For three trading sessions in a row, the EUR/USD pair is trying to rebound higher in light of the pressure on the US currency, which awaits the final results of the dramatic US elections. The bounce gains of the pair pushed it towards the 1.1770 level before settling around 1.1740 at the time of this writing, at a time when markets are waiting for the US Federal Reserve’s monetary policy announcement, as well as the election results. Will Trump win a second term? Or will Biden succeed? And then we witness a complete change in the dramatic policy of the Trump administration over the past four years .We will have to wait and see.

The outcome of the US election remains unknown, and the uncertainty may persist. However, some things became known. There is no blue wave, and the implication is that even if Biden wins the presidency, it is unlikely that the Democrat Party will take over the Senate. This appears to limit the scope of the large fiscal stimulus and means that redistricting on the basis of the 2020 census may be limited.

There are several states that see the result very close to a winner announced. Among those states, Biden appears to be leading in Arizona, New Hampshire, Wisconsin and Nevada. Together, they represent 31 of the Electoral College votes. Without these, Biden is seen winning the 238 Electoral College votes. It is less than the 270 required which places the burden on the Democratic Party. The focus is now on four states - Georgia, Michigan, North Carolina and Pennsylvania - all leaning toward Trump.

Commenting on the US election, Mizuho Bank said, "The ideas that the uncertainty about the elections amid the threat of prolonged legal competition for the White House and Congress (the impasse of the Democrats in the House and the Republican Senate) that would frighten the financial markets, could not be further from the truth. Instead, markets were happy to assume that this Democrat would lead the White House.”

As Republicans moved closer to retaining control of the Senate, the prospects for tax increases and tougher regulations on companies that investors would expect if the Democrats achieved electoral sweep diminished. Therefore, it seems that the great stimulus efforts for the economy that many economists and investors are pushing for are now less likely.

The US Federal Reserve is meeting and is due to announce its latest interest rate policy decision Thursday. But the central bank may be late in determining whether to expand the economic support it was providing through very low interest rates and how to expand it even after the final election results are confirmed.

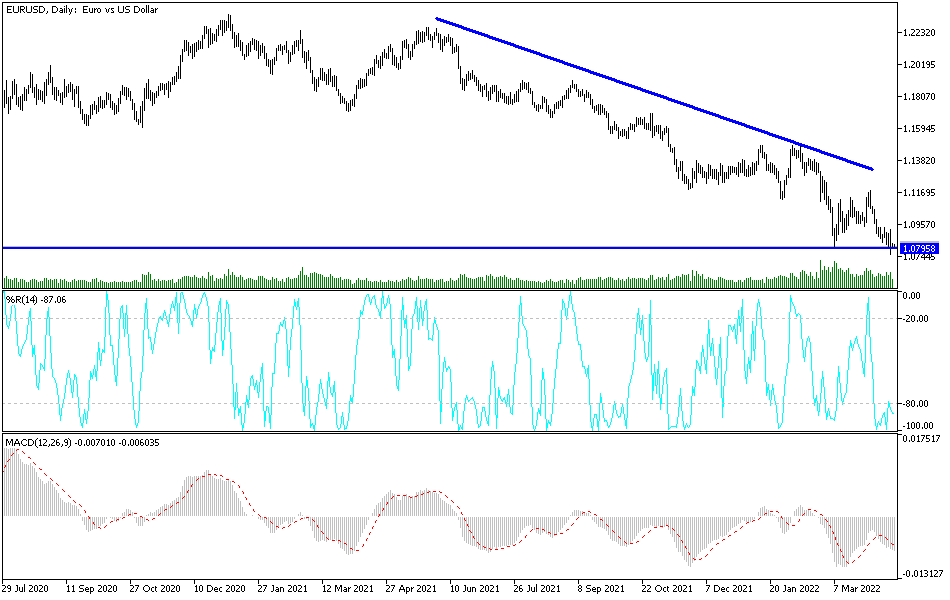

Technical analysis of the pair:

Breaching of the 1.1800 resistance is still important for the bulls to push the EUR/USD pair towards stronger ascending levels, which will transform the bearish outlook and still dominates the pair’s performance on the long run. On the downside, the 1.1600 support is still important for bears to continue their dominance path. In general, any gains for the pair will collide with European restrictions to contain the spread of the coronavirus and its harmful impact on the European economy in the fourth quarter of 2020.

Today's economic calendar:

Regarding the Euro, German factory orders will be announced, and then retail sales numbers for the Eurozone will be released. During the American session, the most important will be the weekly jobless claims and non-agricultural productivity. Then, the Federal Reserve’s announcement of its monetary policy, ending with the statements of Bank Governor Jerome Powell.