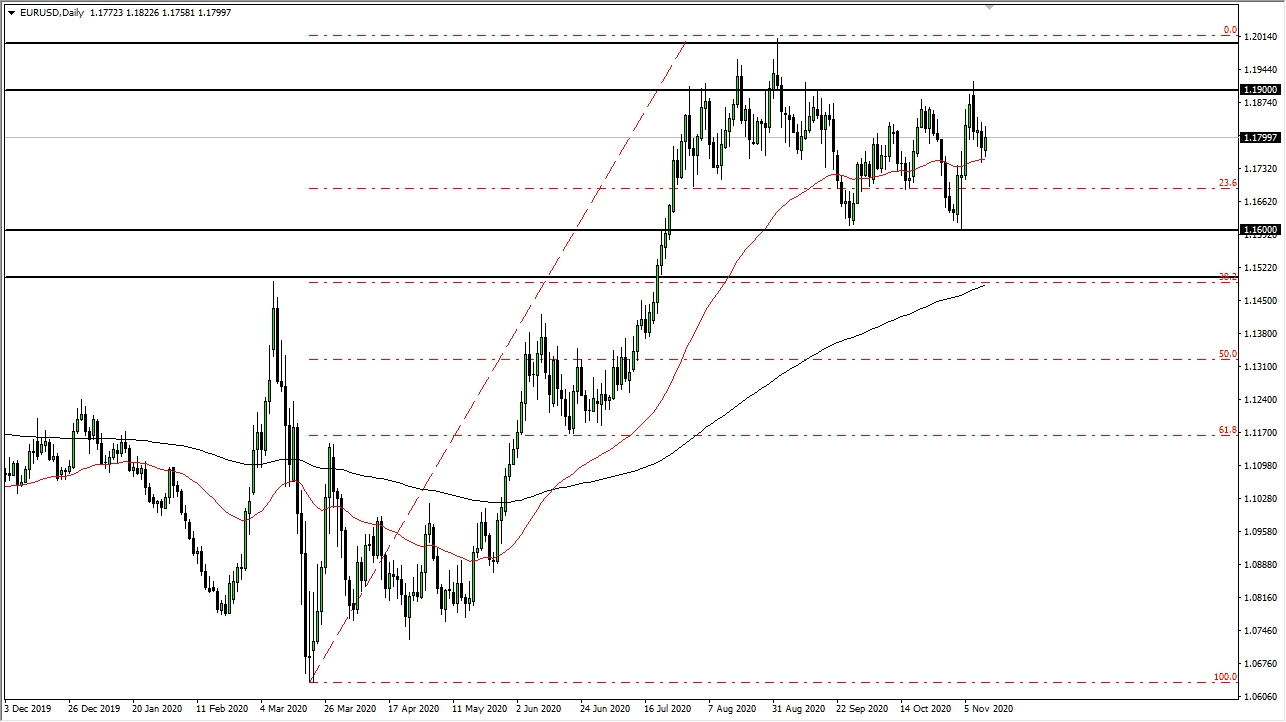

We did pullback just a bit from the highs so at this point in time it looks as if we really do not know what to do next. We look at the longer-term chart, you can see that there has been resistance starting to the 1.19 level, extending to the 1.20 level. However, the support can be found at the 1.16 level underneath, extending down to the 1.15 level. In other words, we are in a roughly 500 PIP range, with 100 points on each side offering more of a “zone of support/resistance” more than anything else.

The 50 day EMA offered support, and the 50 day EMA is also right in the middle this consolidation. The indicator is relatively important, and the fact that it is right in the middle of the consolidation tells you everything you need to know. This is a market that you need to be looking at from a longer-term perspective, and not trying to trade every micro move that happens.

At this point, if we break down below the 50 day EMA I think it is likely that we could go down to the 1.16 level, but I would expect to see a lot of buyers in that general vicinity. Some type of supportive candlestick in that area would be what I would look for a reversal trade. If you are inclined to try to reach down below that area, you need to see the market clear the 1.18 level rather handily, perhaps on the four hour chart to get involved. On the other hand, if we rally from here, I will anticipate that the 1.19 level above would be the beginning of significant resistance that I would be willing to sell at the first signs of failure.

With the European Union locking down due to the coronavirus situation and of course serious concern when it comes to the Brexit negotiations, it makes quite a bit of sense that we would see this pair go back and forth in a bit of a confused type of attitude. This is quite frankly typical of the pair anyway, so it is simply a matter of waiting for a decent set up to get involved. Right now, I just do not see one that is compelling enough for me to put money to work.