After eight trading sessions in a row, the EUR/USD currency pair managed to correct higher, taking advantage of the optimism in the markets amid announcements of successful coronavirus vaccines. The pair started this week's trading by moving towards the 1.1906 resistance, but profit-taking operations were faster, as the pair fell to the 1.1800 support before settling around 1.1840 at the time of this writing. Poor PMI readings for the Eurozone manufacturing and services sectors contributed to the euro's correction.

The US economic survey results led to a sharp rise in the dollar’s value against other currencies. The IHS Markit Services PMI reading for November - which gives an instant glimpse of the American services sector conditions - came in at 57.7, higher than October's reading of 56.9. Expectations were for a reading of 55.0. But the manufacturing PMI was where the biggest losses happened, coming in at 56.7, higher than the October reading of 53.4, while expectations were of 53. The composite PMI - which restores balance between the two results to calculate their share of the economy as a whole - was at 57.9, up from 56.3 in the previous month.

Not only did the data indicate that the US economic recovery gained momentum while the European economy is reversing due to new coronavirus lockdowns, but the survey showed that employment has reached an all-time high. Most importantly, IHS Markit - the report's authors - said that survey respondents reported an unprecedented increase in prices.

The combination of rising employment and higher prices has led markets to offer their expectations about the next Fed rate hike. Moreover, the data suggests that the pressure on the Fed to ease further in the coming weeks is waning. IHS Markit has reported that the improved demand environment has allowed an increasing number of companies to raise their selling prices, with November thus witnessing the fastest rate hike the survey has recorded so far.

The inflation rate hit a record high in the services sector and the highest level in 25 months in the manufacturing sector.

Markets are now used to the likelihood of inflation to be absent from the economic landscape for months, and possibly years to come. Therefore, any hint that inflationary pressures are building up is likely to elicit a reaction from the Fed in the form of higher interest rates. At the same time, higher interest rates improve the attractiveness of US money market assets to international investors, thus strengthening the value of the dollar.

In general, the difference between economic fortunes in the Eurozone and the United States is stark. As the US economy continues to recover rapidly, the Eurozone Composite PMI fell to a reading of 45.1 in November, down from a reading of 50.0 in October and below market expectations of 45.80. The Eurozone Services PMI fell to a reading of 41.3 from 49.6 previously, a contraction caused by the lockdown measures imposed by Eurozone governments in response to the second wave of COVID-19 cases.

Commenting on the findings, Allen Schwilling, an economist at ABN AMRO Bank NV, said: “We expect the current lockdown measures to remain largely in effect over the next few months, until the introduction of a vaccine leads to immunity for key workers and the most vulnerable groups in society, which we expect will be late in first quarter of 2021 or early second quarter of 2021.Therefore, we expect activity in the services sector to remain weak during the fourth quarter of 2020 until the first quarter of 2020.”

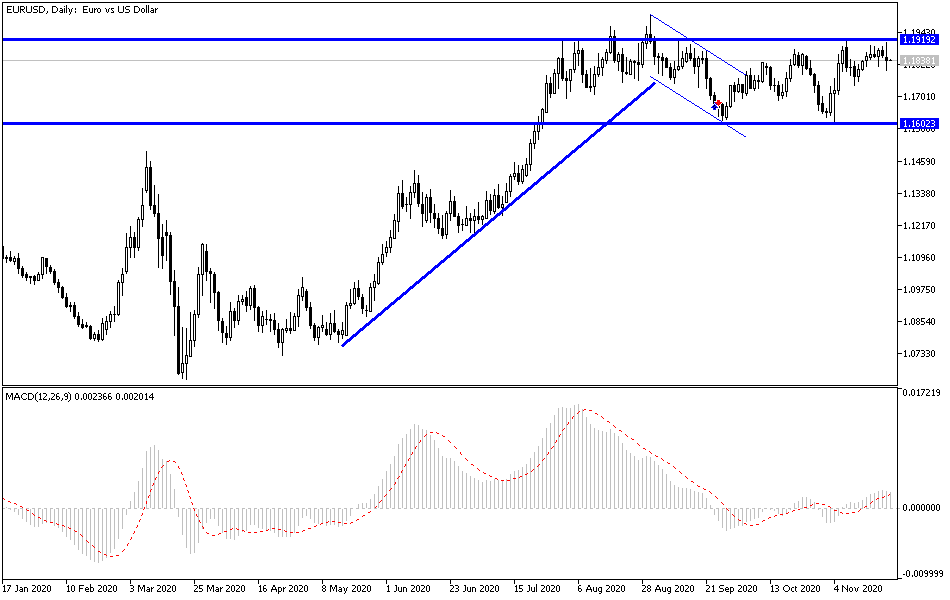

Technical analysis of the pair:

The EUR/USD's move during yesterday's trading was the biggest evidence that the technical indicators have reached overbought areas and that take profit sales can be made at any time. This is especially true given the dwindling movement of the pair in the last trading sessions and the upcoming Thanksgiving holiday, which greatly reduces liquidity in the markets. Stability of the pair below the 1.1800 support will increase the bears' control to move towards stronger support levels. The closest ones currently are 1.1745 and 1.1690, respectively. On the upside, the 1.1900 resistance and the 1.2000 psychological top will remain important targets for the bulls.

Today's economic calendar data:

First, the German GDP growth rate will be announced, then the German IFO Business Climate index will be released. During the American session, US Consumer Confidence and the Richmond Industrial Index will be announced.