Today's signal for AUD/USD:

Risk is 0.75%.

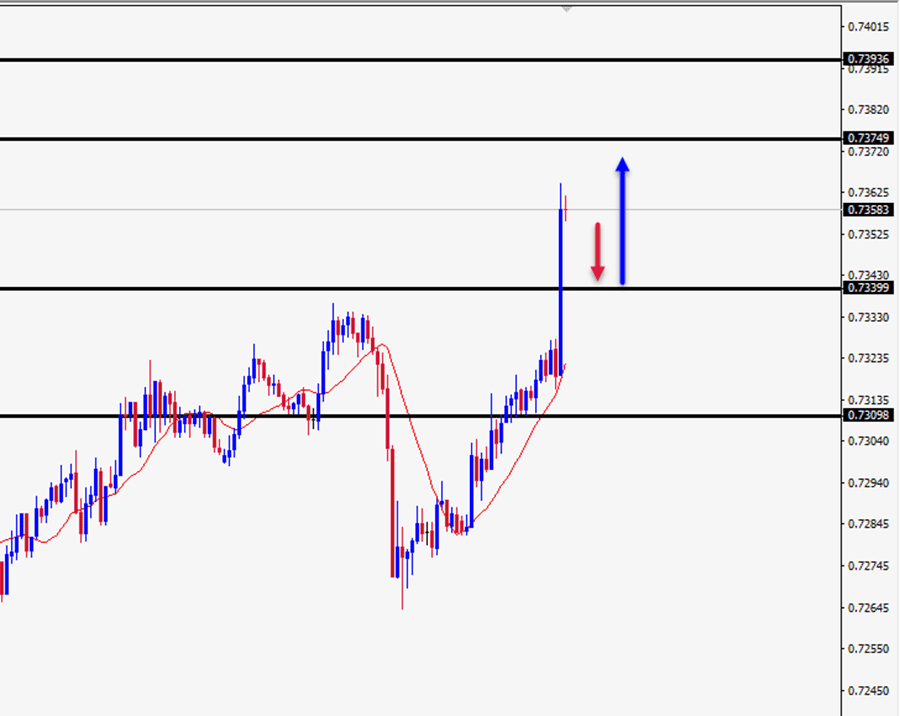

The pair breaks strong resistance levels.

Best Long Entry Points

Long entry by testing one of the levels 0.7346 and 0.7340 on the hourly time frame.

Place your stop loss point below the support level at 0.7296.

Move the stop loss to the entry area and continue the profit with the price moving by 20 pips.

Close half of the contracts with a profit of 30 pips, leaving the remaining contracts until the strong resistance levels at 0.7392.

Best Short Entry Points

Enter a sell position from below the support line at 0.7309, on the hourly time frame.

The best pipeline to place a stop loss is above 0.7347 levels.

Move the stop loss to the entry area and continue the profit with the price moving by 20 pips.

Close half of the contracts with a profit equal to 40 points and leave the remaining contracts until the support level at 0.7256.

AUD/USD Analysis

The AUD jumped against the major currencies after earlier statements from Reserve Bank of Australia (RBA) Deputy Governor Guy Debelle, who said he saw no need for the central bank to increase its monetary rate for at least another three years, but indicated that the board should take care not to remove the stimulus policy too soon.

Debelle added that he hopes public confidence will be boosted by developments of coronavirus vaccines, even before vaccines are made available and distributed widely.

The AUD rose against the USD during early European trading. Preliminary data from the Australian Bureau of Statistics on Tuesday showed that Australian exports increased in October due to record iron ore shipments. Exports grew by 6 percent month-on-month to $ 30.53 billion in October. On an annualized basis, exports contracted 3% in October.

On a technical level, the Australian dollar is trading on a general bullish trend in the medium term. We expect the pair's rise to continue as long as it trades above the support levels, which are 0.7346 and 0.7340, respectively. The pair targets resistance levels at 0.7400.

To enter long, it would be better to re-test one of the above mentioned support levels before the resumption of the pair's rise. However, if the pair reverses the trend and breaks all the support lines, then we can enter selling after retesting 0.7309.