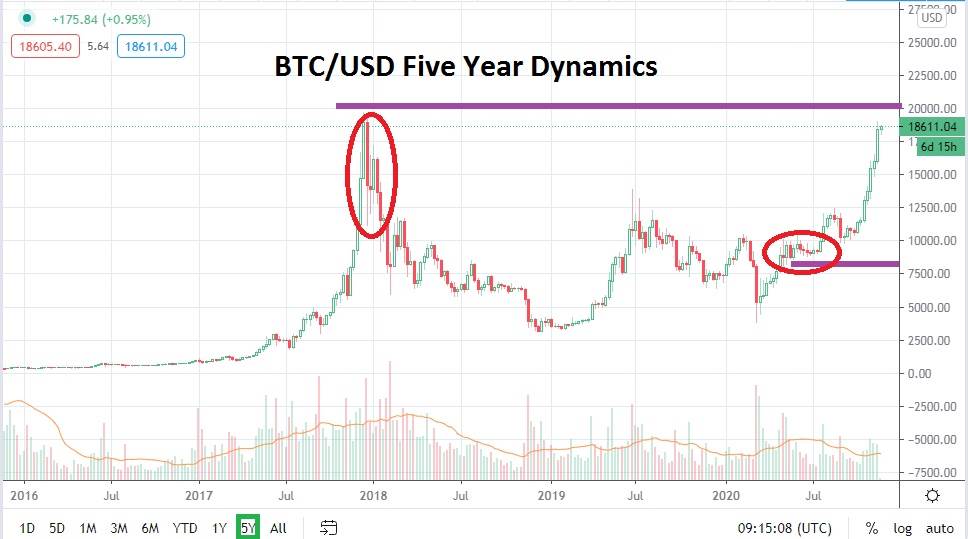

Speculators who enjoy a solid rocket ride filled with danger are encouraged to wager on BTC/USD short term. It isn’t every day that a five-year chart needs to be displayed in order for readers to understand the magnitude of a move, but today is that day. Simply put, Bitcoin is approaching all-time highs and has likely hurt many traders trying to short the cryptocurrency short term.

Interestingly, Bitcoin is attaining this accomplished rocket ride higher while still flying under the radar. I write the above to point out that many financial circles are not giving the same amount of coverage to Bitcoin compared to the hype the cryptocurrency enjoyed in December of 2017. This is likely because of the magnitude of the drop, which followed the record highs in late 2017 when Bitcoin was seemingly adored worldwide and received rampant news coverage only to make many analysts look foolish – once burned, twice shy. Folks may be scared to suggest another wager within cryptocurrency after singing its praises nearly three years ago only to watch things dissolve so quickly.

Technically, BTC/USD has crushed short-term resistance. Speculators who have the emotional fortitude to sell Bitcoin at these levels and wager that the cryptocurrency is going to suddenly nosedive better have very deep pockets in order to withstand fluctuations higher, which may continue to emerge short term. However, speculators wagering on buying positions should be ready for a rather dynamic ride too, because there are no guarantees about its direction and reversal can prove violent.

There is no denying that the momentum of the bullish trend for BTC/USD has been beyond strong and its move higher since mid-October has been breathtaking. As a note of caution, the exuberant rise in the value of Bitcoin is mirroring the move BTC/USD made in late 2017 too. However, the question speculators want to try to figure out is if this time is different for Bitcoin. Is this move going to break through all-time highs and sustain its value? If BTC/USD trades near 18850.00 and sustains this value it could trigger additional speculative buying positions.

Attempting to buy Bitcoin and capture additional upside momentum certainly seems like the less speculative wager compared to being a seller – and I write that without being sarcastic. BTC/USD is speculative. If you choose to trade Bitcoin, you must have your risk management firmly in place and be ready for what can definitely be an emotional ride. Buying Bitcoin within this feverish speculative environment may prove worthwhile, but it could also prove to be challenging.

Bitcoin Short Term Outlook:

- Current Resistance: 18800.00

- Current Support: 18276.00

- High Target: 19100.00

- Low Target: 17990.00