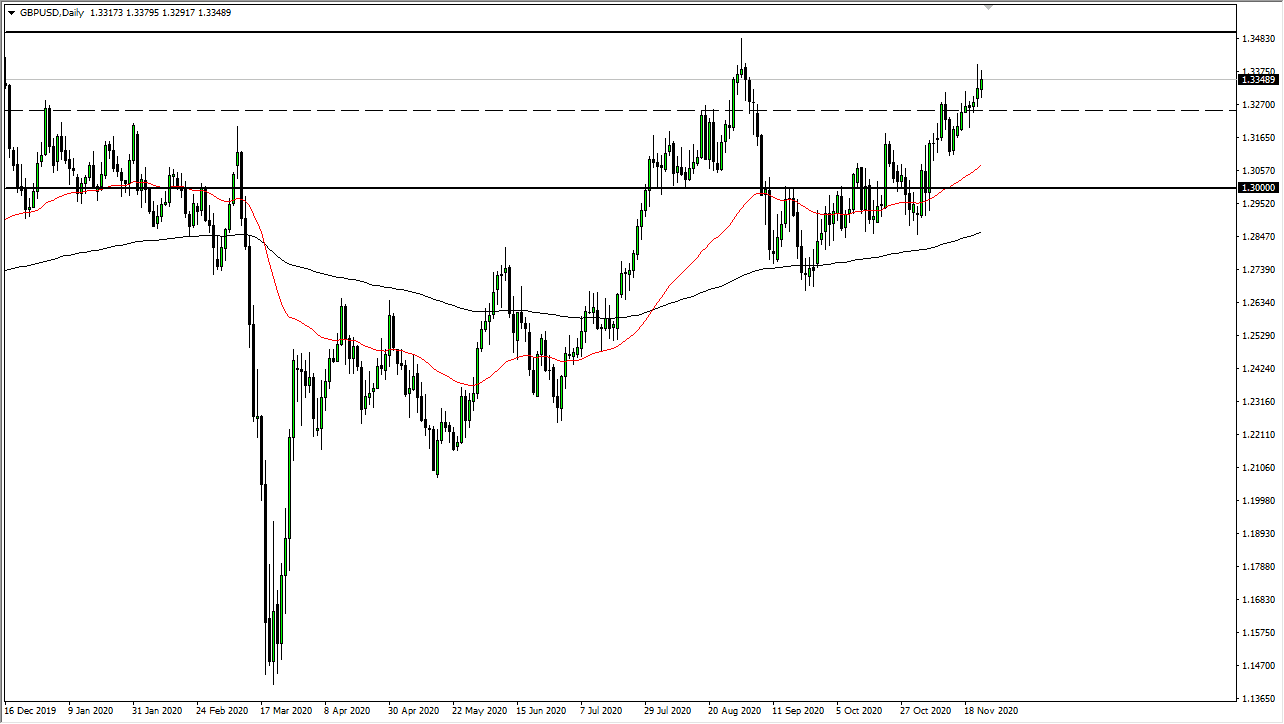

A selloff with a “no deal scenario” could send this market down towards the 50-day EMA rather quickly, if not the 1.30 level after that. The market still favors the upside and short-term pullbacks might be opportunities, but you may see a lot of erratic trading between now and the conclusion of Brexit. I could have printed that statement anytime over the last four years and it would have been truthful.

If there is a sudden “risk off” scenario, then we could see this market go looking towards the US dollar for help. But if we break above the 1.35 handle, then the market could continue to go much higher. We are going to hear a lot of noise, and probably not much more as we are literally moving based on the latest tweet. Market participants are expecting a deal, so the upside is still favored until we get other news that suggests a different outcome.