Today’s AUD/USD Signal

Risk 0.75%.

Yesterday’s deal got activated from the specified levels and the pair rose, although it didn’t reach the final goal.

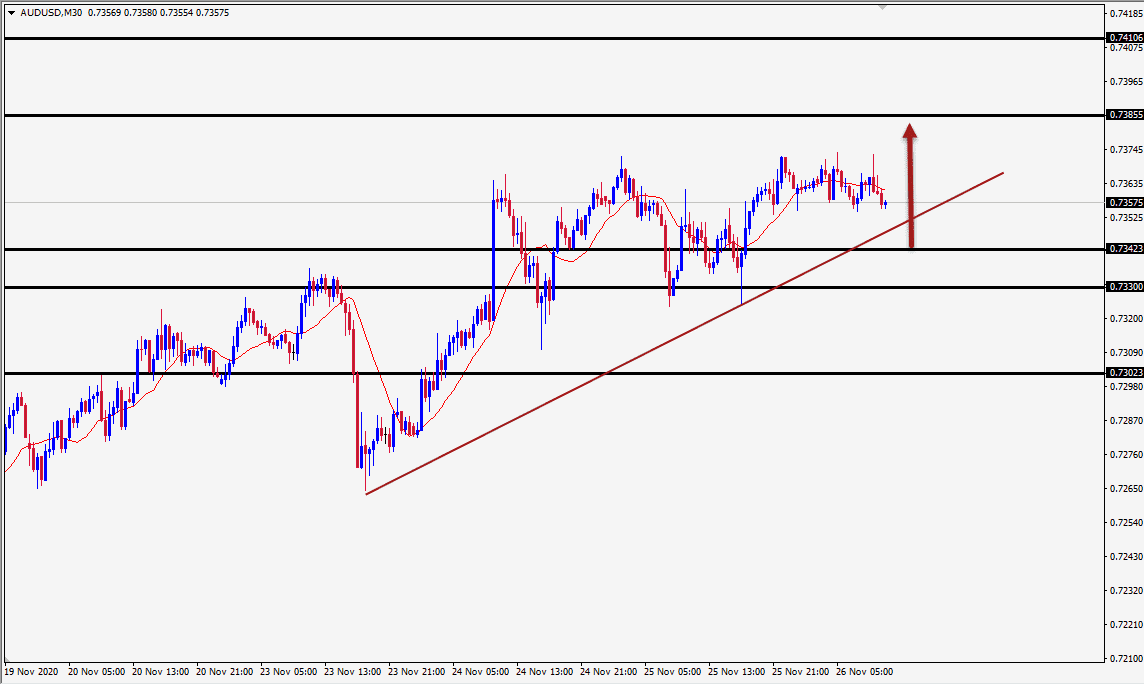

Best Buying Entries:

Long entry from current levels or from any level better than 0.7330 on the half-hourly timeframe.

Put the stop loss below the 0.7302 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance levels at 0.7355 and 0.7410.

Best Selling Entries:

Short entry below the support line at 0.7301 on the hourly timeframe.

Put the stop loss above the 0.7333 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7266 support.

AUD/USD Analysis

The AUD/USD pair continued to rise against its US counterpart, albeit at a slow pace, as the pair lost the strong upward momentum. We expect the slow pace continue, especially with the withdrawal of liquidity from the markets due to the Thanksgiving holiday.

Yesterday's signal was activated from the entry point and a profit was made by moving the stop loss in conjunction with the pair's rise, as written in the signal.

Today's data showed a decline in capital spending in Australia during the third quarter, exceeding expectations by 3 percent compared to the previous quarter, which is greater than the expected decline of 1.5 percent. However, the pace of decline eased from -6.4% in the second quarter.

Investment in buildings and structures decreased by 3.7% and investment in equipment, factories and machinery fell by 2.2% in the third quarter. On an annual basis, total new capital spending decreased by 13.8% in the third quarter. Companies' expectations of future capital spending indicate that it may be close to the bottom.

On a technical level, the Australian dollar is trading on a general bullish trend in the medium term. We expect the pair to continue its rise as long as it trades above the support levels at 0.7342 and 0.7323 respectively. The pair targets the resistance level at 0.7410 as a final target.

To enter a long position, it would be better to re-test one of the above mentioned support levels before the resumption of the pair's rise, but if the pair reverses the trend and breaks all the support lines, then short positions can be entered after retesting 0.7309.