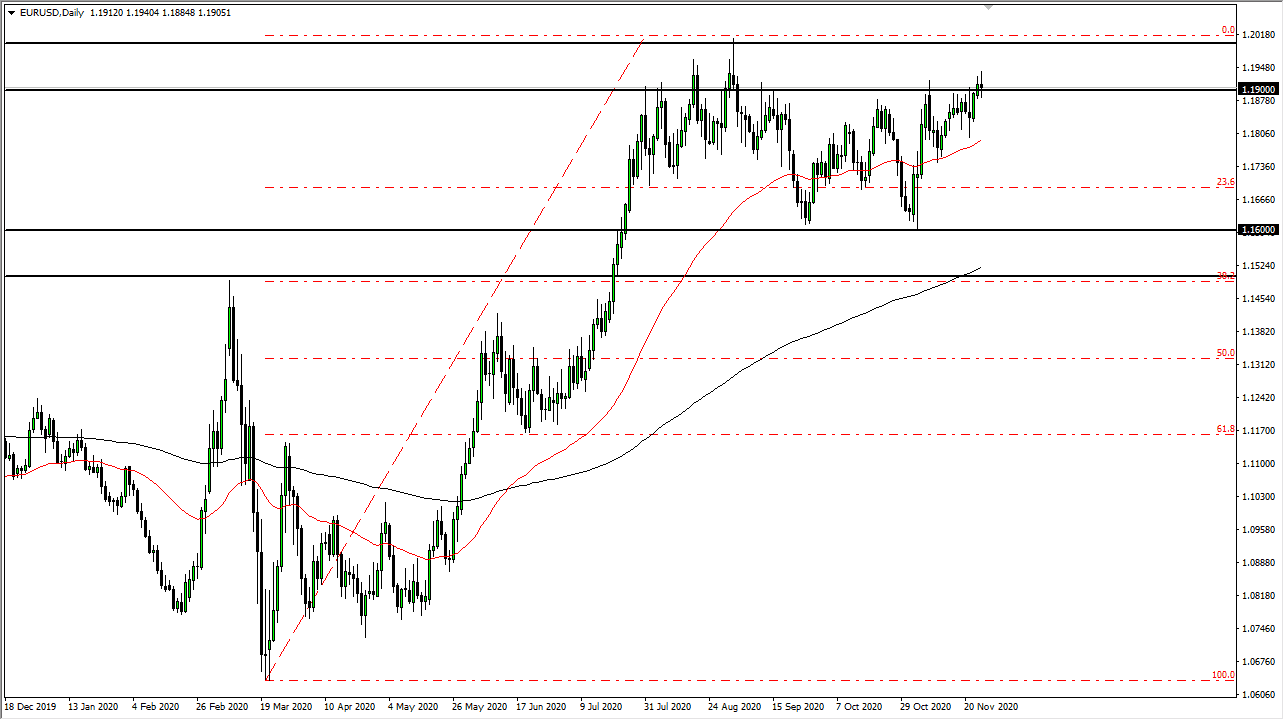

The Euro has gone back and forth during the course of the trading session on Thursday, and what would have been very thin trading due to Thanksgiving in the United States. That being said, you should also pay attention to the fact that the 1.19 level is the beginning of significant resistance that extends to the 1.20 level. The 1.20 level being broken to the upside of course would be a very bullish sign and it could send this market much higher. With this being the case, I think that there are a lot of traders out there looking to get involved once it happens. However, we have seen this area cause a significant amount of selling pressure so I think a short-term pullback could be coming.

Underneath, I like the idea of buying the Euro on a move back down to the 50 day EMA. The 50 day EMA of course is very bullish and I think it will continue to be something that people pay attention to. The 50 day EMA has started to grind higher and it looks as if we are going to continue to see a lot of interest in that area. Below the 50 day EMA, then we have a significant amount of support near the 1.16 level. All things being equal, I would not read too much into the candlestick for the trading session on Thursday, as it was Thanksgiving in the United States so that of course would offer a significant amount of indecision to the market as a liquidity would be an issue. Nonetheless, we are in an area that has been important more than once, so I anticipate that we will probably drift lower into the weekend.

However, we will continue to focus on the Federal Reserve and the fact that it is flooding the markets with liquidity it appears. Furthermore, underneath the radar people are starting to pay attention to the fact that the coronavirus numbers in the European Union are starting to drift lower, while they are drifting higher in the United States. All things being equal, this is a market that is trying to go higher over the longer term and a lot of the big players out there are anticipating a move towards 1.25 handle, which of course would need to see some type of catalyst to make that happen. In the meantime, I think we simply go back and forth with an upward tilt.