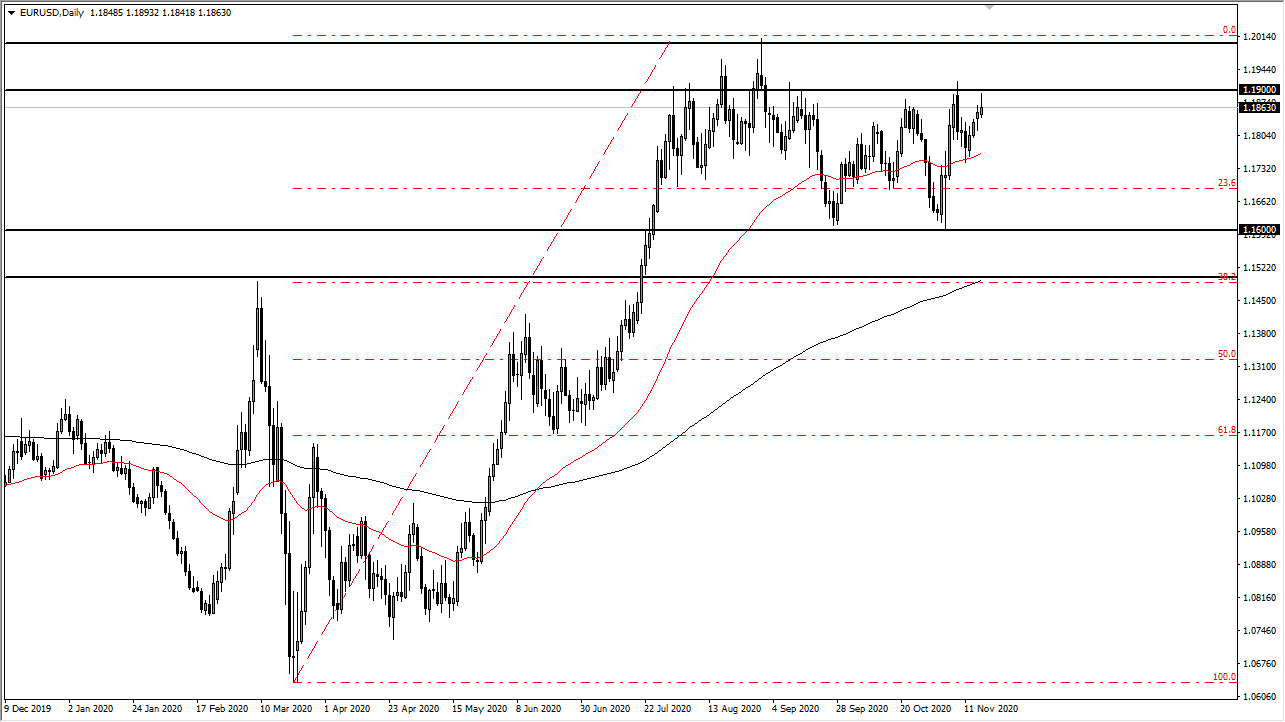

The euro initially tried to rally during the trading session on Tuesday, but gave back the gains near the 1.19 level yet again. This is an area that has been massive resistance previously, extending all the way to the 1.20 level. The market has to put a lot of effort into breaking above there, so we will continue to pull back, even if it is just temporarily.

I would anticipate that the euro will continue to struggle and could go down to the 50-day EMA. The 50-day EMA underneath is a target for short-term traders, and if we can break down below there then longer-term traders will start to push towards the bottom of the larger consolidation area that we have been in for some time. That consolidation area moves between the 1.15 level on the bottom and the 1.20 level on the top. On the outer bands of the consolidation, you have about a 100-point range.

What is interesting is that the 200-day EMA is sitting just below the 1.15 handle, which is a longer-term indicator that a lot of people would watch, so that adds even more credence to the idea of support down at the 1.15 handle. If that does get broken then that would be an extraordinarily negative sign, opening up at least another 200 points lower, if not a move down to the 1.10 level after that. We would get a rush into the market in that scenario, probably more or less based on some type of extraordinarily negative headline when it comes to global growth or such.

The European Central Bank is likely to say something pretty dovish, which will weigh on the euro as well. Furthermore, if global growth is starting to slow down, then people flock to the US dollar for safety and get into the US Treasury markets. This is a market that I do think is going to continue to struggle to go higher, so I like the idea of fading short-term rallies as well as anything else.