Germany is on course to become the twelfth country to surpass 1,000,000 confirmed COVID-19 infections. Chancellor Angela Merkel announced an extension of the second nationwide lockdown until December 20th. With over 300,000 active cases and more than 15,000 new ones, the healthcare system struggles to cope. Vaccine-related optimism pushed the DAX 30 marginally higher, but the lack of bullish momentum can result in a collapse below its resistance zone.

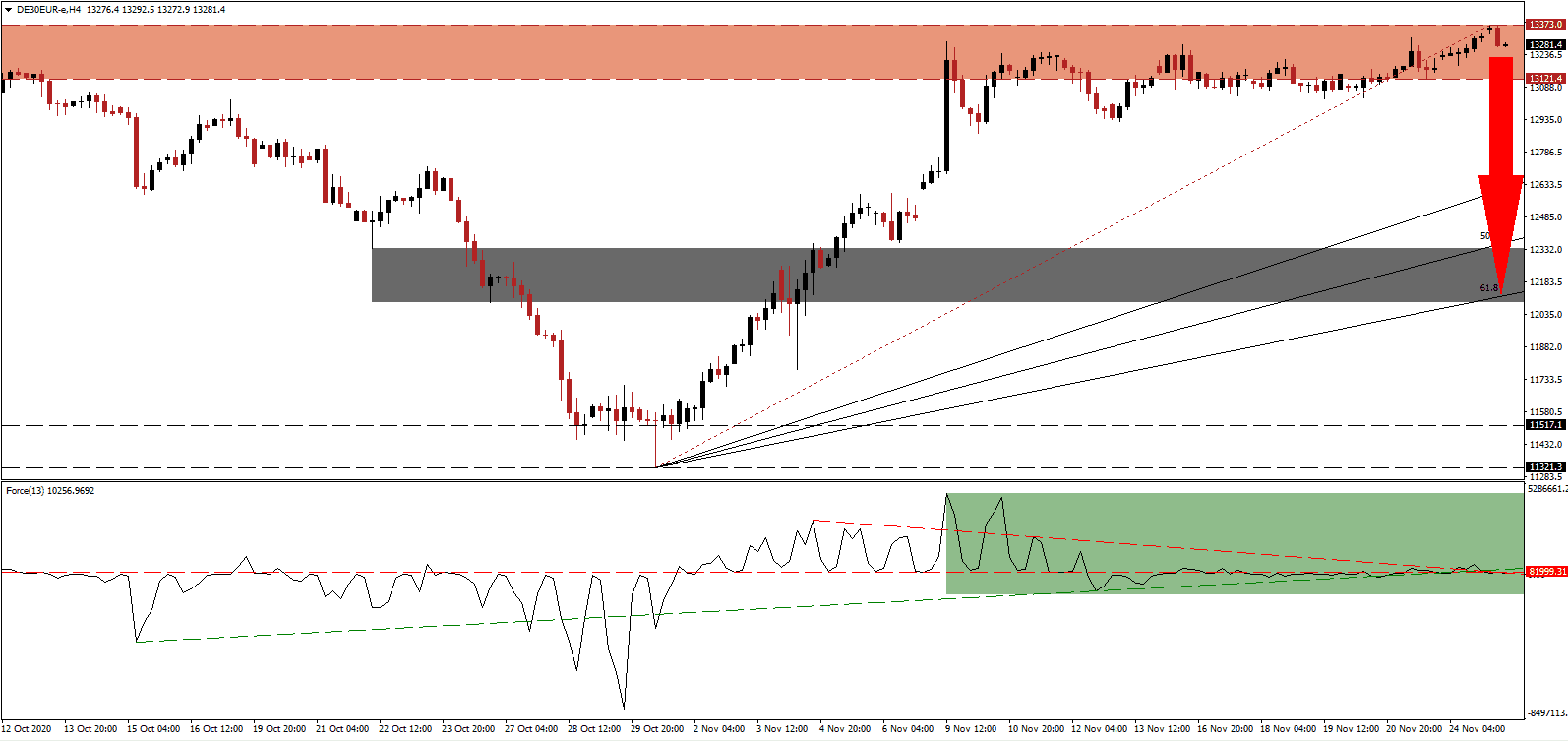

The Force Index, a next-generation technical indicator, shows the absence of upside pressures, with the descending resistance level and the ascending support level converging. After a minor bump higher, the Force Index retreated below its horizontal resistance level, as marked by the green rectangle. Bears wait for this technical indicator to cross below the 0 center-line to regain complete control over the DAX 30.

Following a 9.8% GDP plunge in the second quarter, third-quarter GDP expanded by a record of 8.5%. While the manufacturing sectors expanded, the services sector reversed course, and the extended lockdown threatens a recession in the fourth quarter. The DAX 30 remains vulnerable to a severe profit-taking sell-off with a breakdown below its resistance zone located between 13,121.4 and 13,373.0, as identified by the red rectangle.

Some economists anticipate a fourth-quarter GDP decline of 1.0%, which will be duplicated by other developed European economies. Most countries spike debt levels during the first wave of the COVID-19 pandemic and are unable to do so during the second one. German business confidence, per data from IfO, continues to deteriorate, adding to breakdown pressures in the DAX 30. A correction into its short-term support zone between 12,087.6 and 12,338.6, as marked by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level, appears likely.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 13,280.0

Take Profit @ 12,180.0

Stop Loss @ 13,500.0

Downside Potential: 11,000 points

Upside Risk: 2,200 points

Risk/Reward Ratio: 5.00

A clear breakout in the Force Index above its descending resistance level can pressure the DAX 30 higher. Traders should take advantage of any advance with new net short positions amid a short-to-medium-term bearish outlook on German equities. With dominant bearish pressures, the upside potential remains reduced to its next resistance zone located between 13,735.7 and 13,827.9.

DAX 30 Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 13,650.0

Take Profit @ 13,820.0

Stop Loss @ 13,500.0

Upside Potential: 1,700 points

Downside Risk: 1,500 points

Risk/Reward Ratio: 1.13