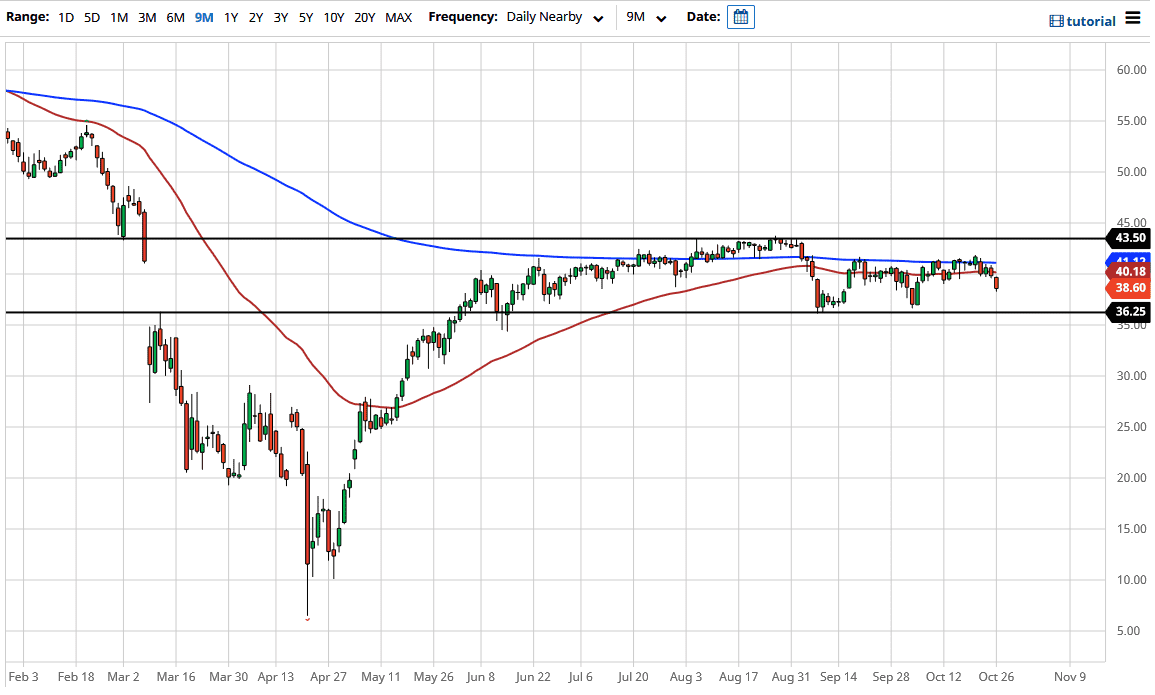

It looks like we are ready to go down towards the bottom of the overall range, which I currently see and the $36.25 level. That being said, It is only a matter of time before we see a certain amount of bearish pressure come back in on rallies and short-term exhaustion will probably be sold into. In fact, that might be the best way to trade this market is to simply fade short-term rallies that show signs of exhaustion on smaller time frames.

The market has the 50 day EMA sitting just above the $40 level and is very flat. Beyond that, the 200 day EMA is likely to continue to show a lot of ugly negativity. After all, there is no significant amount of reason to think that we are suddenly going to see a massive amount of demand come into the picture when it comes to crude oil. Because of this, I do believe that we are not that far from seeing some type of bigger move. After all, even though we see a tropical storm coming into the Gulf of Mexico, the WTI market cannot seem to pick up its feet. If that is going to be the case, the market is likely to see extreme negativity if that cannot pick things up.

The size of the candlestick, although not huge, is worth paying attention to because it is bigger than several the previous one, but even more important than this candlestick is closing at the very bottom of the range, showing a significant amount of confidence in the downside. This shows that there is probably going to be a certain amount of follow-through, and therefore it gives you a bit of a “heads up” as to where we may go given enough time. If we can break down below the $36.25 level it is likely that we will see an acceleration of negativity, perhaps exacerbated by a strengthening US dollar. It is a bit early to know that yet, but it is very likely to suggest that the two may occur at that exact same time. I believe that if we can break above the 200 day EMA, we may go looking towards the $43.50 level as significant resistance.