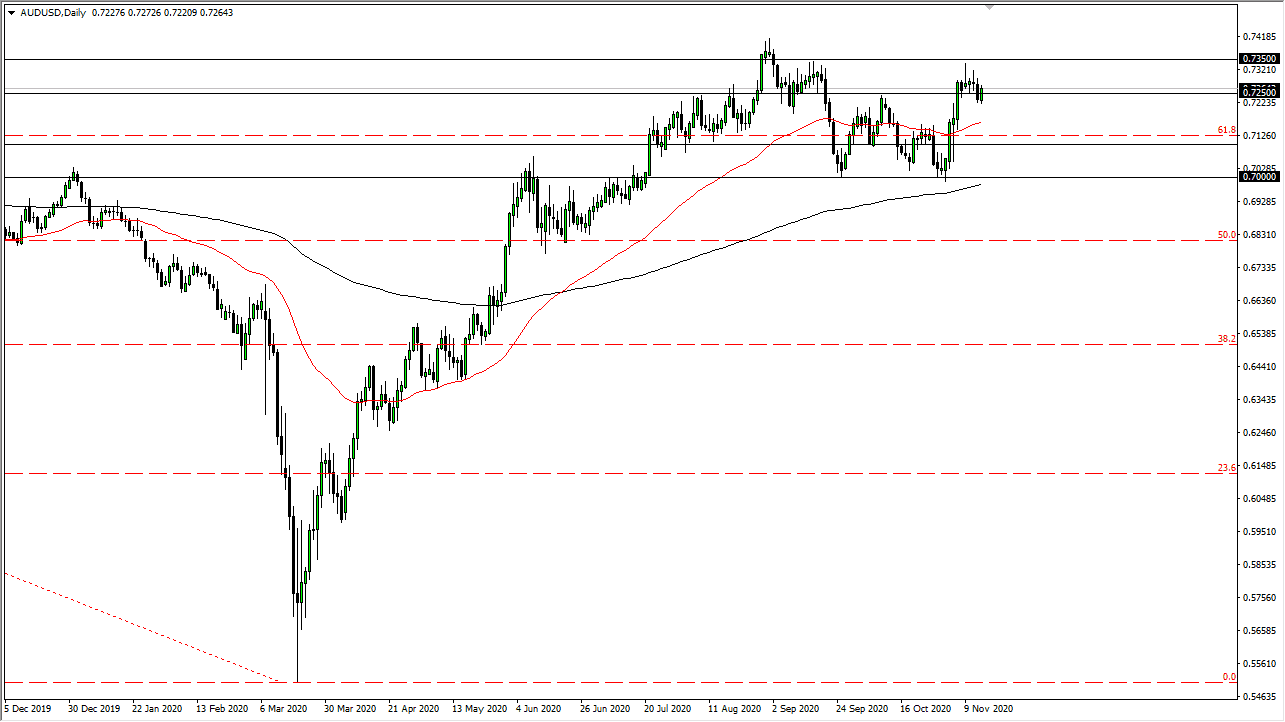

The Australian dollar rallied during the trading session on Friday, breaking back above the 0.7250 level. The market is likely to see a lot of resistance above, and when you look at the weekly candlestick, it is a shooting star. That suggests that the market will see a significant amount of resistance above, and I am looking for signs of exhaustion to use to my advantage. The Australian dollar is essentially stuck in a range and nothing has changed over the last couple of days.

The Australian dollar rallying above the 0.7250 level is a slightly positive sign, but the 0.7350 level is massive resistance. Every time we have approached that level over the last couple of months there have been sellers, so I think we will continue to see that. Furthermore, it will happen due to the fact that the Reserve Bank of Australia may not only ease monetary policy going forward, but even threatened to go negative with interest rates, which should drive down the value of the Aussie given enough time.

People are starting to focus on the fact that the United States is probably looking at stimulus. However, it is only a matter of time before the sellers come out on signs of exhaustion and push this market down towards the bottom of the overall range. The 50-day EMA would be the first target, which is at the 0.7150 level. After that, we could go looking towards the 0.71 handle, which is the beginning of significant support, extending down to the 0.70 level.

Looking at this chart, we have been going sideways for a while and I do not know that we will do anything more than that going forward. There are concerns about coronavirus, stimulus, and negative interest rates at the same time. We also have to worry about whether or not the global economy can pick up, something that is necessary for the Australian dollar to do well over the longer term. I do not see much of a catalyst in the short term to push the market outside of the range that I have marked on the chart.