The euro initially tried to rally during the trading session on Wednesday but gave back the gains to turn around and fall towards the 50-day EMA. We are still stuck and sideways in general so there is not much to get excited about here, because we have a couple of currencies that are both suffering. The market is likely to see more confusion because we have so many moving pieces out there.

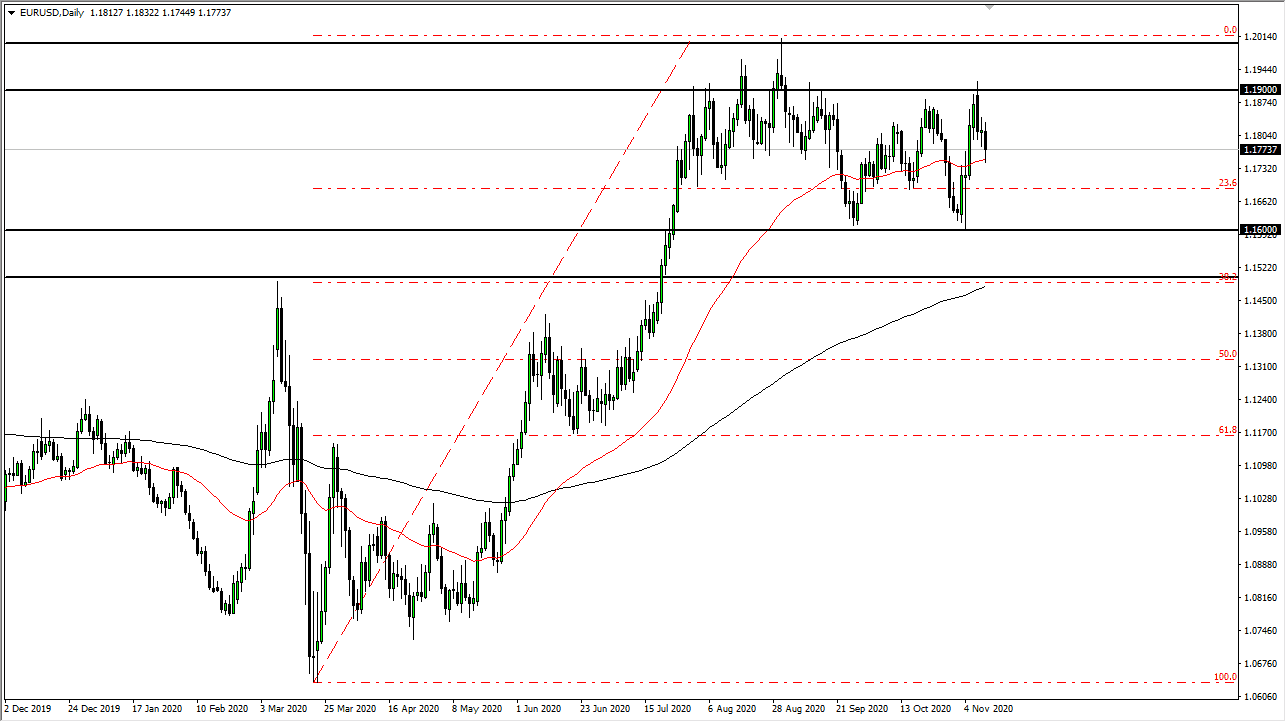

The area between the 1.19 and the 1.20 level is massive resistance, and is the top of the overall consolidation range that we are trading in right now. The support underneath at the 1.15 level that extends to the 1.16 level is the bottom of the overall range as well. In other words, since we are in the middle of this range, we are in “no man’s land.” What makes it even more interesting is the fact that the 50-day EMA is sitting right there and many longer-term traders will be looking at that as a potential indication of where we are going. It is essentially flat, which tells me that the shorter-term momentum simply is not there, and we will continue to go back and forth.

The European Central Bank is likely going to be extraordinarily loose with monetary policy at its next meeting, which could be weighing on this pair. In addition, stimulus in the United States is likely going to be much smaller than anticipated, as the jobs number recently highlighted the overall strength. There is a major battle in the Senate as to how much spending there should be, and it will be interesting to watch the politics play out between now and Inauguration Day. There is still a lot of noise when it comes to Georgia, as there are two Senate races that need to have another run off. We so far do not even know who will have control of the Senate in January. That will be a major driver of where we go next and, in the meantime, I think we are simply going to fluctuate because nobody has much conviction.