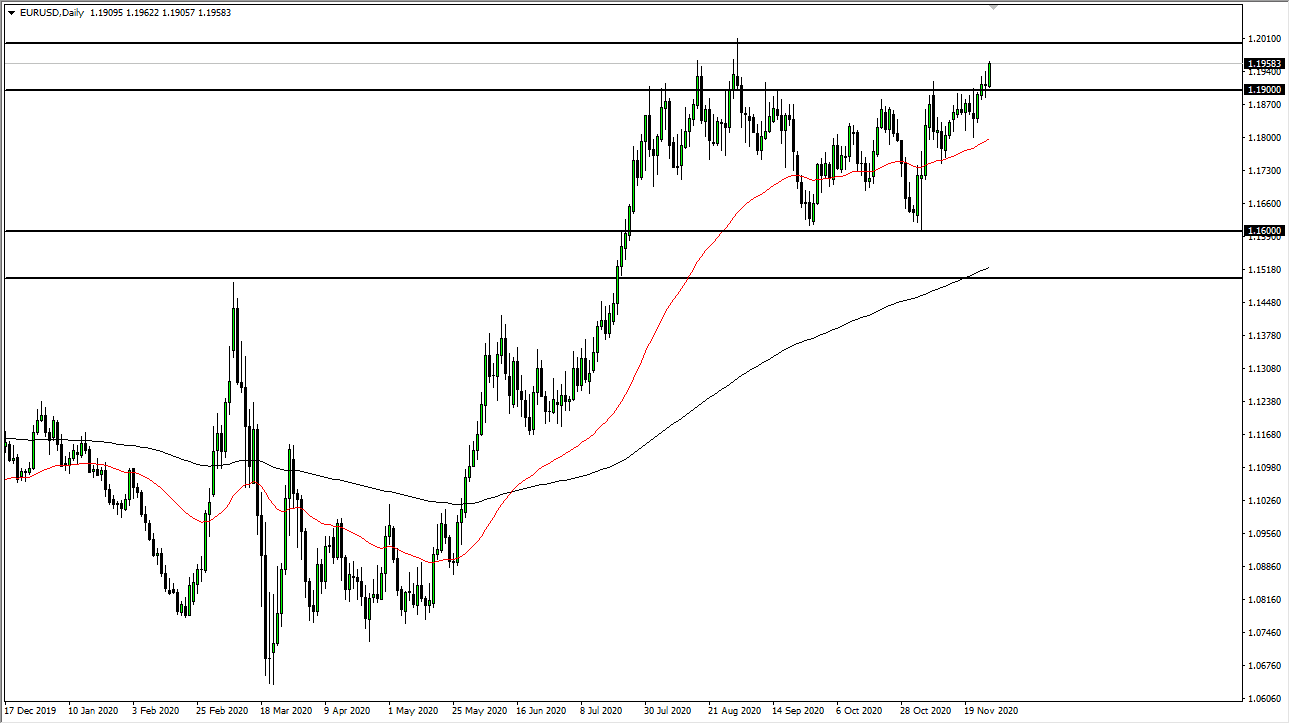

The euro rallied again during the trading session on Friday, but remember that many people are away from their desks the day after Thanksgiving. Volume may have been a problem, so it is likely that short-term pullbacks could occur. The market will continue to find buyers underneath, as it is obviously trying to break out.

One of the main factors driving the market is that the coronavirus situation is getting better in the European Union while it seems to be getting worse in the United States, which may continue to push the market towards the euro. Wall Street is completely divorced from reality as they start to price on a post-coronavirus economy, which is reaching a bit too far. But at this point, one cannot argue with the idea of the 1.20 level being broken as extraordinarily bullish. If we break above there, the market will be likely to go to the 1.23 level.

Right now, you have to “embrace the momentum” and buy dips. I think the euro will probably continue to grind higher over the long term, simply because the markets are starting to get a bit exuberant. Nonetheless, the 50-day EMA underneath is going to offer support, and it currently sits at the 1.18 handle. If we were to break down below there, we would probably go looking towards 1.16 level. But it certainly looks as if that is less likely at this point, so I like the idea of picking up value when it happens. If we get a major “risk off” situation, then we could see a rush towards the US dollar. But at this point, it looks as if the US dollar is firmly on its back foot, so we will finally build up enough momentum to break out for the longer-term move. While I think that the European Union is struggling, it is a relative situation at this point, which seems to be favoring the upside.