The euro fluctuated during the trading session on Monday, showing just how little excitement there is for owning the euro. The market has gone from both bullish to bearish as the vaccine news hit the markets. It looks as if traders are not as excited as people once thought they would be, possibly due to the fact that the European Union is getting ready to lock itself back down.

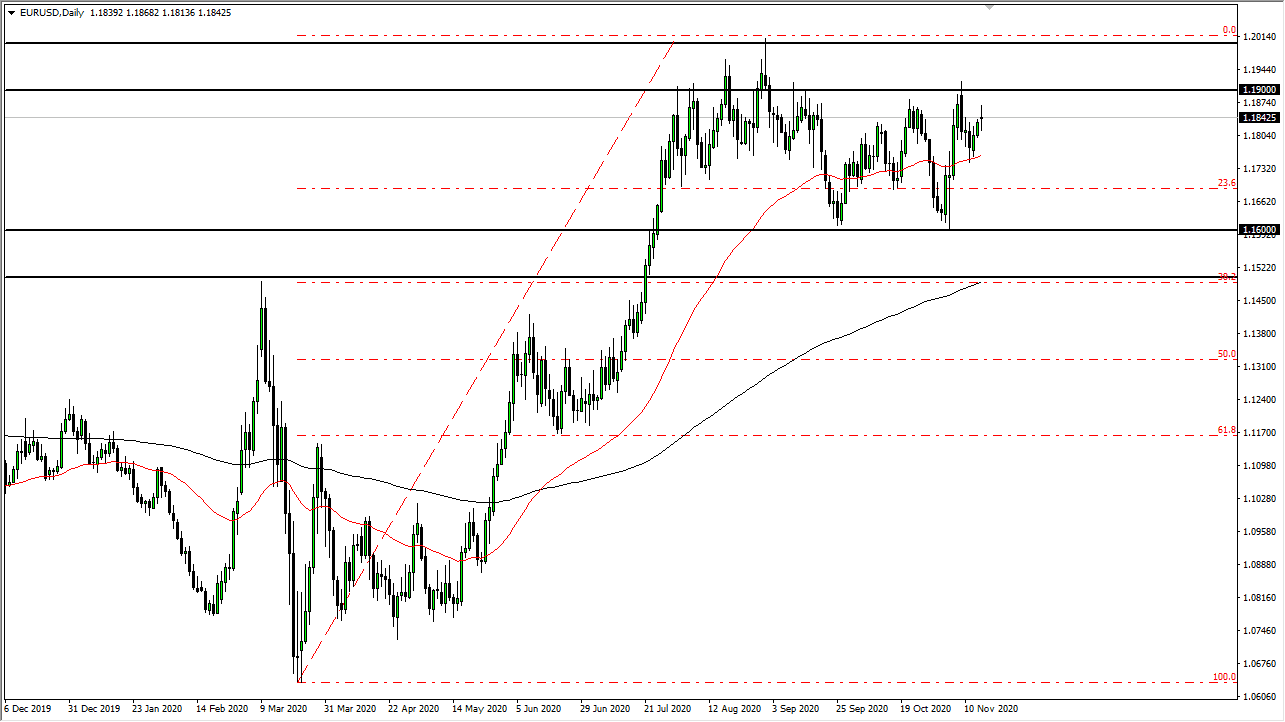

The 50-day EMA underneath is a major indicator to which many people will be paying attention, and it could offer a short-term target. If we break down below there, the market is likely to go much lower, perhaps reaching down towards the 1.16 level. The 1.16 level underneath is the beginning of massive support down to the 1.15 handle, as a “zone of support.” What makes this area even more important is the fact that we not only get that 38.2% Fibonacci retracement level at that handle, but we also have the 200-day EMA sitting there as well. Markets are going to continue to see plenty of interest in that region.

At this juncture, if we were to break down below the 200-day EMA, then we will drop down to the 1.13 level next. That is where the 50% Fibonacci retracement level is. That is far down the road, and it is assuming that the whole thing falls apart. It seems most of Wall Street and perhaps Canary Wharf are betting on the idea of the US dollar getting hammered, so it is not going to be a massive dive unless something kicks off.

I still prefer fading short-term rallies at the first signs of exhaustion because it has worked for so long. There is a massive amount of resistance between the 1.19 handle and the 1.20 level, so it is not until we break above the 1.20 level that I will be truly impressed and start to think that perhaps we can go higher for the longer term. We just do not have the momentum, so we will roll right back over.