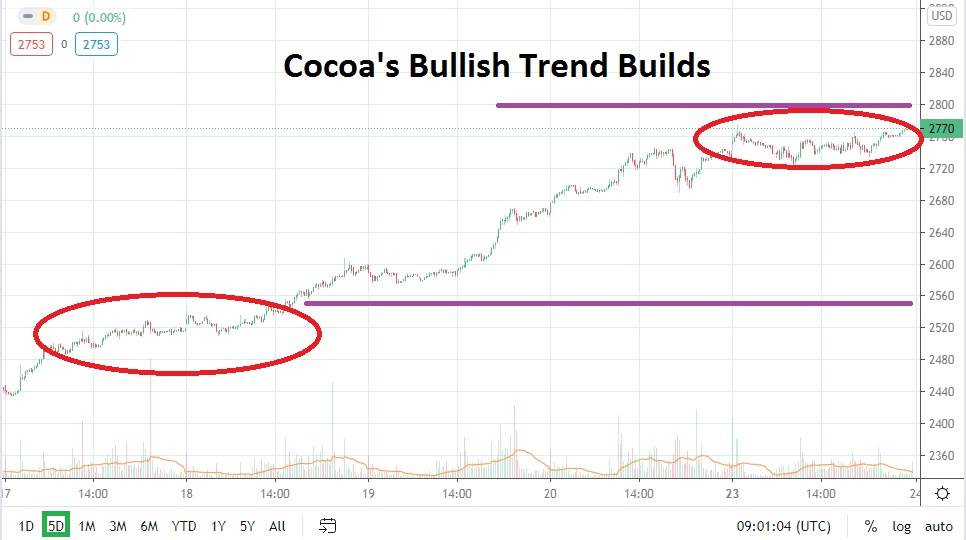

Cocoa is enjoying a solid bullish trend, but not without a fight. After breaking through mid-term resistance late last week which was last seen in September, the commodity now seems to be targeting prices seen in February of this year. Before concerns about coronavirus became rampant, cocoa was trading around values of 2900.00 in February. The high values seen early this year were significant because they pushed the commodity within sight of junctures not experienced since 2016.

The short-term trend of cocoa has not been a one way path; as recently as November 3rd the commodity was trading around 2200.00 USD. Since the middle of this month, cocoa has seen a steady and incremental rise in value and speculators may want to purse the commodity based on the notion that further upward momentum will be secured. However, traders need to be careful regarding the amount of leverage they use and, if profits are found, it is important to not become too greedy and know when to cash out winning positions before they vanish.

Speculators can certainly look for downside reversals in cocoa, but stop losses should be firmly in place if this is their plan of action. Aiming for a reversal lower to the 2750.00 mark could be a legitimate wager; if a quick trade is sought based on that belief some downside pressure will be displayed. However, since breaking the 2700.00 juncture on the 20th of November, cocoa has delivered a rather strong punch upwards, and if the commodity’s value is sustained within its current levels without experiencing a major pratfall, cocoa could be ready to challenge higher values.

The next logical target for speculators in cocoa appears to be the 2790.00 juncture. If resistance proves vulnerable at 2780.00, speculative forces within the commodity may be prepared to put in a serious test of values seen early this year within cocoa.

Although cocoa is rather highly valued, the commodity does have a history of trading at loftier prices. Demand for cocoa worldwide remains solid. From a technical viewpoint, the commodity may be able to test the higher values last seen in February. Upon accomplishing a ‘new’ higher range, speculative forces may be able to muster a volatile reversal lower, but until then, speculators may think the upside has the power to be prominent.

Cocoa Short-Term Outlook:

- Current Resistance: 2780.00

- Current Support: 2750.00

- High Target: 2800.00

- Low Target: 2723.20