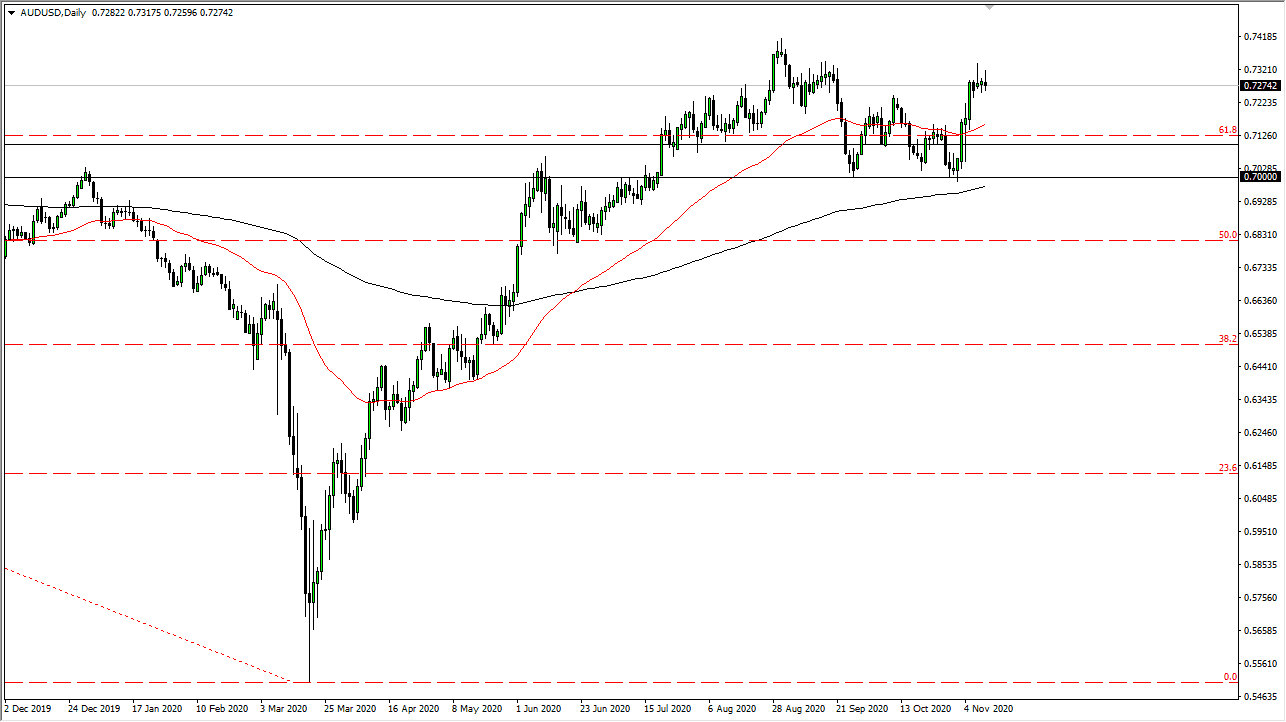

The Australian dollar initially rallied during the trading session on Wednesday, but gave back the gains in order to form a shooting star again. This market continues to hear a lot of noise, as we are towards the top of an overall range between the 0.70 level on the bottom and the 0.73 level on the top. It is also a market that is highly sensitive to risk appetite, which seems to be waning over the last several sessions.

The Reserve Bank of Australia is likely to do more stimulus and quantitative easing, even suggesting that negative rates might be on the way. This would be a new experiment for Australia and should weigh heavily on the Australian dollar. The US dollar could get a bit of strength thrown towards it as well because stimulus looks to be very likely, but smaller than initially thought. The market is likely to see traders coming back towards the greenback once that realization hits.

Coronavirus numbers are rising in both Europe and the United States, which will have a negative effect on demand for “risk on assets” going forward. I am surprised that we have not seen a pullback at this point yet, especially as we are at the top of the overall range. If we break down below the 0.72 level, that should kick off more selling pressure, perhaps reaching down to the 50-day EMA initially and then back down to the 0.70 level. What is interesting about that area is that the 0.70 level also features the 200-day EMA, so it is likely that the longer-term traders will be looking at that as a potential support level as well. The market will find buyers if we go down to that area; but if we break down below it, that will almost certainly send this market much lower. I suspect that we are still stuck in a range, and that is probably the main takeaway at the moment.