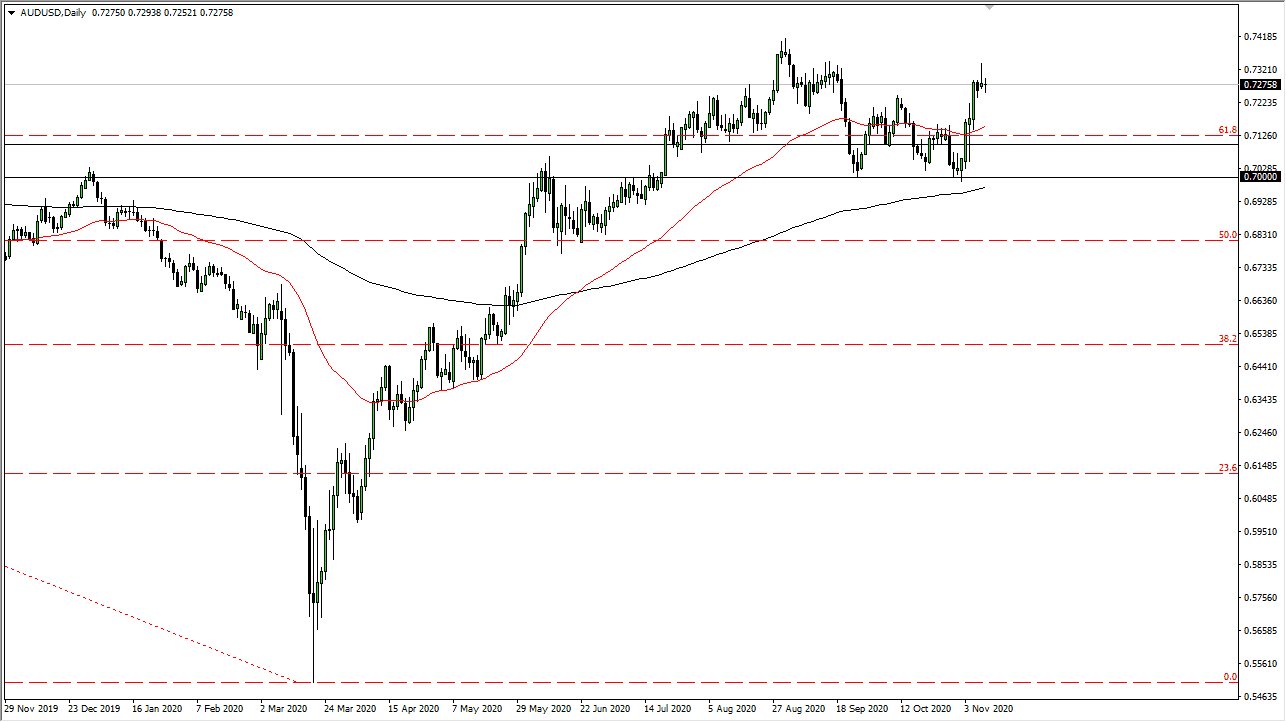

The Australian dollar has found the trading to be difficult, as we have seen choppy trading in both directions. We are at the top of an overall range, but right now the market is being thrown around in a couple of different areas. The 0.73 level is the top of a range that extends all the way up from the 0.70 level, so we should see more hesitation. We will eventually see some selling pressure, but it looks like we are trying to go “risk on”, despite the many issues out there.

This market continues to hear a lot of noise in general, because not only do we have concerns about risk appetite, but we also have the Reserve Bank of Australia threatening cutting rates, perhaps even going negative. In that case, we would see the Aussie dollar struggle a bit. Whether or not we break down is a completely different question, because it comes down to whatever we are focusing on in the next 15 minutes. However, we will eventually get some impulsive candlestick that we can follow. If we break down below the lows of the candlestick from Tuesday, then I think it opens up more selling. If we rally from here, then breaking above the top of the shooting star from Monday would be a very bullish sign.

To the downside, the 50-day EMA would offer a significant amount of support, and it is only a matter of time before we try to find buying pressure in that area. This is a market that will see a lot of fluctuation as we head into a very uncertain future. Looking at the shape of the candlestick so far this week, I think this is a decision point that to which the markets will pay close attention.