Throughout last week's trading, the EUR/USD was in a positive upward correction range amid investor optimism that Joe Biden would beat Trump in the US presidential elections. Bounce gains of for the pair pushed it towards the 1.1890 resistance before closing the week's trading, its highest level for nearly two months, and stabilizing around the 1.1875 level. With the reopening of trading this week, it is expected that the currency pair will witness a price gap in one of the two directions in response to the announcement that Biden has won the presidency of the United States of America. So far, expectations are optimistic that Biden will remove all the obstacles that Trump made over the course of four years, which caused the financial markets and investors heavy losses. This may be due to America's trade wars around the world, especially with China, as well as its withdrawal from all international alliances, which were making a great balance in the global economic performance.

But it must be taken into account that Euro gains may collide with fears of re-restrictions by European countries to contain the new spread of the coronavirus, which is registering record numbers compared to the first wave at the beginning of the year. The new restrictions - which have led to the shutdown of a host of non-essential companies - allow greater freedom than the near-total 10-week Italian shutdown that began in March. The restrictions have nonetheless brought in mutual accusations from regional governments who feel they are being unfairly targeted. In particular, the south, which largely survived in the spring, was more angry, despite concerns that its health-care system was particularly weak.

Italy's move mimics that of many parts of Europe, where infections are rising again. But governments have been reluctant to impose total lockdowns nationwide as they did in the spring due to the terrible economic damage caused by the lockdown. For example, many European countries have chosen to keep schools open - making it easier for parents to work - while bars, restaurants and many shops close.

The Italian restrictions came into effect on the day the country recorded an all-time new level of confirmed infections in a single day - 37,809 - and the largest number of deaths - 446 - since spring. The number of recent cases in Lombardy has risen to nearly 10,000, accounting for more than 25% of the new infections confirmed in Italy on Friday.

In the largest economy in the Eurozone, the German Minister of Health has warned of troubled times ahead unless the country can "break" the increasing trajectory of coronavirus cases, which has doubled the number of patients in intensive care in just 10 days and set a new record of more than 21,500 new confirmed cases on Friday.

By the end of last week, industrial production in Germany grew strongly during the month of September, albeit at a slower pace than expected before the new restrictions were imposed to contain the coronavirus. Industrial output in Germany increased 1.6 percent month-on-month, more than the revised 0.5 percent increase in August, but slower than economists' expectations of 2.7 percent.

Excluding energy and construction, production in the industry rose 2.0 percent in September.

Within the industry, production of intermediate goods showed an increase of 1.4 percent. The output of consumer goods rose by 3.0 percent and output of capital goods by 2.2 percent. Output in the auto industry, the largest in manufacturing, grew 10 percent from the previous month. Outside of industry, energy production decreased by 2.5 percent, while construction production grew 1.5 percent. The data showed that the annual decline in industrial production came in at 7.3 percent in September. However, this was slower than the 8.7 percent decline recorded in August. Compared to February, a month before the restrictions due to the coronavirus pandemic were imposed in Germany, production decreased by 8.4 percent.

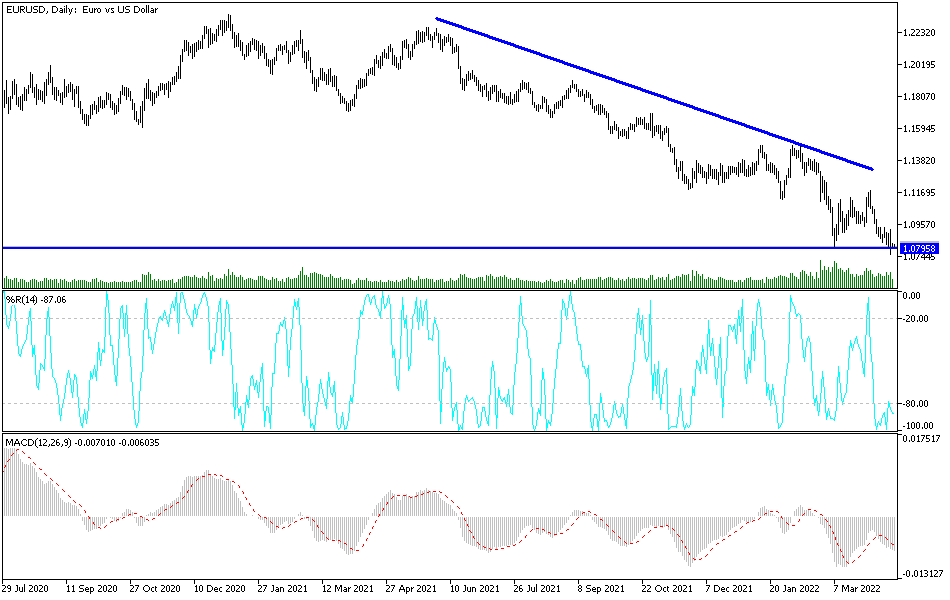

Technical analysis of the pair:

On the daily chart, the EUR/USD is still in an upward correction range supported by stability above the 1.1800 resistance, which is currently the closest to moving towards the psychological resistance level at 1.2000, and more if the dollar continues to decline. In return, the failure of this trend will lead to the currency pair returning to the downside, as the formation of the head and shoulders will begin to pressure the pair and thus the bears will take over again. The strength of the second coronavirus wave and more European restrictions may negatively affect the positive outlook for the EUR. We are currently awaiting the dollar's reaction to Biden's victory and his future plans to revive the US economy and confront the COVID-19 epidemic.

Today's economic calendar:

Regarding the Euro, the German Trade Balance will be announced, followed by the investor confidence index reading in the Eurozone and the statements of the European Central Bank Governor Lagarde. There is no significant US data expected today.