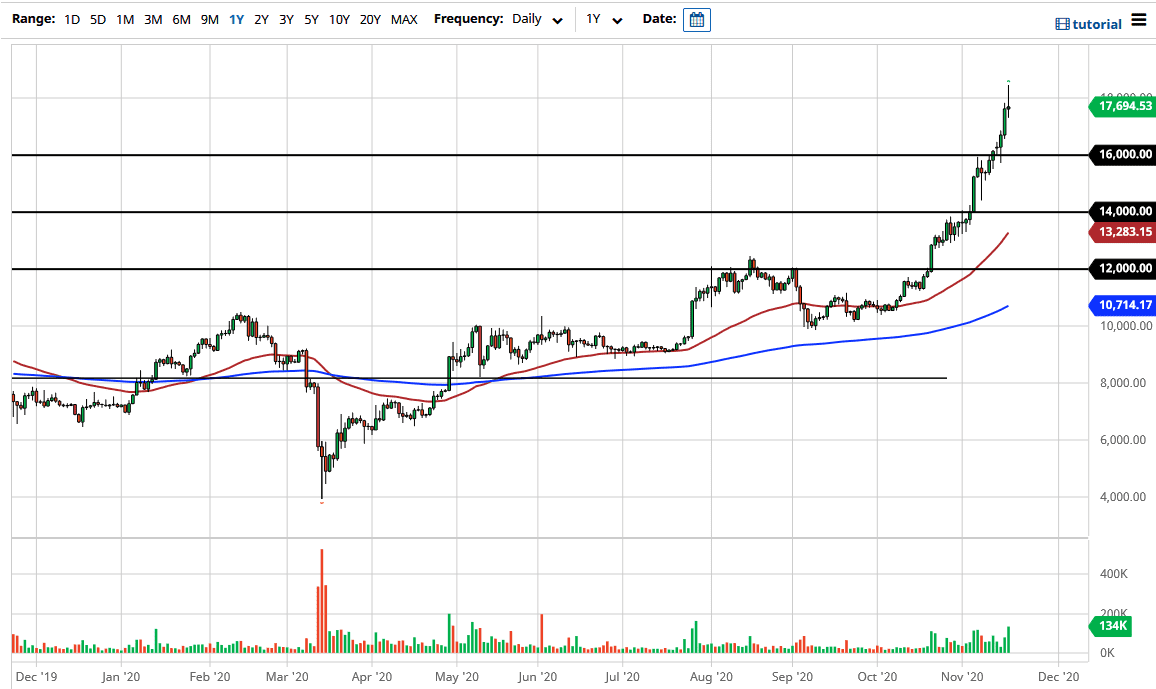

Bitcoin sliced through the $18,000 level during the trading session on Wednesday, but gave back almost all the gains to form a massive shooting star. I have been warning for several days now that this market is starting to get into the parabolic territory, and the Wednesday candlestick could be the first sign that this is in fact starting to be the case. I would anticipate an immediate pullback rather soon, but that does not mean I would be looking for a selling opportunity; rather, I will be looking for value underneath if I were to put money to work in the Bitcoin market.

The most obvious place that we would see buyers would be the $16,000 level as it was previous resistance, and therefore will attract a certain amount of attention. The market is likely to see traders get in and out of the market because many of them have had extraordinarily quick and large gains. If you are buying at this point, you are certainly flirting with disaster, as the market has gone straight up in the air since the beginning of October. In fact, at the beginning of the month of October, we were at $10,800, and are now knocking on the door of $18,000 again.

Looking at this chart, the market is likely to find a lot of support at the $14,000 level as well, and while that could be a significant amount of support, the reality is that Bitcoin has a bad habit of correcting viciously. You do not want to be on the wrong side of the trade if and when that happens. Depending on how you play Bitcoin, you may find that the market might be best approached by holding onto a longer-term position and purchasing puts, or you may simply want to trim some of your position. After all, markets cannot go in the same direction forever and it is only a matter of time before we pull back, if for no other reason than to simply acknowledge the fact that gravity still exists. Unfortunately, we may be getting a little “long in the tooth” when it comes to the rally, because we are starting to see a lot of “Bitcoin Gurus” again, which is almost certainly a sign that we are closer to the top than we are the bottom.