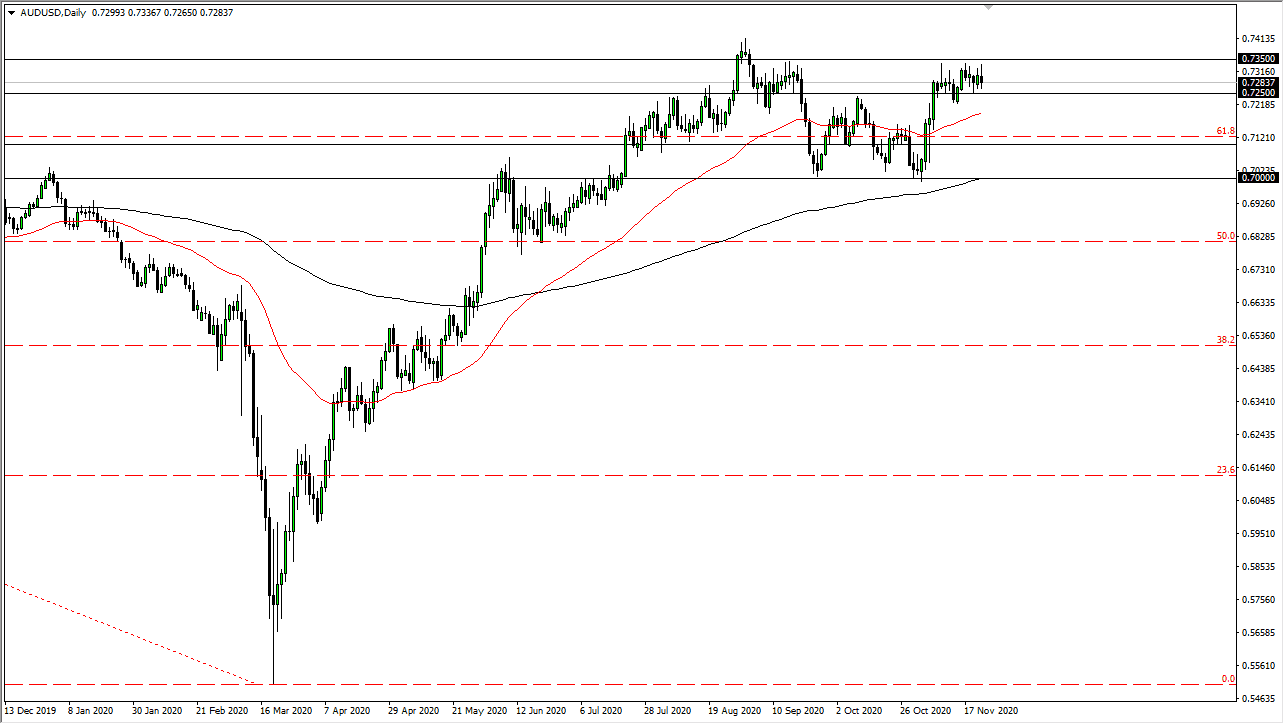

The Australian dollar has fluctuated during the trading session on Monday, as we continue to hear a lot of noise in this general vicinity. The 0.7250 level on the bottom of this range has offered support, just as the 0.7350 level has offered significant resistance. The market has been stuck in a 100-point range, which is tight. The market will continue to try to break out given enough time, but it is still trying to figure out where it wants to go longer term, so it is certainly worth paying attention to just above.

To the downside, if we were to break down below the 0.75 zero level, it is likely that we could then go down to the 50-day EMA. Underneath, it is likely that we could go looking towards the 0.71 level, which is a level that is the top of the previous overall support. The 200-day EMA is sitting right at the 0.70 level, so there would be plenty of buyers in that area as well.

Dips continue to be bought into, because people are still focused on the idea of the US dollar getting hammered. I am not a huge fan of the Australian dollar itself, but we eventually have to make a longer-term decision. The candlestick for the trading session on Monday suggests that we will probably see more of the same, so the markets are likely to continue with the overall choppy behavior, and in the short term I am looking to trade back and forth in this 100-point range. Remember, the Australian dollar is considered to be a “risk on currency”, so we need to pay attention to what the world is thinking as far as risk appetite is concerned. However, if we get a major “risk off” type of situation, this pair will rollover towards the 200-day EMA. As we are in the middle of Thanksgiving week, it is likely that we will simply fluctuate, as much of the world focuses on holidays and lack of liquidity.