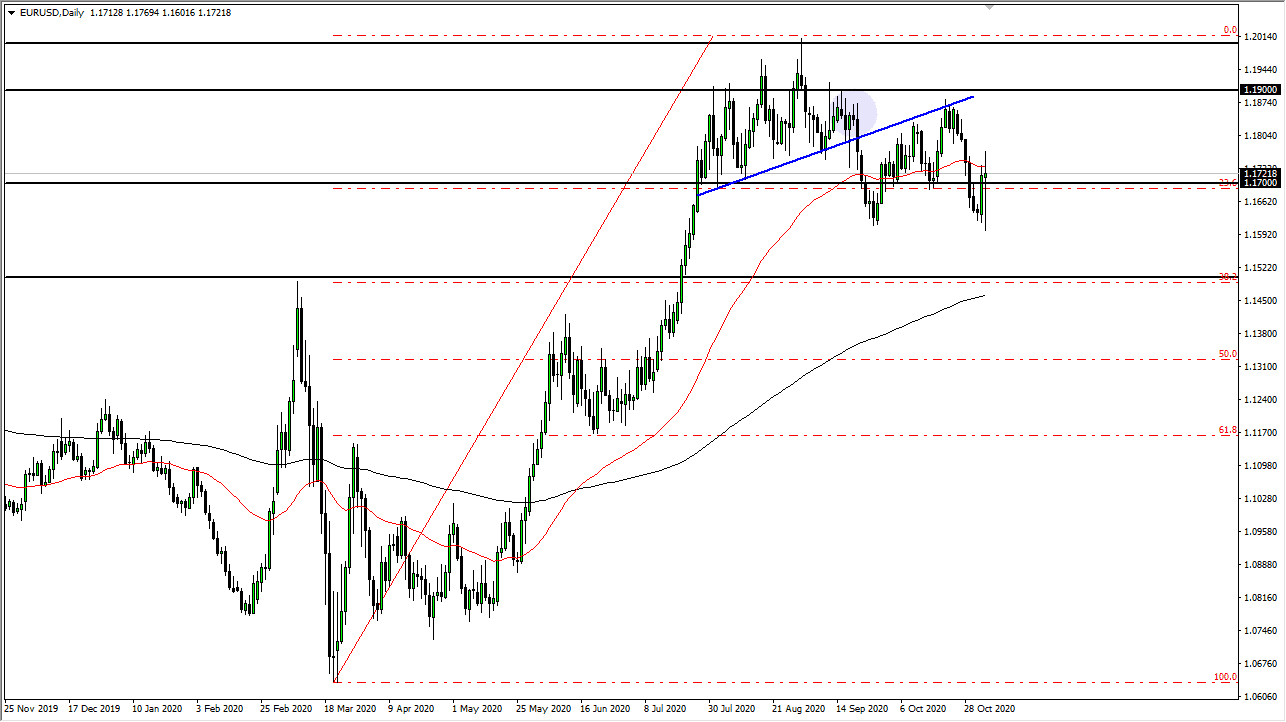

After the volatility that we have seen due to the US election, the Euro has been all over the place. We are sitting just barely above the closing price of the previous session, so it is hard to suggest that the market is ready to go anywhere in the short term. When I look at the longer-term chart though, I can argue for a range that we are in, and that we have just tested the bottom of it during the trading volatility.

The candlestick is a hammer, which suggests that we have buyers underneath who are willing to jump into the market and push towards the 1.18 handle, possibly even the 1.1050 level. In that general vicinity, I would expect to see resistance as well. The market is likely to see sideways action, as the 50-day EMA will attract a lot of attention.

We had broken down below a major trendline about a month ago, and now we have retested it only to fall again. That is a very negative sign, but it looks like the markets really have no idea what to do with themselves, due to the European Union locking down half of its countries (or so it seems), which will do a number on the economy. Furthermore, it looks like deflationary problems will continue to be a major issue in places like Germany, which does not bode well for the currency or the economy in general. Beyond that, we have the European Central Bank ready to do more at the next meeting, loosening monetary policy.

On the other side of the Atlantic, we have a lot of questions about whether or not we get a decent-sized stimulus bill or not. It is difficult to imagine that the government is going to be working together, so although stimulus is probably coming, the likelihood is that it will be much smaller than originally thought. In that case, that could also drive up the value of the US dollar. In the meantime, I believe we are essentially stuck in a range between the 1.16 level on the bottom and the 1.1850 level on the top