Big Picture 8th November 2020

In my previous piece last week, I saw the most attractive trade opportunities as likely to be in short trades in the EUR/USD currency pair below 1.1627. This was an OK call as there was not a daily (New York) close in the EUR/USD below that level.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar and the strongest fall in the relative value of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

Last week was dominated by the U.S. elections which produced a very close result which surprised many analysts. Almost all major pollsters were so far off with their predictions as to call into question the viability of the political polling industry. It appears virtually certain that the votes as counted will give Joe Biden a narrow victory, although President Trump is refusing to concede and has alleged fraud, claiming he has won if only legal votes are counted. Although no results have been formally certified yet, all the major networks have called the race for Joe Biden, who has already been congratulated by most world leaders after another batch of results was released in the key swing state of Pennsylvania yesterday. Joe Biden is claiming victory and he seems to have won the popular vote by about 3 to 4%.

President Trump has only two legal possibilities for remaining President beyond January 20th. The first option would be for Trump’s team to prove election fraud or miscounting of the vote in at least three states for a total of a few tens of thousands of votes, while hoping that the ongoing count in Arizona continues to erase Biden’s lead there. Almost all observers agree the chance of this happening is vanishingly small.

President Trump’s second option would be to persuade a majority of the state legislatures in Arizona, Pennsylvania, Wisconsin, and Georgia to override the official counts and send pro-Trump electors to the electoral college. While technically a legal course of action, it is extremely difficult to see this happening, as it would erode more than a century of political norms and plunge the U.S. into a civil war or something close to it. Therefore, unless President Trump’s team can produce some damning evidence quickly, this is virtually certain not to happen.

Another notable feature of the election result was that the Democrats seem to have made either no gains or only very limited gains in congressional elections, and it seems highly likely that Republicans will retain control of the Senate. This will weaken Joe Biden and the Democratic party’s abilities to pursue a legislative agenda for at least the next two years. It also means that a further round of economic stimulus will be forthcoming, but it will probably be less generous than if the Democrats has won full control of the U.S. Congress.

Markets saw riskier asset rise quite firmly last week as it became clearer that Biden could almost certainly claim victory. It is not that markets are especially enthusiastic about a Biden presidency, but rather that they were looking for certainty about the outcome and started to get it. We can expect this risk rally will increase on Monday and into the coming week, with a weak U.S. Dollar and stronger stocks and riskier currencies.

Another major story in the U.S. which was pushed off the front page due to the dramatic election results has been several consecutive days of new all-time highs in confirmed new coronavirus cases in the U.S.A. with daily numbers coming in at over the 100,000 mark and deaths continuing at over 1,000 daily. Joe Biden has already pledged to make getting coronavirus under control one of his top priorities since claiming victory.

The big coronavirus story right now is the sharp rise in deaths globally. Last Friday saw a record number of new cases confirmed globally, at 623,312. I already mentioned the situation is bad in the U.S. but in Europe it is even worse. Several European nations have imposed new lockdowns in an attempt to get the situation under control. The European Union is now reporting more daily cases and deaths than even the U.S.

The U.S. stock market rose strongly last week, making its strongest weekly rise since last April.

Europe is leading the share of the global death toll, at about 37%, while the U.S.A. is accounting for approximately 15%, while Latin America and the Caribbean has 23% of the total. The strongest growth in new confirmed cases is happening in Albania, Algeria, Andorra, Austria, Azerbaijan, Belarus, Bosnia, Bulgaria, Canada, Croatia, Cuba, Cyprus, Czech Republic, Denmark, El Salvador, Estonia, Georgia, Germany, Greece, Guatemala, Hungary, Indonesia, Iran, Italy, Japan, Jordan, Kenya, Kosovo, Latvia, Lebanon, Liechtenstein, Lithuania, Malaysia, Moldova, Montenegro, Morocco, North Macedonia, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey, U.S.A., Ukraine, the United Kingdom, and Uruguay.

The coming week is likely to bring a high level of activity to the Forex market possible exceeding the already high volatility seen last week. However, there is little high-impact economic data due over the coming week except U.S. inflation data and monthly policy input from the Reserve Bank of New Zealand.

The U.S. stock market typically rises after a U.S. Presidential election and it is likely that we will see U.S. and global stock markets continue to rise over the coming days coupled with a yet weaker U.S. Dollar.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a large, strong, bearish outside candlestick. It closed quite near the bottom of its range, which is a bearish sign. Significantly, the long-term bearish trend has resumed, as the price is now lower than it was both 3 and 6 months ago. Overall, next week’s price movement in the U.S. dollar looks likely to be downwards.

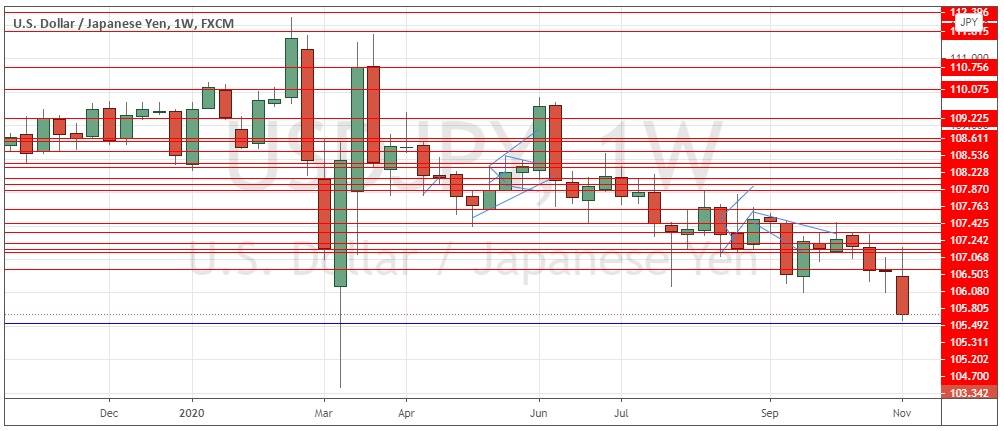

USD/JPY

The USD/JPY currency pair is in a long-term downwards trend after falling strongly last week, printing a strong weekly bearish outside candlestick which closed near the low of its range. The closing price at the end of the week was the lowest seen in four years. We see a significant bearish breakout here below long-term support just above 104.00. However, the price is not far from support at 103.07, so traders may want to see that level invalidated before getting short here.

Bottom Line

Bottom Line

I see the best likely opportunity in the financial markets this week in taking a short trade in the USD/JPY currency pair.