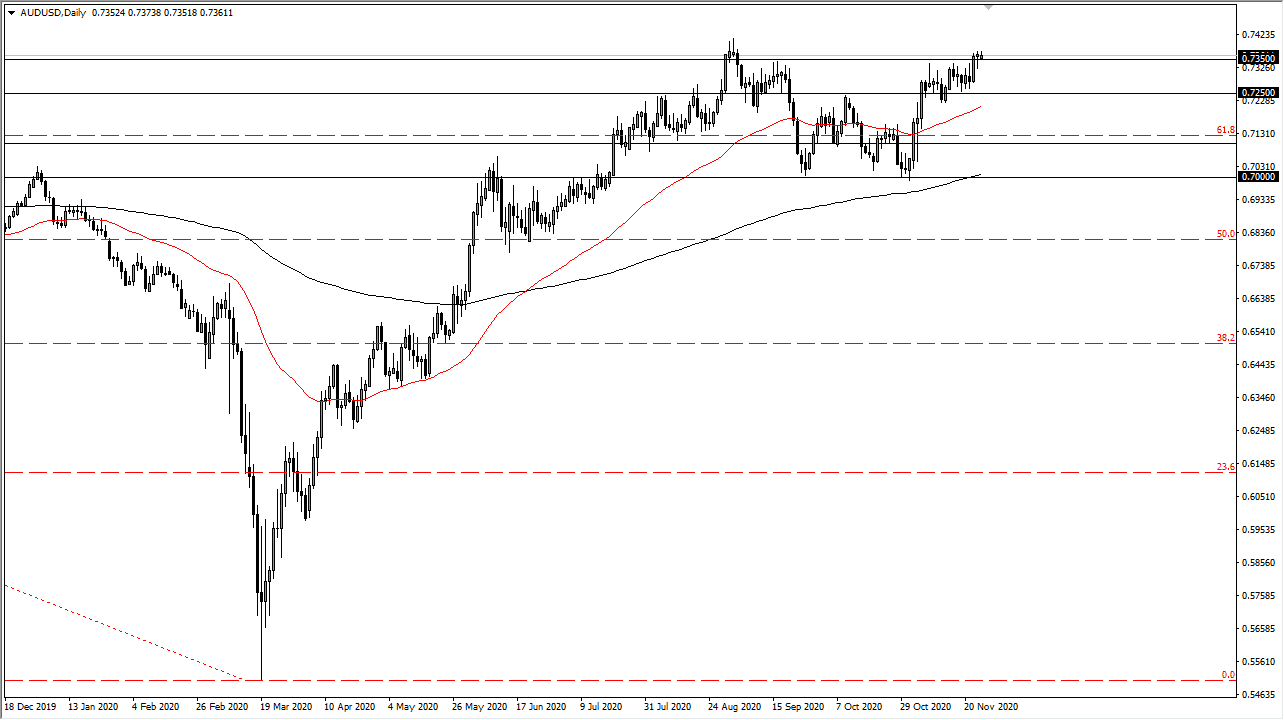

The Australian dollar initially tried to rally during the trading session on Thursday but gave back the gains as we continue to hang about the 0.7350 level. We have recently been going back and forth between the 0.7250 level in the 0.7350 level, so overall this is a market that is trying to build up enough pressure to finally take off to the upside. With this being the case, do not be surprised at all if we have buyers come back into the market after short-term pullback. Obviously, we are building up enough pressure to make a serious charge to the upside, but that would probably need some type of headline to get things moving.

Traders are banking on the idea of a recovery after the virus, as the vaccines are already an ounce. All things being equal, you can look at this and suggest that there is a big “W pattern” showing signs of trying to break out, and that could lead for a charge towards the 0.75 handle and beyond. After all, the market has had a massive bounce from the bottom and has moved back and forth to work off the frothing this of the market. Ultimately, I think that you are looking at a scenario where you need to find value on dips, and I believe that the 50 day EMA might be a logical indicator that comes into play as well. If we grind sideways with a slightly downward tilt, it would not be a huge surprise to see that the 50 day EMA could reach down towards the 0.7250 handle which of course is crucial. With this being said, I think that it is only a matter of time before the Aussie takes off based upon the fact that we are getting a bit of an exuberant market.

If we did somehow turn around a break down below the 0.70 level, it would be toxic for this currency pair, and we would probably fall rather hard. Overall, I think that this is a scenario that certainly favors the upside, but I do not know whether or not we are ready to break out quite yet. The Australian dollar is going to be highly sensitive to the global outlook, and what traders are starting to think about as far as global growth due to coronavirus restrictions being lifted and/or increased.