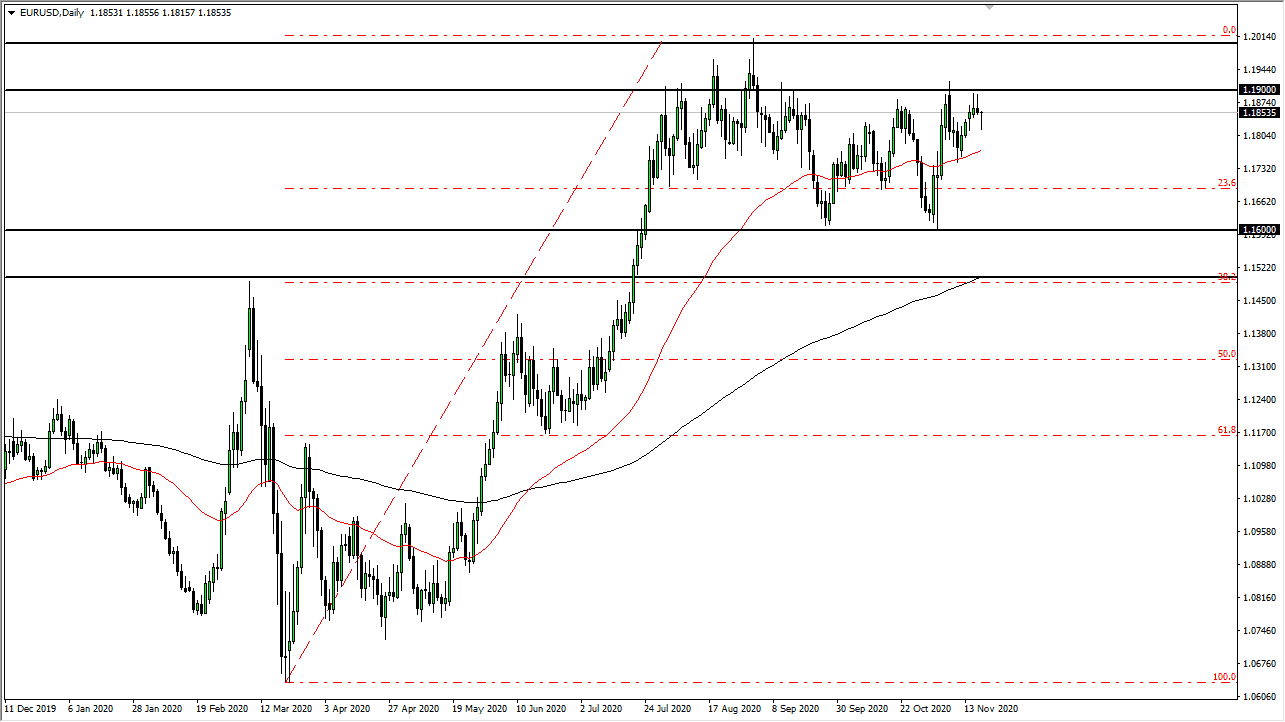

The Euro broke down a bit during the trading session on Thursday but as the Europeans went home, the Americans decided to buy it. That being said, the 1.19 level above is still a significant amount of resistance, extending all the way to the 1.20 level. I think that signs of exhaustion are still sold into, but it is also worth noting that the most recent low was down at the 50 day EMA, and higher than the one before it. The question now is whether or not the market is trying to build up the necessary momentum to break out? I think it is a bit early to suggest that is a definite, but overall, it is going to come down to what the ECB decides and of course coronavirus figures.

Looking at this chart, if we do break down significantly, and perhaps below the 50 day EMA, then we could go down to the 1.16 handle. That is a significant support level that extends down to the 1.15 handle, so all things being equal I think that we still have plenty of buyers down there as well. I still play the range that we are in, but I will state that the last couple of days have shown just how noisy the markets really are.

It will be interesting to see whether or not we can crack the 1.19 level, but it is clear that the New York traders are willing to jump on anything even remotely risk related, so we have a major disconnect when it comes to parts of the world. That is going to continue to be a major driver of choppy behavior, which is typical of this pair anyway. This being said, I think that we continue to go back and forth on short-term charts more than anything else.

Looking at the candlestick for the day it does suggest that there is still plenty of buying pressure underneath, but at the end of the day we cannot seem to break out to the upside so I think you probably get a back-and-forth session on Friday as well. Looking at this chart, I believe it is a battle between who has more coronavirus figures in damage from coronavirus than the other, and therefore think it is very noisy in general.