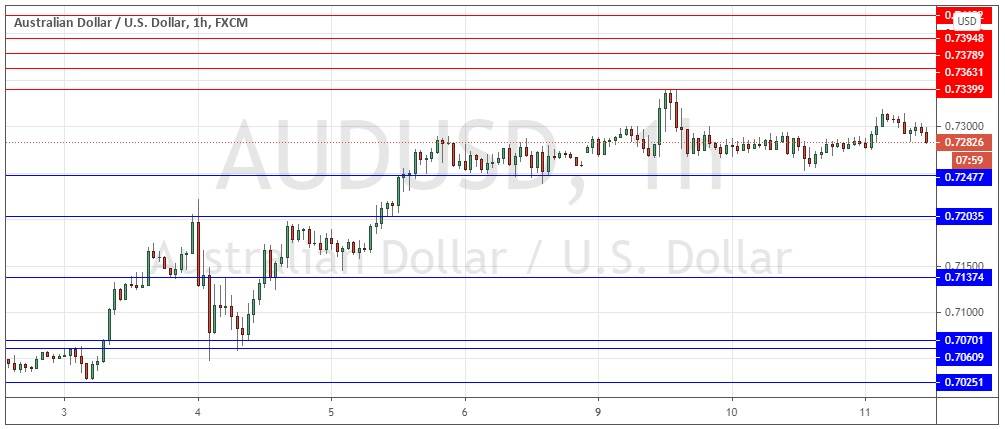

Yesterday’s signals were not triggered as there was no bearish price action when the resistance level identified at 0.7301 was first reached.

Today’s AUD/USD Signals

Risk 0.75%.

Trades may only be taken from 8am New York time Wednesday until 5pm Tokyo time Thursday.

Long Trade Ideas

Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7248, 0.7204, or 0.7137.

Put the stop loss 1 pip below the lowest recent price.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7340, 0.7361, or 0.7379.

Put the stop loss 1 pip above the highest recent price.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that the quietly bullish situation had not changed. I saw 0.7248 as very pivotal and was happy to take a long trade if we had gotten a bullish bounce at 0.7248.

I also thought that a sustained break below the support level at 0.7248 would be a bearish sign and day traders may want to watch for that and get involved there on shorter time frames if it happened – this did not happen either.

My analysis remains the same as the relatively narrow consolidation above 0.7248 has continued over another day. I am marginally less bullish overall as I think there is a slightly higher chance of 0.7248 breaking down as the price is taking its time while failing to rise, and the short-term price action at the time of writing is bearish.

I will take a short trade if we get two consecutive hourly closes below 0.7248, or a long trade if we get a bullish bounce from that level.

The Australian dollar is an interesting currency to trade as it has become such a solid risk barometer. There is nothing of high importance due today concerning either the AUD or the USD.

There is nothing of high importance due today concerning either the AUD or the USD.