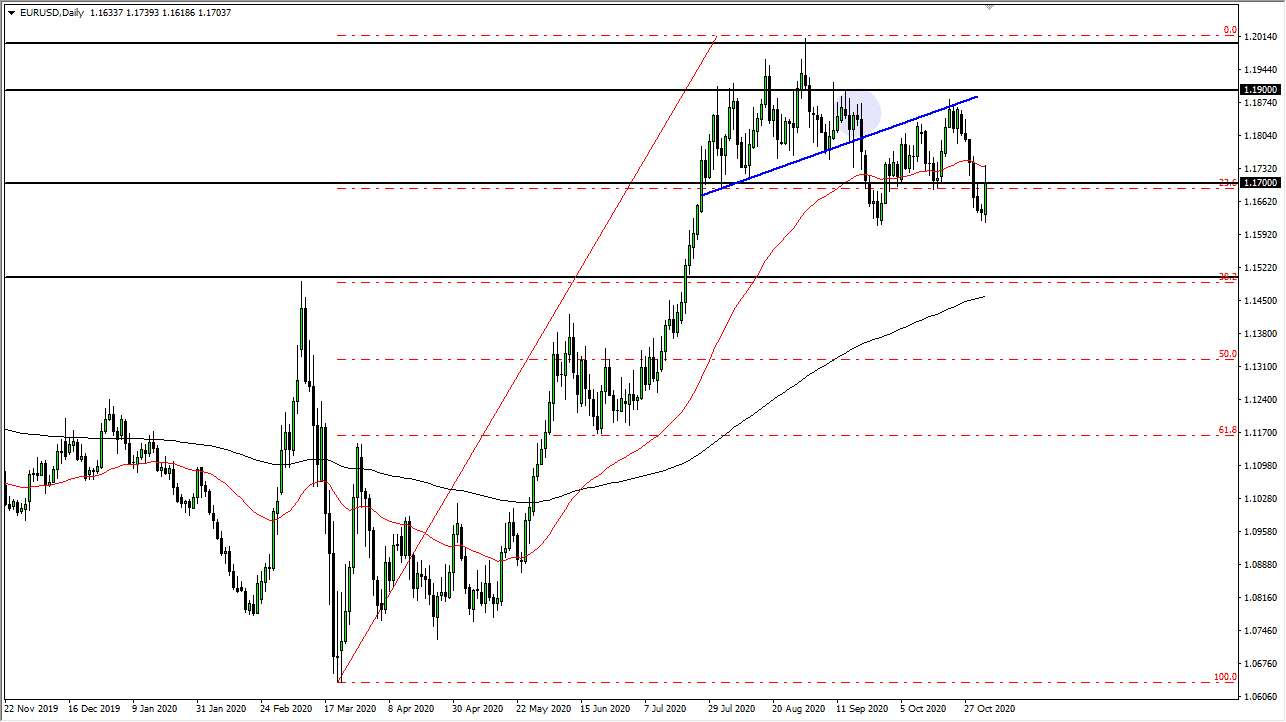

The Euro has rallied significantly during the trading session on Tuesday, reaching above the 1.17 level in order to reach towards the 50 day EMA. The 50-day EMA is a crucial technical indicator to which people pay attention, and we failed in that area. Doing so suggests that we are ready to see sellers come back into the marketplace. With this we would continue the overall negativity that we have seen lately with the European Union. That may happen right away as soon as we see the election results.

Fundamental issues are still going to plague the European Union and, by extension, the Euro. The European Central Bank is said to do something rather drastic next month, which is negative for the currency. This is a scenario in which the US dollar might pick up a bit of strength, due to the fact that the market is starting to shift its attention towards potential growth, as opposed to just stimulus. The latest GDP numbers were drastically divergent between the two economies. The United States gained almost 33%, while the Europeans managed just 12.7% last week. This is a large difference, and it is therefore likely that money will go looking towards the US stock market more than anything else. We are paying attention to the US election in the short term, which is something on which people will be trading initially, but the longer-term outlook for the European Union is much softer than it is for the United States. Furthermore, if we see a rush into treasuries based upon some type of “risk off trade”, that could also send this market lower.

The trend line that we had broken down below and retested now suggests that we have further to go. We might go looking towards the 1.16 level, possibly even down to the 1.15 level, which is where the 38.2% Fibonacci retracement level sits. The 200-day EMA underneath will attract attention as well. All of that ties together, so it is a nice shot for a target.