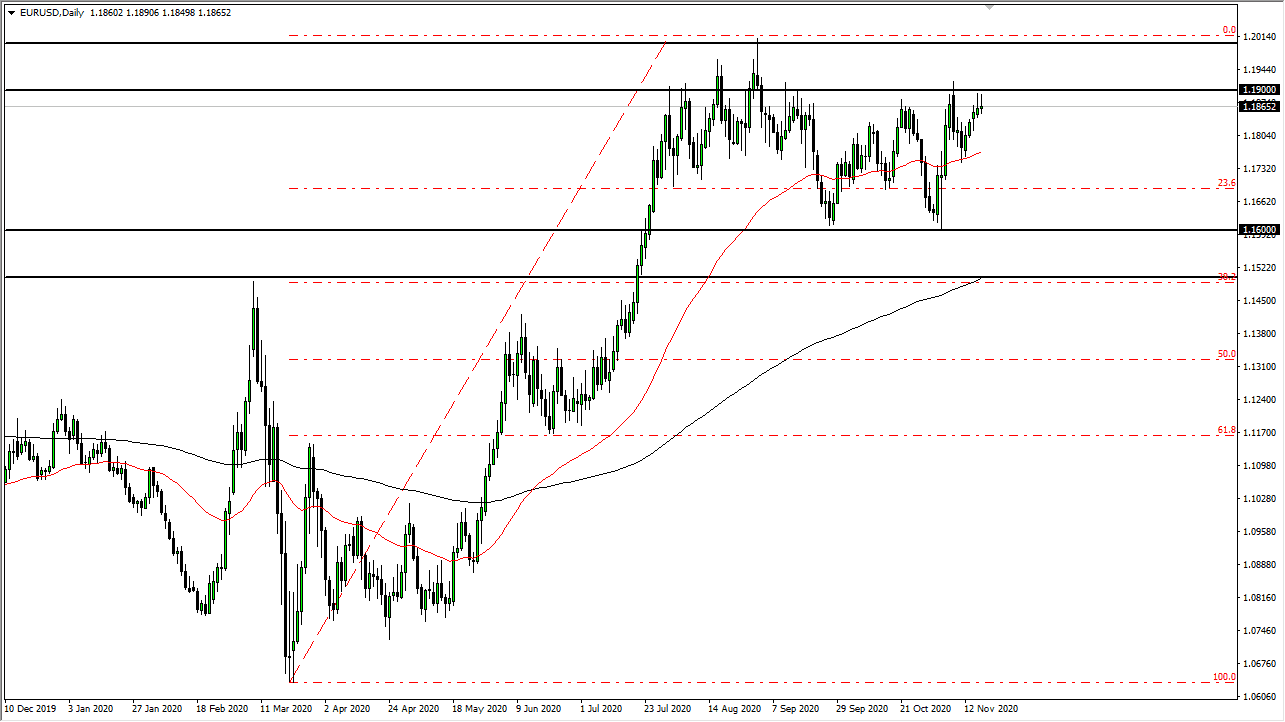

The euro initially tried to rally during the trading session on Wednesday but continues to struggle near the 1.19 level. This is an area that extends all the way to the 1.20 level as far as resistance is concerned, so it should not be a surprise that we have pulled back to form a shooting star. When you look at the last three candlesticks on the daily chart, we have a hammer followed by two shooting stars. This tells me that we are trying to build up pressure to make a longer-term decision.

Until we can break above the 1.20 level though, I think this is a market that is still very much range-bound. In other words, I still prefer shorting this market on short-term signs of exhaustion.This is a market that is trying to figure out whether or not it is paying attention to the coronavirus figures in the United States, or if it is paying attention to the coronavirus figures in the European Union. Is it now going to start focusing on the European Central Bank and its undoubtedly loose monetary policy? Or perhaps now it is ready to start focusing on the fact that the Federal Reserve is going to do whatever it takes to liquify the markets? The problem is that there is a plethora of multiple issues out there that could cause this market to vacillate.

Looking at the price action, I do believe that the market is testing the top of the range that is very well defined.The area between the 1.19 and the 1.20 levels will continue to be extraordinarily strong. That area being broken would be a major shift in attitude and would almost certainly send the euro all the way to the 1.25 handle. Until that happens, assume that we will get more fluctuation, which is the typical day-to-day action in this pair anyway. The euro is one of the least volatile currency pairs nine times out of ten, so to expect a big move in this market is very difficult at times. On a break down to the downside, we could go as far as the 50-day EMA without changing too much.