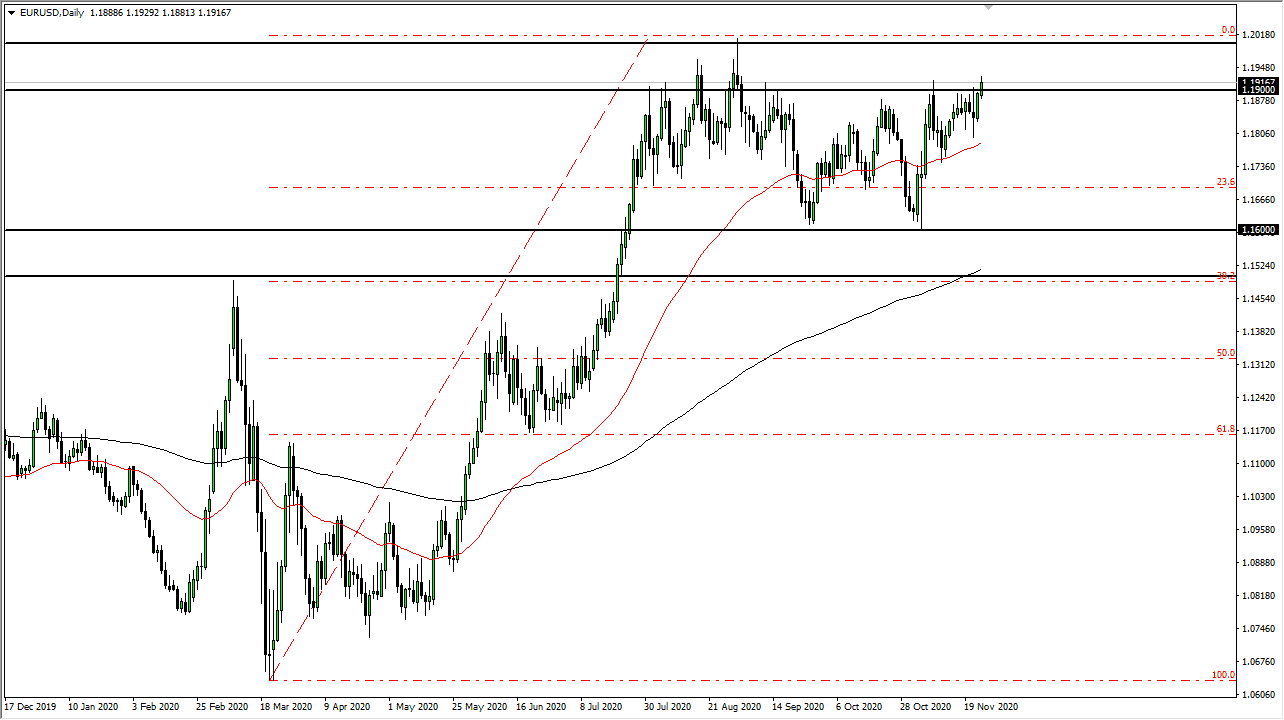

The euro was choppy initially during the trading session on Wednesday, but we eventually broke above the 1.19 level and even closed above there. This is the first time we have been able to do that for a while, and the first hint of this may have shown itself about a week-and-a-half ago when we could not make it below the 50-day EMA. The market will likely continue to try to grind towards the 1.20 level. This is a reflection of the US dollar getting sold off against almost everything, and a lot of this was done during the US session.

Short-term pullbacks will continue to be bought into and “buying the dips” is probably the best way to play this market. People are banking on a Brexit deal, which would be good for both the British pound and the euro against the greenback. That is exactly what we are looking at on this chart, but you should also notice that the area between the 1.19 level and the 1.12 level has been massive resistance. The fact that we pulled back just a bit towards the end of the day is not a surprise, but it seems like the relentless march higher is going to continue to have this market looking to break out finally.

If we break above the 1.20 level, then it could kick off the next leg higher in this pair. At that point, the market will likely go looking towards the 1.23 handle initially, perhaps even the 1.25 level. After all, this market has been selling the greenback against everything. The 50-day EMA underneath is going to offer a bit of a floor, and we will probably see an attempt to break out. However, if the Brexit situation suddenly turns sour, we could see a move back down towards the 1.16 level underneath, which has shown a significant amount of support previously. I have no interest in selling this market unless of course Brexit falls apart again.