The Australian dollar went back and forth during trading on Thursday as we continue to see a lot of questions out there. Having said that though, we are starting to see coronavirus numbers pick up, and that is going to work against the value of the Australian dollar as it is considered to be a commodity currency, and then of course will move based upon the idea of whether or not we are going to continue to grow. I believe at this point it is likely that we are going to see a lot of concern out there, and therefore it does make quite a bit of sense that the US dollar may pick up some strength.

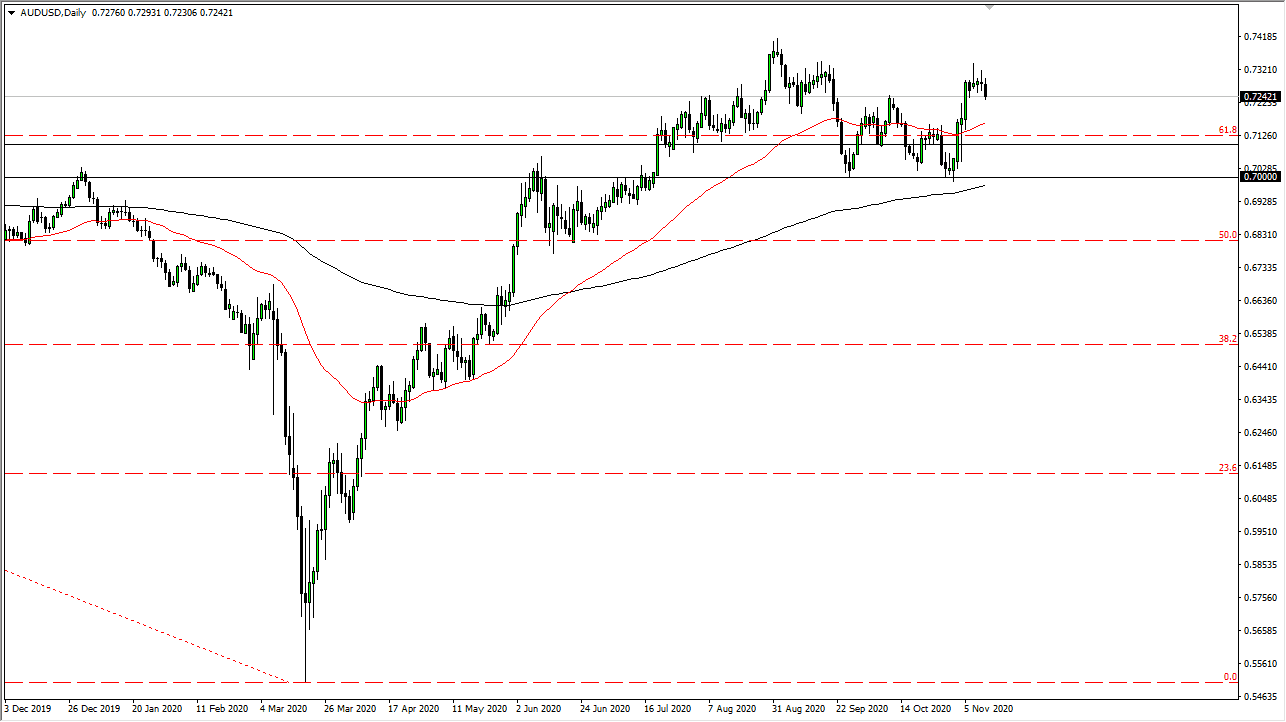

To the downside, the 50 day EMA would be a target, perhaps down to the 0.71 level. The area between the 0.71 level and the 0.70 level is a massive level that people will be paying attention to, and if we were to look at it through the prism of a longer-term trader, the 200 day EMA is sitting right there and it is likely that we will continue to see people paying attention to it. Ultimately, this is a market that I think continues to see a lot of volatility and at this point in time it is likely that the market will continue to respect the 300 point range that we have been in, and it certainly would make sense as we go into the weekend for that to continue to be the case. After all, nobody wants to carry a ton of risk into the weekend when just about anything could happen.

The Reserve Bank of Australia continues to suggest that we could be looking at more quantitative easing, perhaps even negative interest rates. That is very tough on currencies as well, so I believe at this point the Aussie dollar may selloff as well. If we were to break down below the 200 day EMA, perhaps in part due to some type of economic event or even just the negative interest rates coming, then it could open up a move to the 0.68 level rather quickly, possibly even lower than that. As far as going higher is concerned, we would need to break above the 0.75 level in the short term to continue going much higher.