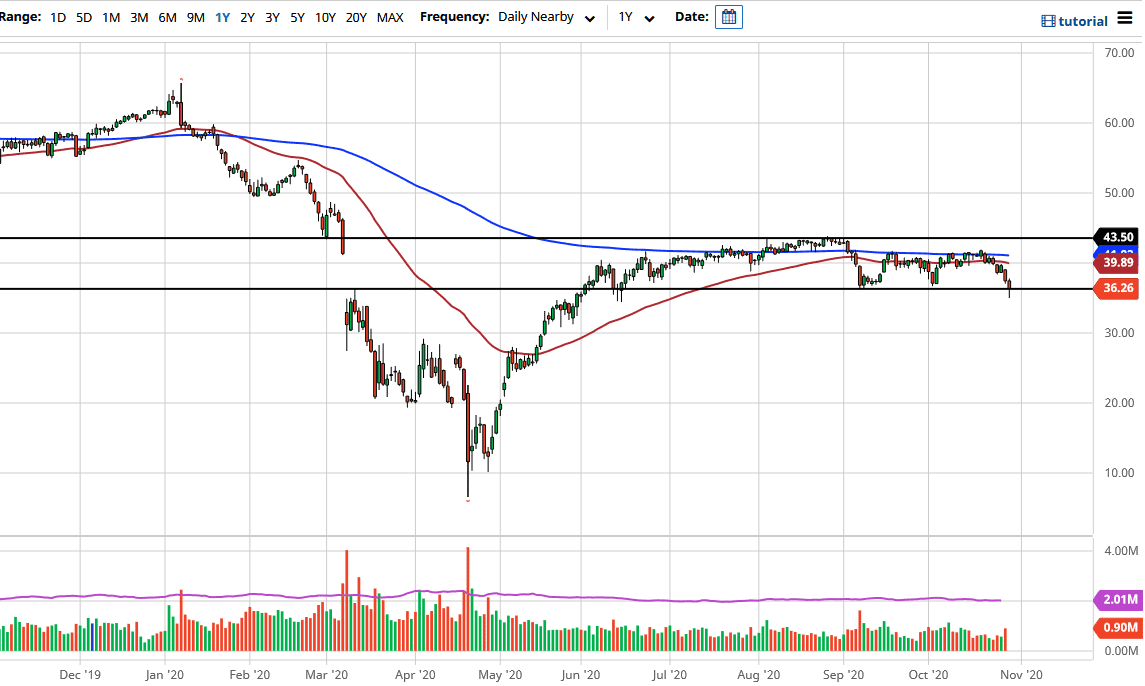

The West Texas Intermediate Crude Oil market has shown itself to be a bit threatened during the trading session on Thursday as we have broken below the $36.25 level during the day. However, we have recovered that loss and now it looks as if the level is going to trying to find support. However, I think at this point the market still has plenty of issues out there that work against the value of it, and therefore I am looking for a selling opportunity more than anything else.

Looking at the shape of the candlestick, it is a hammer so I do think that we may get a little bit of a bounce. That being said, I think it is only a matter of time before sellers come back into this market due to the fact that there are so many things working against the value of crude oil right now. Not the least of which of course is going to be the European Union shutting down various parts of the economy, and of course the fact that there is almost no demand anyway. Looking at the chart, you can see that we clearly stretched below the bottom of the overall consolidation area but cannot close below there. That being said, I do think that it is only a matter of time before that happens.

If we do rally from here, the market is likely to go looking towards the $40 level above at the 50 day EMA, where I would expect to see selling pressure. On the other hand, if we break down below the bottom of the candlestick, then I believe that the market could go down towards the $35 level, possibly even towards the $30 level. This is a market that will continue to struggle with the strengthening US dollar, so if the greenback start to take off to the upside, we may see this market fall for that reason alone. Regardless, there is not enough demand out there for crude oil to send it in a longer term uptrend at this point. In fact, I am simply looking at this market as one that you should be fading on short-term rallies that show signs of exhaustion, and of course a break down below the low of the trading session on Thursday. Either way, I do think it is only a matter of time before crude oil breaks down.