As expected, the forex trading market may witness a state of instability until the official announcement of the US presidential election results. As soon as the vote counting started, we noticed a state of instability in the EUR/USD performance: the pair rebounded up to the 1.1770 resistance, then quickly rushed down towards the 1.1601 support, then stabilized around 1.1660 at the time of this writing. This is abnormal activity for the major currency pair, especially in the beginning of today's trading. It may remain so until the final announcement of the voting results and the reaction to determining the fate.

The EUR/USD rose again from its lows reached in late September in anticipation of Democratic Presidential Candidate Joe Biden’s victory, but it may fall by 2% if the result is contested or in response to a sudden victory for President Donald Trump, some analysts say. Accordingly, the single European currency traded comfortably above the 1.17 level on Tuesday, after falling to 1.1620 in the previous session, amid strong and broad gains in positively correlated stocks, commodities and currencies around the world.

Gains in risk assets were increased along with dollar losses as investors bet heavily that Joe Biden and the Democratic Party would wrest both the White House and the Republican-dominated Senate, enabling them to rule without restrictions for four years from January 2021.

But with investors and traders cautious in the wind, a disputed outcome remained possible and may become more likely after President Donald Trump slammed the Supreme Court's decision over the weekend to allow mail voting to continue on Election Day in Pennsylvania, which would likely delay the outcome of swing condition.

Commenting on the reaction from the results, Jordan Rochester, an analyst at Nomura, said: “What does the disputed outcome mean for the markets? The short-term/immediate impact on the foreign exchange/interest rate markets can be highly dependent on the outcome of the election. A 2% drop in EUR/USD is a possibility in this scenario of prolonged uncertainty.” He added: “However, even under the scenario of a contested election by Trump (if it comes to the need to wait for a complete count of votes via email and/or fraud accusations), due to the small winning margin in Biden's favour, we think the negative impact on the markets will ultimately be limited on the long run”.

The disputed election could mean weeks of uncertainty as points of contention are settled in court, the least favourable outcome for investors, while the Euro is unlikely to celebrate any victory for President Donald Trump. His victory would ensure renewed trade tensions between the United States and China while preserving the possibility of a trade battle between Washington and Brussels. Joe Biden is less hostile towards the Chinese government and the European Union than the current president, making him the Euro-friendly candidate and the preferred winner for risk currencies.

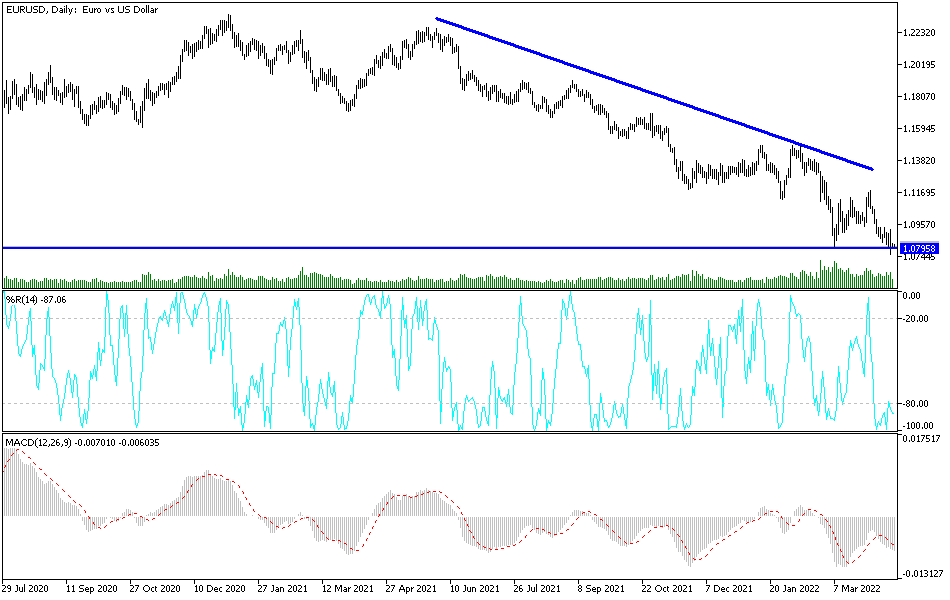

Technical analysis of the pair:

The EUR/USD pair will remain in a state of instability until the official announcement of the winner in the US Presidential Elections. Trump's victory will restore the markets to the same current situation, and Biden’s victory will make a strong and instant change to prices. Therefore, caution and sufficiency must be observed while awaiting for the results. Fast movement is not suitable for many trading accounts and for many traders. Technically, the pair crossed the 1.1800 resistance barrier, which is very important for the bulls to help move towards the psychological resistance level at 1.2000. At the same time, gains will collide with concern about the coronavirus outbreak and European closure measures, so gains may stop very soon. On the downside, breaching the 1.1600 support, as it would have happened at the beginning of today's trading session, is important for bears to pull the currency pair to a stronger support level.

Today's economic calendar data:

The Services PMI reading for the Eurozone economies will be announced, followed by the producer prices announcement in the bloc. From the United States of America, non-agricultural jobs change from ADP, and the trade balance of the United States will be announced, and then the ISM US services PMI reading will be announced.