For the second day in a row, the EUR/USD currency pair is witnessing profit-taking selling after a bullish jump at the beginning of the week’s trading. The pair reached the 1.1920 resistance amid market optimism and investor risk appetite after a Biden victory was announced by the media, as well as further announcement regarding the development of coronavirus vaccines. With the market pricing for these important events, profit-taking sales started pushing the pair towards the 1.1745 support before settling around 1.1777 at the time of writing.

Contributing to the euro sales was the European Central Bank Governor Lagarde warning of growing optimism about a vaccine against the coronavirus.

Therefore, it is expected that policymakers at the European Central Bank will prefer to buy assets and long-term loans at cheaper rates to support the Eurozone economy during the crisis caused by the coronavirus. “While all options are on the table, PEPP and TLTRO have proven to be effective in the current environment and can be dynamically adjusted to respond to how the pandemic is developing,” Lagarde said in an introductory speech at the European Central Bank’s Forum on Central Banking.

The main tools for adjusting our monetary policy are likely to remain in place.

The annual event of the European Central Bank is usually held in the Portuguese city of Sintra, but this year will be held virtually due to the pandemic. The Pandemic Emergency Purchase Program, or PEPP, was launched for the first time in March with a volume of 750 billion euros, which was increased in June to 1.350 trillion euros. Asset purchases under this scheme were set to operate at least until June 2021. Targeted Long-Term Refinancing Operations, or TLTROs, were first deployed in June 2014. The TLTRO III Round was announced in March 2019 and its terms were relaxed in March of this year with the outbreak of the pandemic in Europe.

Pharmaceutical company Pfizer and German biotechnology company BioNTech announced this week that their coronavirus vaccine has been more than 90% successful in preventing the disease.

"While the latest news about the vaccine is encouraging, we can still face repeated cycles of accelerating spread of the virus and tightening restrictions until widespread immunity is achieved," added European Central Bank President Lagarde. "So the recovery may not be linear, but rather unstable, stalled, and dependent on the pace of the vaccine," she added.

Lagarde drew attention to the strong resurgence of the coronavirus, which forced Germany and France, among other countries, to return to closures. She said the second wave of COVID-19 presents new challenges and risks, but the blueprint for managing it is the same.

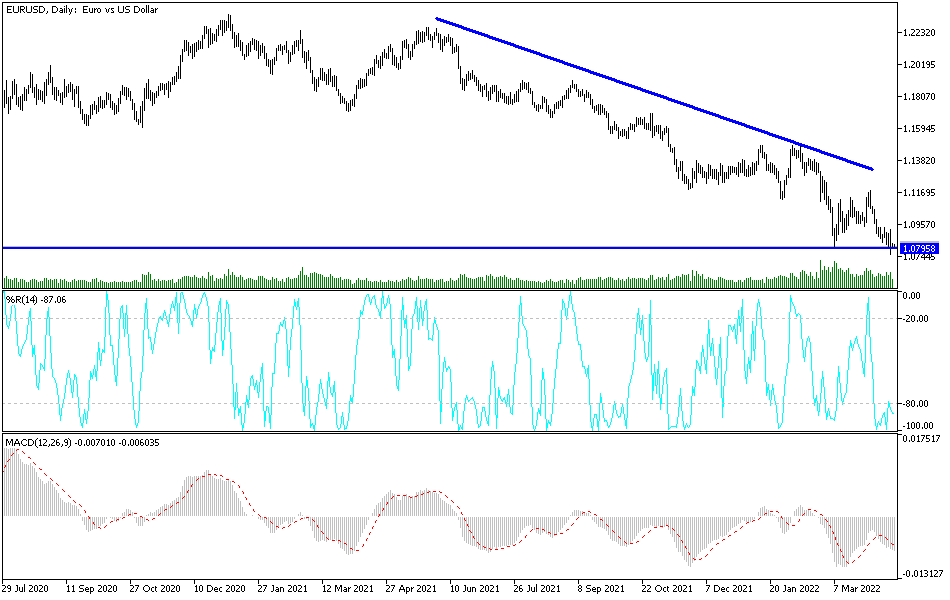

Technical analysis of the pair:

According to the recent EUR/USD performance, and as is evident on the daily chart, the formation of the head and shoulders began to affect the technical trends of the pair. Accordingly, the sales operations increased to reap profits. Forex traders will start to consider buying the pair again if it breaks below the 1.1700 support. I had expected in the technical analyses that the pair gains would be subject to a rapid collapse as European restrictions contribute to the slowdown in the economic activity of the bloc, which is feeling the effects of the pandemic. Also, the strength of the euro exchange rate does not please European Central Bank officials much. In the same period of time, if the pair returns to breach the 1.1920 resistance, it will be easier to move towards the 1.2000 psychological resistance.

Today's economic calendar:

Regarding the euro, the German Consumer Price Index will be announced, followed by the rate of industrial production in the Eurozone. Later on, new remarks will be made by European Central Bank Governor Lagarde. Regarding the USD, the US Consumer Price Index and the weekly jobless claims will be announced, followed by statements by Federal Reserve Governor Jerome Powell.