New daily infections continue to reach record highs in Germany and globally, dampening optimism for global growth. Numerous downward revisions for 2021 confirm an uneven recovery at best, a troubling sign for the export-oriented German economy. The DAX 30 remains inside of its resistance zone, from where risks of a profit-taking sell-off magnify.

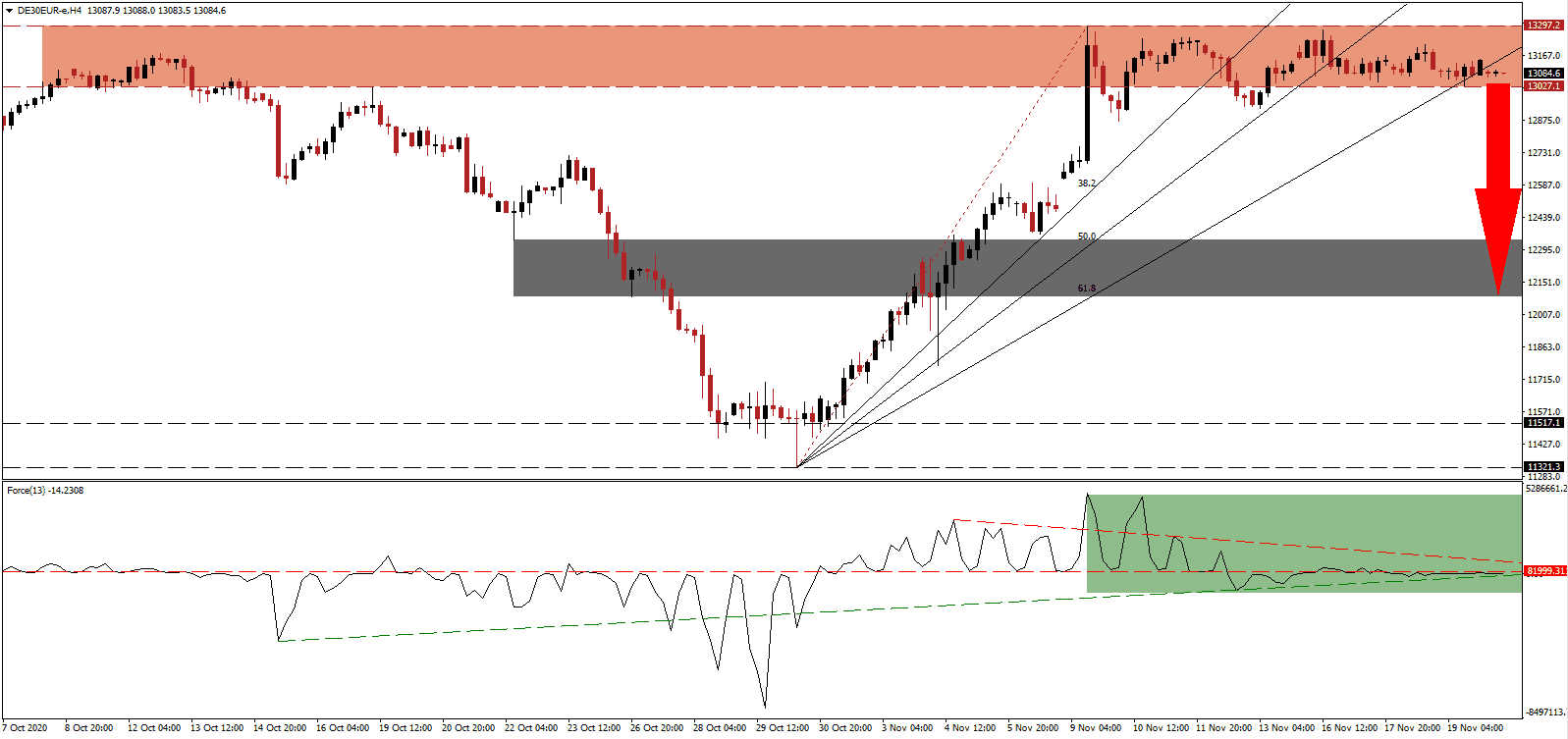

The Force Index, a next-generation technical indicator, flatlined below its horizontal resistance level, with the descending resistance level expanding breakdown pressures, as marked by the green rectangle. This technical indicator is well-positioned for a collapse below its ascending support level and farther into negative territory. It will solidify bearish control of the DAX 30.

Per the latest economic assessment by the German Institute for Economic Research (DIW), fourth-quarter GDP will contract by 1.0% due to the partial nationwide lockdown, costing the German economy €19 billion. The Institute for Macroeconomics and Business Cycle Research (IMK) confirmed an increased recession risk but labeled them relatively low, suggesting a severe slowdown in the growth rate instead. A breakdown in the DAX 30 below its resistance zone located between 13,027.1 and 13,297.2, as identified by the red rectangle, will introduce an accelerated sell-off.

Germany relies heavily on its dominant automotive industry, but some economists see the end of the golden decade for Europe’s largest economy. Global trade conflicts and an uncertain outlook due to the Covid-19 pandemic add significant stress, while Germany ended its fiscal conservatism, further eroding future growth prospects. After the DAX 30 moved below its ascending 61.8 Fibonacci Retracement Fan Support Level, bearish pressures increased. A correction into its short-term support zone between 12,087.6 and 12,338.6, as marked by the grey rectangle, is pending.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 13,085.0

- Take Profit @ 12,100.0

- Stop Loss @ 13,300.0

- Downside Potential: 9,850 points

- Upside Risk: 2,150 points

- Risk/Reward Ratio: 4.58

An advance in the Force Index, initiated by its ascending support level, may ignite a short-term price spike in the DAX 30. With economic downside pressure on the rise, the upside potential remains limited to its resistance zone located between 13,496.6 and 13,643.8. The healthcare condition continues to worsen, and traders should view any breakout attempt as a selling opportunity.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 13,440.0

- Take Profit @ 13,640.0

- Stop Loss @ 13,300.0

- Upside Potential: 2,000 points

- Downside Risk: 1,400 points

- Risk/Reward Ratio: 1.43