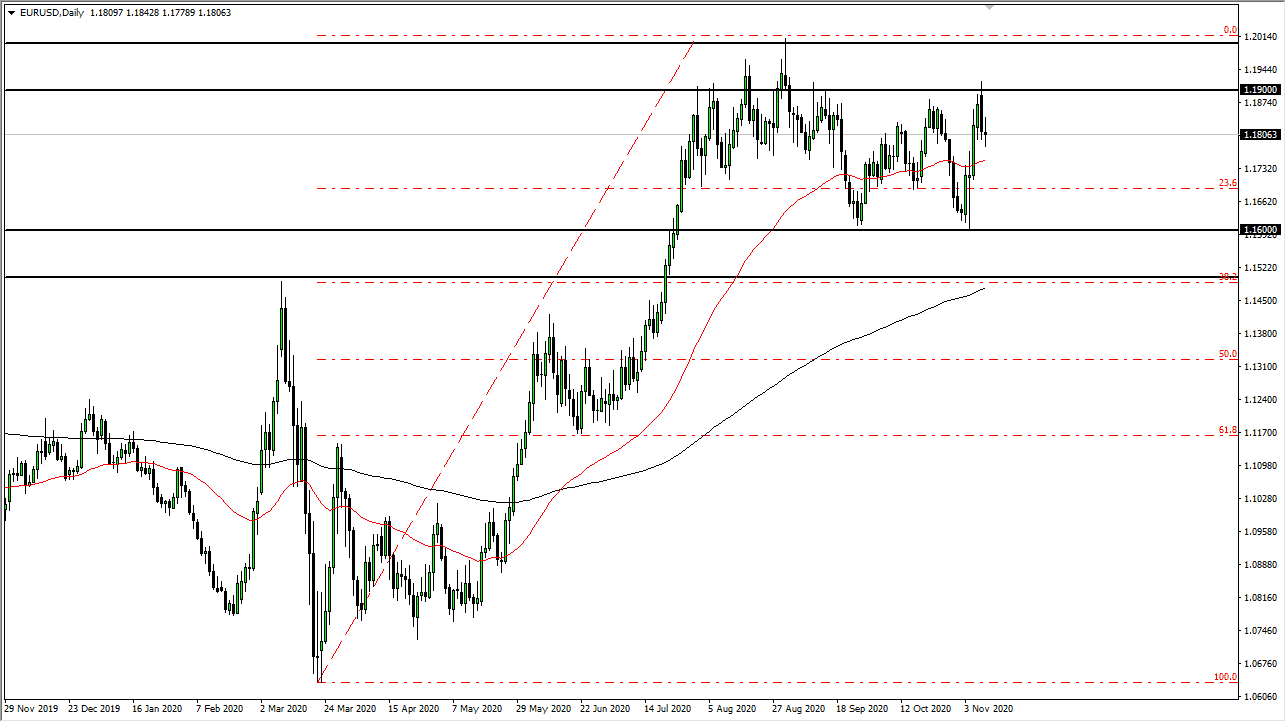

The euro is struggling for direction from a longer-term standpoint, which the candlestick for the trading session on Tuesday suggests. We had sold off rather hard during the trading session on Monday, but then turned around to fluctuate. Looking at the candlestick from the Tuesday session, it appears that the 1.18 level will be crucial in the short term. If we were to break down below the candlestick for the trading session on Tuesday, it is likely that we could go much lower, perhaps down towards the bottom of the larger consolidation area.

Looking at the chart, you can make out a larger consolidation area between the 1.20 level and the 1.15 level underneath. The market looks likely to continue in this overall 500-point range, and the 1.19 level is the beginning of the resistance zone, just as the 1.16 level underneath is the beginning of the support zone.

The 50-day EMA is right in the middle of the overall consolidation area, so the market continues to go sideways as this widely followed indicator flattens out. The European Central Bank is likely to have a significant dovish tone to its next meeting, and people will be paying attention to the statement. We continue to hear a lot of noise in this area, and we will have to make a longer-term decision. However, we are heading into the quietest time of the year, which could keep this market sideways. I feel that the short-term attitude of this market will be more or less negative. I am not talking about a major breakdown, but there is a lot of weight around the neck of the euro. I like to fade short-term rallies as the market gets a little extended. As far as buying is concerned, I would be much more comfortable buying this currency closer to the 1.16 handle.