Similar to last week's trading, the EUR/USD pair moved in the same upward correction range at the beginning of this week’s trading, as it remained stable around the 1.1868 resistance at the time of writing. Contributing to the stability of the pair were the successive announcements from major pharmaceutical companies around the world regarding the development of effective coronavirus vaccines.

One of the main pillars of support for the euro in 2020 was the expectation that member states of the European Union would meet and agree on a common approach to financing the response to COVID-19 and recovery from it. The plan - which helped push the euro to its highest levels in several years this summer - involved borrowing money by the European Commission to spend on EU countries that were hit the hardest by the crisis, thus guaranteeing debt by all nations.

However, the plan has not yet been published, and news that Hungary and Poland have hampered progress raises questions about whether the plan will be passed.

“Hungary and Poland carried out their threat and rejected the long-term EU budget in protest against the rule of law mechanism,” says Christoph Weil, chief economist at Commerzbank. "This also hinders the recovery fund, which should benefit countries like Italy and Spain in particular. And now, the European Union heads are urging states and governments to address this problem.”

The two countries blocked approval of the European Union's long-term budget on Monday, which includes a 750 billion euro coronavirus rescue package. They said approval of the budget would interfere with their domestic laws because the budget includes a new tool designed to prevent European Union funds from going to countries that violate certain rule of law standards. Hungary and Poland have both recently come under scrutiny over domestic law changes that the European Union argues undermine the independence of the judiciary, media freedom, and human rights.

The veto will likely be discussed at the European Council summit scheduled for Thursday, which makes this meeting extremely important given that the other topic under discussion is the state of trade negotiations between the European Union and the United Kingdom, which are currently at an impasse. However, according to a Commerzbank analyst, EU leaders are likely to eventually reach an agreement with Poland and Hungary over their concerns.

As for coronavirus effects, the German central bank said in its monthly report released yesterday that the German economy recovered in the summer, but it is unlikely to continue into the fourth quarter due to the recent resurgence of the epidemic. Despite very strong growth, overall economic performance in the third quarter remained 4 percent below the pre-crisis level in the fourth quarter of 2019.

The German central bank added that experts estimated that the catch-up movement will not continue in the last quarter of 2020 at the present time due to the re-emergence of the epidemic in Germany and neighbouring European countries, as well as additional containment measures. However, given that measures have limited life far less than in March and April, a similar severe recession like in the spring is unlikely.

Moreover, the bank noted that global production conditions have not been affected so far, despite the very large number of new infections across Europe.

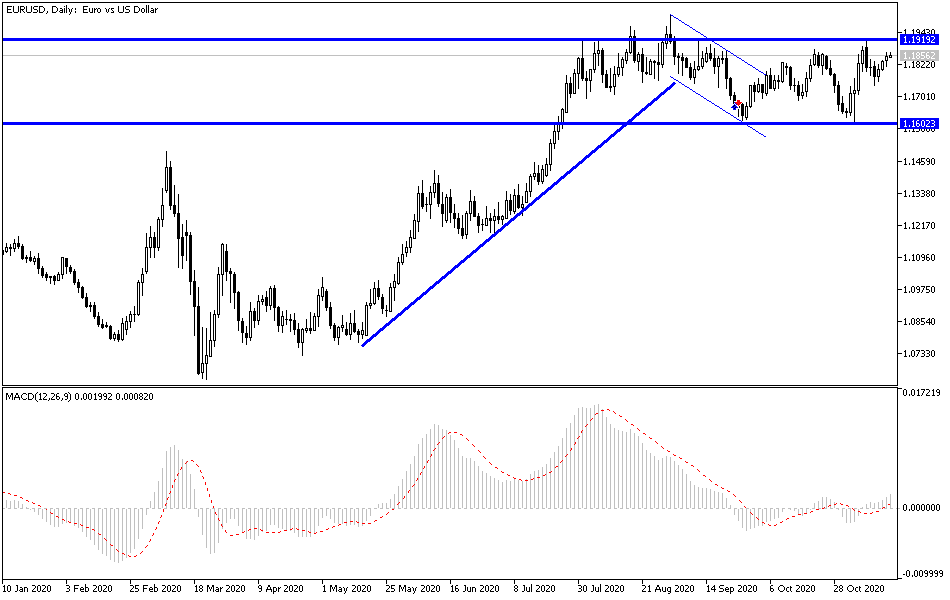

Technical analysis of the pair:

As I mentioned in the recent technical analyses of the EUR/USD, stability above the 1.1800 resistance will remain important for bulls to push the pair towards higher resistance levels, which are currently closer to 1.1920, and then towards the interesting psychological resistance at 1.2000, respectively. According to the performance on the daily chart, crossing the 1.1745 support will trigger the bears' control again, as is the case on the long run.

Today's economic calendar:

All focus will be on the US economic data, which is represented in the US retail sales numbers, followed by industrial production numbers.